Reversal Setups

These patterns appear after the market has moved up or down a lot, and the price reaches a point where it struggles to go higher or lower.

Market patterns begin forming once the price reaches key levels. These patterns are commonly observed, making them easier to identify once you've learned how to recognize and apply them. There are four main types to watch for.

- Double Tops

- Double Bottom

- Head & shoulders

- Reverse Head and shoulders

This learn trading tutorial will only cover double tops and bottoms, for the other 2, read this other article: head & shoulders & reverse head & shoulders

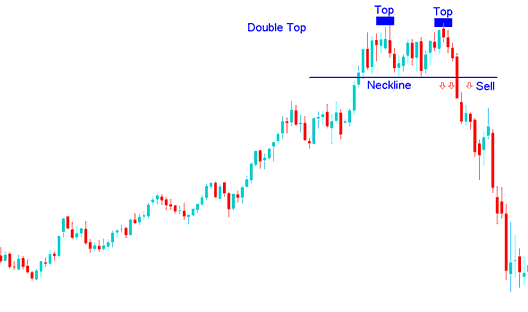

Double Top

This configuration that signals a market reversal materializes following a prolonged uptrend. As its name suggests, this formation consists of two peaks that are substantially equal in height, separated by a shallow dip.

This arrangement is seen as done when the xauusd price goes up twice and then goes below the lowest spot between the high points, also called the neckline. The signal to sell from this pattern happens when the price goes below the neckline.

In XAU USD, this setup is used as an early signal that a bullish market trend is about to turn & reverse. However, it's only confirmed once the neck line is broken and the market moves below the neckline. Neck-line is just another term for the last support level formed on the chart.

Summary:

- Forms after an extended move upwards

- This pattern shows that there will be a reversal in the market

- We sell when price breaks-out below neck-line point: see below for an explanation.

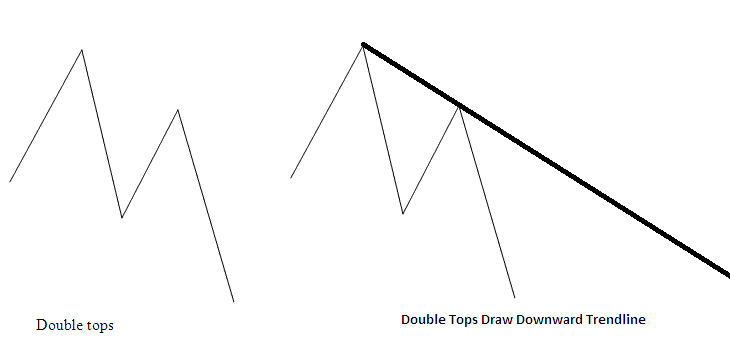

The double top look like an M-Shape, the best reversal signal is where the second top is lower and lesser than the first one as cited below, this means the reversal setup can be confirmed by drawing a downwards trend-line just as is illustrated below. If one opens a sell trading signal the stop loss order will be placed just above this downwards trendline.

M Shaped

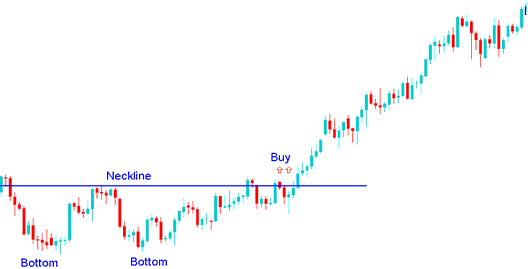

Double Bottom

This reversal pattern follows a long downtrend. It has two equal lows with a small peak between them.

This particular configuration is considered finalized once the gold trading price establishes its second low point and subsequently pierces the peak level situated between those two lows, which is identified as the neckline. The signal to initiate a buy order, derived from this bottoming pattern, is triggered when the market breaks above the neckline to the upside.

In XAU/USD trading, this setup often signals that the bearish market trend may be nearing a reversal. The formation is confirmed only when the neckline, acting as the resistance zone, is broken. Once this resistance is breached, the price is expected to move upward.

Summary:

- Forms after an extended move downwards

- This pattern indicates that there'll be a reversal in the market

- We buy when price breaks-out above neckline point: see below for the explanation.

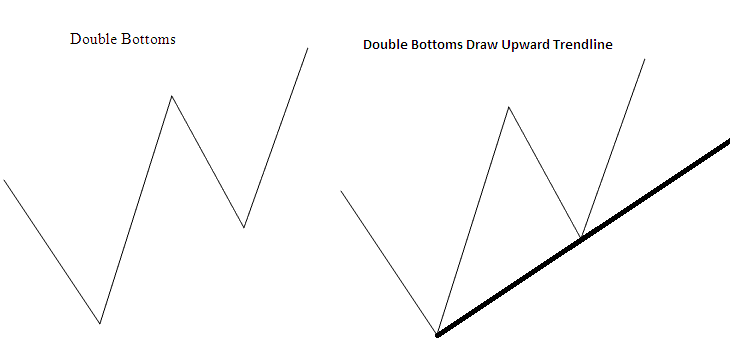

The double bottoms pattern formation look like a W Shape, the best reversal signal is where the second market bottom is higher than the first one as cited below, this means the reversal setup can be confirmed by drawing an upwards trend line such as shown below. If one opens a buy signal the stoploss order will be placed just below this upward trend-line.

W Shaped

Study More Lessons and Courses:

- How to Analyze/Interpret MT4 Downward XAUUSD Trendline in MT4 Platform

- How to Trade MetaTrader 5 Upwards Gold Channel in MT5 Platform Software

- Types of Candlesticks Patterns

- XAUUSD Patterns Candlestick Definition Explained and Illustrated

- Guide Tutorial Price Action Strategies Lesson Guide

- MT5 Real Account Registration Course Tutorial

- What Amount of XAU USD Power for $20 in Gold?

- XAU/USD Support & Resistance for Gold

- XAUUSD Take-Profit Order Setting on Mobile Trade App

- Learn How to Create The Best XAUUSD Strategy