XAUUSD Trend Line Break

After price has consistently moved within the confines of a channel in one specific direction for a prolonged duration, it eventually arrives at a boundary where further movement within that channel ceases. When this threshold is crossed, we state that the trendline has been breached.

Since this line is point of support or resistance then we expect the market to move and head towards the in the opposite market trend price trend direction. When this happens traders will close the orders that they had bought or sold. This is known as taking and booking profit.

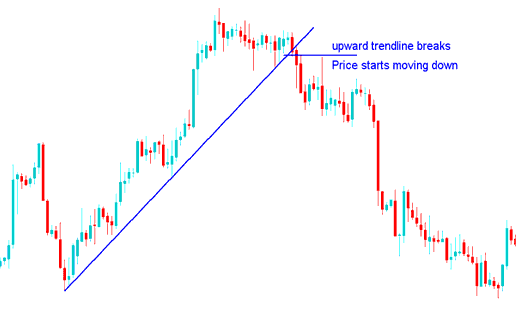

Up trend Reversal

When gold price breaks-out up line (support) the market will then move down

This signal is considered to be confirmed with formation of lower high or lower low. This also provides an opportunity to go short once it is broken.

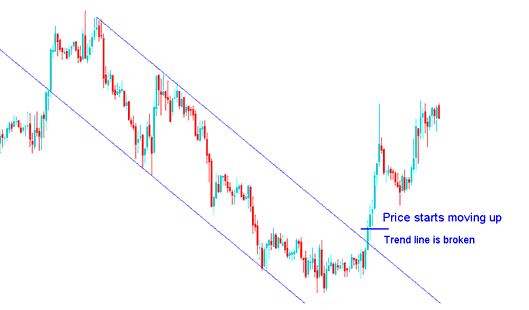

Down trend Reversal

When gold price breaks downward line (resistance) the market will then move up

Downward Channel break

The sign is seen as done when there's a higher low or high spot. It also means a chance to buy once the price goes past it.

Note: Sometimes when price breaks its market trend it may first consolidate before moving in the opposite direction. Either way it's always good to takeprofit when the market direction reverses.

To trade this setup, once a trader starts a new trade in the trend reversal direction, the price should quickly move that way, breaking out rapidly, meaning the market should quickly go in that direction without much pushback.

Conversely, if the market fails to immediately advance in the direction suggested by the price breakout, exiting the trade is the recommended course of action, as this suggests the prevailing trend remains intact.

Another tip is to wait for the trend line to be broken and for the market to close above or below it to confirm this trade signal.

Frequently, traders enter trades anticipating a reversal prematurely, even before the established trend line has been definitively violated, only to witness the price merely touch this line and then adhere to the overriding market direction, causing gold to extend its current move.

For this setup, wait for confirmation. Look for gold price to close above or below the trendline, depending on direction.

- Upwards Market Direction Reversal - this signal is confirmed once the market closes below this upwards line, this should be the right time to open a short sell trade, so as to avoid a trade whipsaw.

- Downward Market Direction Reversal - this signal is confirmed once the market closes above the downwards line, this should be the correct time to open a buy long trade position, so as to avoid a trade whipsaw.

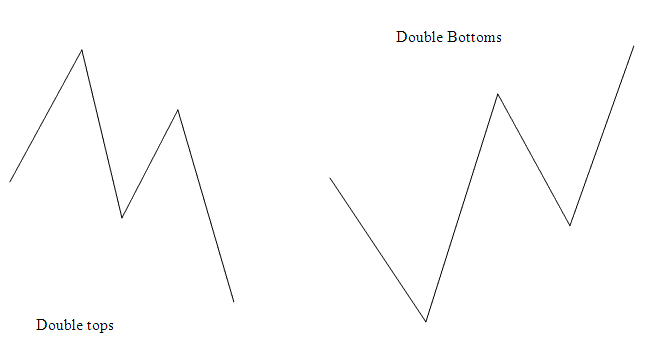

Combining with Double Tops or Double Bottoms Patterns

A good trade set upto combine this set-up with is the double tops & double bottoms patterns. Read Double Top & Double Bottom Chart patterns Guide.

This formation ought to be complete and fully developed prior to the market trend's breaking signal. Given that these double tops and double bottoms are also indicative of a trend reversal, integrating these two setups should enhance a trader's ability to sidestep market 'whipsaws'.

The chart examples provided previously confirm that these specific chart setups had manifested even before the XAUUSD reversal signal officially appeared.

First Example of Upward Direction Reversal - the Double tops pattern had already formed before the trend break reversal setup appeared on the trading chart.

Second Illustration of a Downward Trend Reversal: The Double Bottom chart pattern had already finalized its formation just prior to the appearance of the trend break reversal setup on the chart.

Combining Double Top or Double Bottom Formations with Other Reversal Trading Indicators

Study additional tutorials and courses at.

- Bollinger Bands: Fib Ratios XAUUSD Indicator Analysis

- Auto Stop Loss & Take-Profit Expert Advisor(EA) Bot

- XAU/USD Practice Trade in MetaTrader 4 XAUUSD Practice Account

- Trading with the True Strength Indicator on MT4 Platform

- What is Margin Level in MT5 Trading Program?

- Can You Start XAUUSD with $10 for Nano XAU/USD Account?

- How Can I Use MetaTrader 4 Trade XAUUSD Platform for iPhone?

- XAU/USD Practice Trade in MetaTrader 4 XAUUSD Practice Account

- How to Draw a Downward Channel?

- What is a Mini Lot in XAUUSD for Mini XAU USD Account?