What Does Descending Triangle Chart Pattern Mean?

Falling Wedge Trading Setup

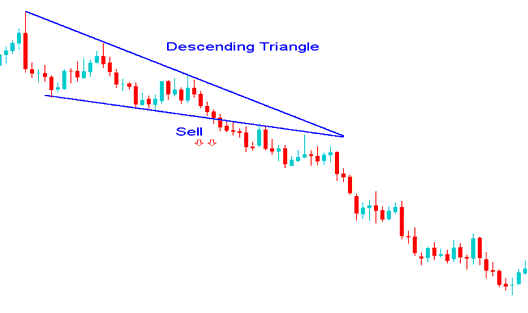

The descending triangle chart pattern setup in gold trading is formed in a downward trend and it highlights that the downward direction of price movement is going to continue.

Descending triangle chart pattern is a continuation pattern setup that signals the current downwards market trend is going to continue.

Descending triangle pattern is also known as falling wedge pattern.

Descending triangle chart pattern setup highlights that there's a support zone that the sellers keep pushing each time moving this support zone lower, and once it breaks price will continue to move downwards.

A downside penetration of the lower line of the descending triangle chart pattern is a technical sell signal for a market breaking out down from a descending triangle, and this shows selling will follow.

What Happens to Price Action After Falling Wedge Pattern?

The market formed a descending triangle pattern during its downwards trend which led to further selling and continuation of the downward market trend.

The technical sell signal is when price breaks out the lower horizontal sloping line of the descending triangle pattern and selling resumes to push the trading price lower - continuation of the downwards trend.