Examples Templates

When creating your own trading system, it's important to consider several factors. Your approach should effectively identify emerging market trends while also protecting you from being misled or experiencing whipsaws. The key lies in developing a trading system that suits your needs and adhering to it consistently. Practicing discipline is essential for achieving success in trading, especially with XAU/USD.

Before Gold on a real account, you have to figure out & determine what trading strategy works for you. It's good to know in what chart timeframe you are going to be working in, & how much you're willing to risk once you begin trading online. All these should be factored in, should be written down within your xauusd plan. A good place to test this gold plan would be on a free demo account. This is where you test your strategies risk-free without depositing money to identify which trading strategy is best suited for you.

So, the crucial question is: how can a gold trader like yourself develop a "sound trading system" or achieve the "optimal system"?

Before building a functional strategy, the first critical action is to precisely define your central ambition or target:

These examples show a goal and steps to reach it.

Trading System Goals

1.Identify a new trend

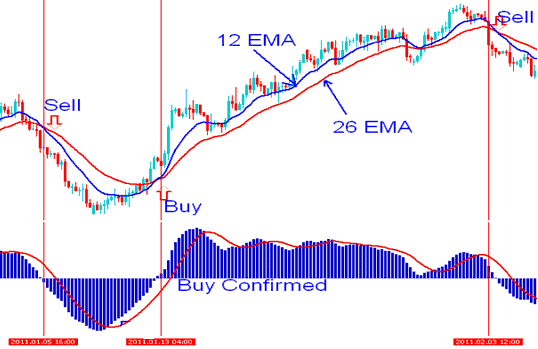

The MA crossover method strategy is the most commonly employed technique for identifying a new trend. The decision to initiate a long or short trade is made when two moving average indicators cross over or under each other.

2.Confirm the new trend

Traders mostly use the RSI and Stochastic indicators to confirm a trend.

Indicator based Trading Strategy

The best kind of strategy is one that uses technical indicators. It will be easy to create the trading signals, which means you will make fewer mistakes and it will help you avoid quick market changes.

Key Objectives When Formulating and Implementing a Trading System:

- Find entry points as early as possible.

- Find exit points securing maximum gains.

- Avoid fake entry and exit signals.

- Proper Trade Money Management Rules

Successfully completing these four trading objectives will lead to a profitable strategy that is effective.

The last key is how bold you will be when entering or leaving a trade. Bold traders jump in as soon as signals align, without waiting for the candle to close. Many wait for the candle to close on their chart time frame. That gives a steadier signal for entering the market.

To make money in the market, you need to create your own winning system: a way of doing things that gives you profitable signals. You should have a plan that helps you reach your money goals. The best trading systems are sometimes the ones you make yourself. You don't have to keep searching for the best trading systems or systems that work: this website gives you all the tools and guides you need to create your own.

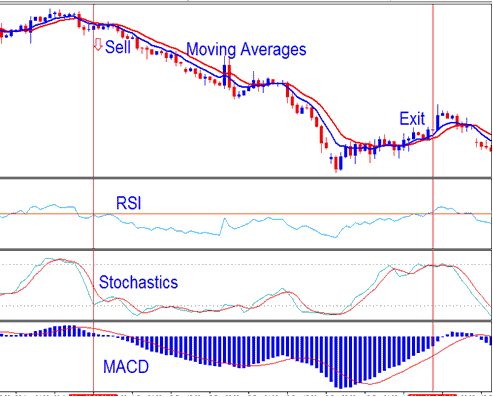

Below is example of a trade system depending on RSI, MACD and Stochastic.

Gold System - Best MT4 Examples Systems

The example system above includes four technical indicators. Each one creates trade signals through its own approach. The Moving Average produces signals with the crossover method pictured. The RSI, Stochastic, and MACD rely on other forms of analysis to spot buy and sell signals, as shown in the example. The next section covers how to create these signals. Check the sidebar navigation under study trading tutorials menu in key concepts.

For beginner traders, it's hard for them to come up with their own trading strategies since they do not have much knowledge about the market. However, this learn website will explain how a beginner trader can create their own free system in just 7 easy guide-lines. Best strategy is one you create yourself & learn how to trade the market with it.

The main advantage of creating your free systems is that you will know how to make profits by yourself - and not rely on other peoples efforts.

In the next gold course located at the side-bar navigation learn lessons menu below the gold key concepts will explain to you how to create a trade system like that one above, write it's xauusd rules & how to back test the trade system on a practice practice trade account before using it on a real account.

Best MT4 Examples Systems

Gold Strategies

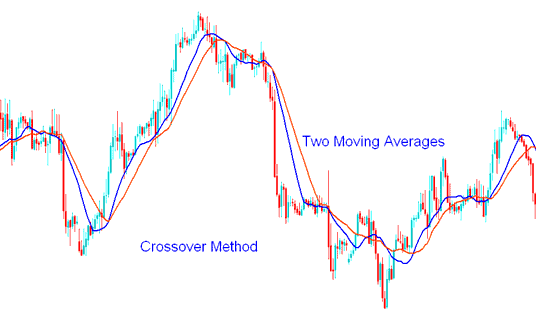

The MA crossover method uses two moving averages to spot entry and exit signals. One has a shorter period, the other a longer one.

MA Crossover Technique - Moving Average Cross over Method

The method mentioned above is known as the moving average crossover method because signals appear when the two averages cross each other up or down.

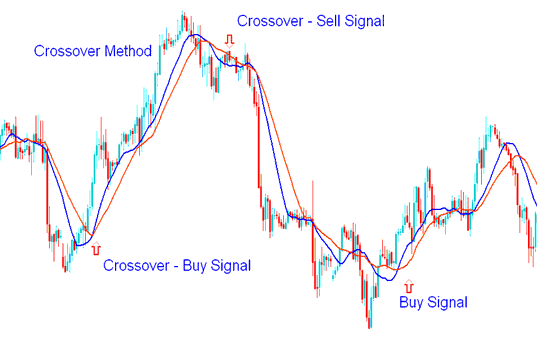

Examples of Trading Systems - Short and Long Signals Produced by the Strategy in Use

A buy trade signal, or a long trade, is produced when the shorter moving average (MA) indicator crosses above the longer moving average (MA) indicator, indicating that both moving averages are trending upward.

A sell signal - also called going short - shows up when the shorter moving average crosses below the longer moving average, and both averages are heading down.

Best MT4 Examples Systems

Stochastic can be combined with other technical indicators to make a trade system.

- RSI xauusd indicator

- MACD xauusd gold indicator

- MAs technical indicators

Systems Examples - Best MT4 Templates Example Systems

Short Signal Means Sell Trade Alert

How the short sell Gold signal was generated

From our gold rules the short sell signal is generated when:

- Both Moving Averages are heading down

- RSI is below 50

- Stochastic heading and moving downwards

- MACD heading downwards below centerline

Short trading signal was generated when all the written down rules were met. The exit signal is given when a signal in the opposite direction is generated.

This method's advantage lies in combining different types of technical indicators to validate trading signals, minimizing the occurrence of false signals or whip-saws.

- Stochastic - xauusd momentum oscillator

- RSI - gold momentum oscillator

- MAs XAUUSD Technical Indicator - trend following trading indicator

- MACD - trend following indicator

Based on the chart timeframe used - this strategy can be used as Gold scalping system when the minute charts are used or as a day trade system when hourly trading charts are used.

Example 3: Strategy Example

This trade system is fully elaborated within the trade plan on the trade plan lesson on this learn web site under the key concepts section tutorials located on the right navigating menu.

Chart Timeframe

1H gold chart

Trading Indicators that spot a new trend

How Moving Averages Intersect Works

Indicators that confirm the trend

RSI indicator

The STOCHASTIC OSCILLATOR indicator

Long Entry - Buy Trade Signal

1. Both Moving Averages(moving averages) pointing upwards

2. RSI value above 50

3. Both stochastic oscillators heading up

Short Entry - Sell Trading Signal

1. Both Moving Average pointing down,

2. RSI value below 50

3. Both stochastics moving down

Exit Signal

1. Moving Average Indicator generates in the opposite market trend signal

2. RSI generates in the opposite trend signal

Money Management in XAUUSD Trading

StopLoss - 35 pips

Take-Profit - 70 pips

Reward to Risk 2:1

Best MetaTrader 4 Templates Example Systems

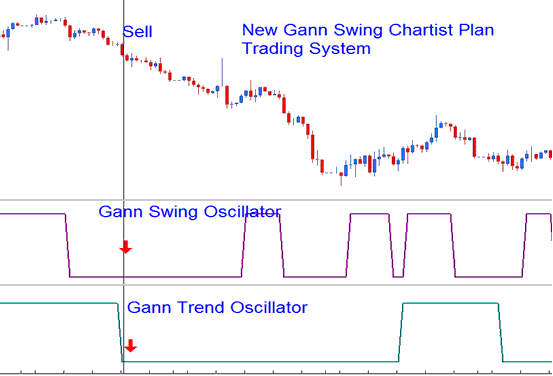

The Gann Swing Oscillator is specifically designed for integration with the Gann HiLo Activator and Gann Trend to constitute a comprehensive trading methodology often termed the - "New Gann Swing Chartist Trade Plan". Within this established approach, the Gann Swing Oscillator Indicator serves to pinpoint market movements for executing trades exclusively in alignment with the prevailing market trend, as indicated by the Gann Trend.

Below is the illustrations of New Gann Swing Chartist Trade Plan

Gann Chartist Plan - Gold Systems - MT4 Template Trade Strategy

More How-To Guides and Subjects:

- How Do I Gold Set Buy Stop XAU/USD Order on MT5 Platform?

- One of the Best Broker for Gold for All Trade Method/Techniques

- Overview of Different Gold Account Types

- How to Integrate Gold EA Bots into the MT4 Platform

- How to Spot XAUUSD Divergence in XAUUSD Chart and How to Divergence in XAUUSD Chart

- Chart Trade Pattern Defined with Examples

- Technical XAUUSD Indicators Used for Setting Stop Loss Orders

- XAUUSD 20 Pips a Day Method