How Stochastic Gold Indicator Works

The Stochastic oscillator employs specific time periods to compute both fast (%K) and slow (%D) lines. Selection of time frames depends on the trader's strategy and purpose for using this indicator in gold trading.

- A trader using the Stochastic oscillator indicator in combination with a trend indicator to see overbought & oversold levels, one can use periods 10 periods.

- The default price period used by stochastics gold oscillator indicator is 12.

Traders ought not to rely exclusively on the stochastic gold indicator when making determinations for gold trading: rather, it should be utilized in conjunction with supplementary indicators.

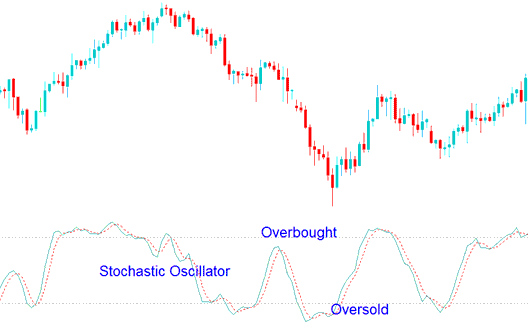

In sideways or ranging market conditions, this Stochastic oscillator technical indicator proves valuable for signaling areas where the market is approaching oversold or overbought territory - potential locations for profit-taking during trades.

The default oversold and overbought levels for gold trading are set at 20 and 80, though some traders use 30 and 70.

To ascertain the 'overbought' zone, the stochastic gold trading oscillator mark set at 80% is employed.

To look for 'oversold' region 20% stochastic gold trading oscillator mark is use.

The overbought & oversold levels are displayed as dotted horizontal lines on the stochastic oscillator indicator. These levels can also be adjusted to the 30 & 70 levels.

Overbought & Oversold Levels on Stochastic Indicator

Learn More Tutorials and Topics:

- Implementing Fibonacci Lines on Gold Charts within the MetaTrader 5 Software Environment

- What are the Differences between MT4 and MT5 Gold Platforms?

- How do you create an Expert Advisor (EA) in MetaTrader 4?

- Differentiation Between STP XAU/USD Brokers and ECN XAUUSD Brokers

- Gold Indicators for Gold Beginner Traders

- What is a Mini XAU USD Account for Trading?

- How to Apply Gold Trend Line Analysis in Trading Gold

- Basics of Gold Trading

- Doji Candlesticks and Marubozu Candlesticks Pattern

- How Do You Read the XAU/USD Indicators List?