Which Candle Pattern is Bearish?

The list below breaks down all the bearish candle patterns, how to read them, and how to trade using these setups.

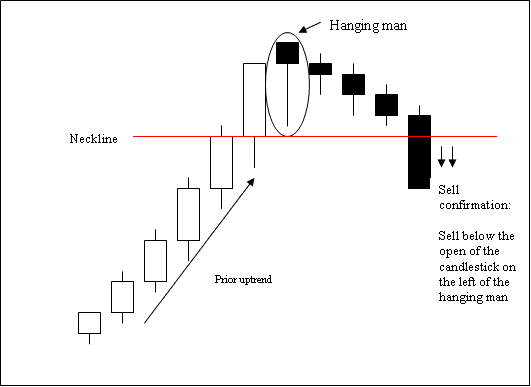

Hanging Man Candles

The hanging man candle pattern suggests a bearish reversal during an upward trend. This pattern is named due to its resemblance to a man hanging from a noose.

Hanging Man Candle Pattern.

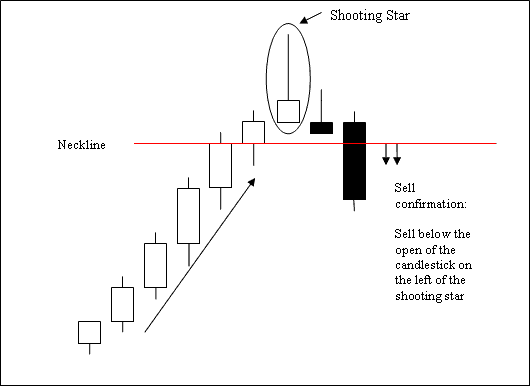

Shooting Star Candlesticks

The Shooting Star forms as a bearish reversal candlestick. It appears at a trend's high point.

The shooting star pattern forms at an uptrend's peak. Open matches the low. Price climbs but drops back to close near the open.

Shooting Star Chart Design

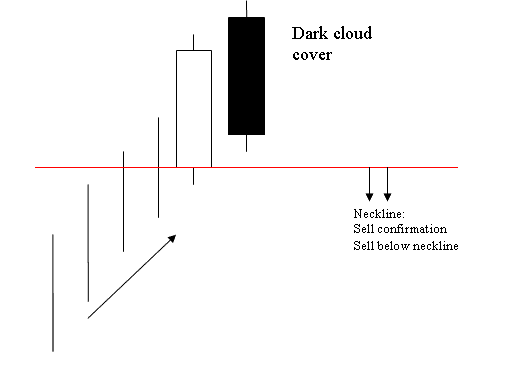

Dark Cloud Cover Candles

The Piercing Line candlestick formation serves as the direct counterpoint to the Dark Cloud Cover setup.

Dark Cloud candle stick pattern is a long white body followed by a long black body.

The dark bar passes through the middle of the previous light bar.

This is a bearish price reversal xauusd setup which forms at the top of an upwards trend.

Dark Cloud Cover Candle Pattern the market opens higher & closes below the mid-point of the white body.

The Dark Cloud Cover candlestick pattern suggests that the strength of the upward trend is diminishing, indicating that the price trend may reverse and start moving downward in gold trading.

Dark Cloud Cover acts as a bearish sign. The cloud blocks further upside in the price trend.

Dark Cloud Cover Candle Pattern,

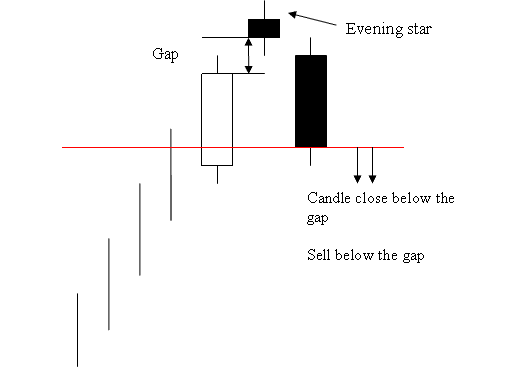

Evening Star Candles

The opposite of the Evening Star candle pattern is the Morning Star candle pattern formation.

Evening Star candle pattern

Bearish Engulfing Candles Pattern

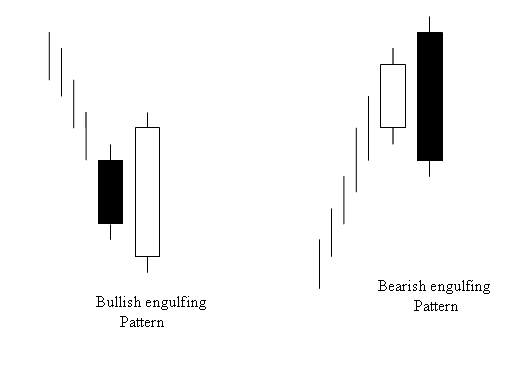

Engulfing is a candle pattern that shows a change in direction, and it can be bullish or bearish based on whether it is at the end of a market going down or up.

Bullish & Bearish Engulfing Candlestick Pattern Setups - A Tutorial on Bearish Candle Patterns.

Bearish Candle Patterns - Full List of Downward Signals

Get More Courses: