What Happens in Trade after a Hanging Man Candlestick Sticks Setup?

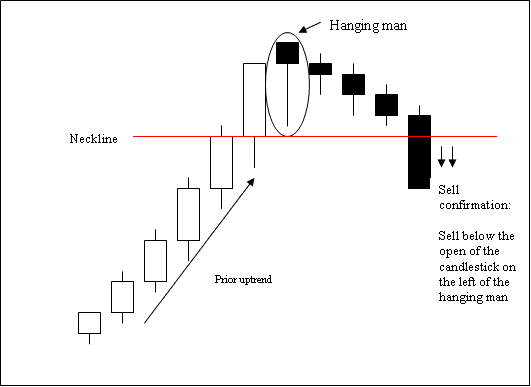

The Hanging Man candlestick configuration is a potential bearish reversal signal that manifests during an uptrend. It earns its name because its appearance resembles a figure suspended from a rope high above.

A hanging man candle has:

- A small body

- The body is at the top

- The lower shadow is 2 or 3 times length of real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body isn't important

What Happens in Trade after a Hanging Man Candles Pattern?

Technical Analysis of the Hanging Man Candles

The signal to sell because things are going down is confirmed when a down candle closes under where the candlestick opened on the left of the hanging man candle setup.

After a xauusd trader initiates a trade based on this candlestick setup, a few pips should be placed just above the high of the hanging man candle to set a stop loss order.

Get More Lessons & Courses:

- Gold MAs

- User Guide and Tutorial Course for MetaTrader 4 Gold Trading Software

- Trading Gold Charts with Pivot Points

- MetaTrader 4 Platform Download and MetaTrader 4 Software Lesson Guide Platform Installation Tutorial Guide

- Three types of gold charts used in XAU/USD analysis

- Setting Up and Saving Your Preferred Layouts in MT5 for Gold Trading

- How to Configure a Trailing Stoploss Indicator in Charts

- Instructions for Loading a Pre-configured XAUUSD Template onto MT4 Software