Gold Trading Basics: Intro to XAUUSD Online Trades

Trading gold online is becoming more popular with traders. XAUUSD is one of the things a gold trader can trade online.

With this popularity it means xauusd as a financial instrument is liquid enough to be transacted on the online markets. Because of the many traders are now trading this metal online it means there is always someone willing to buy or sell their xau/usd contracts at any time of the day when gold trading market is open.

This liquidity has also led to setup formation of trends in the market price movement of gold. These trends mean that xauusd can be interpreted using analysis & traders can determine what direction the market price of gold is likely to move in.

Gold now possesses sufficient liquidity to be traded as a financial asset in the digital marketplace. This development has prompted numerous brokers to incorporate gold as one of the tradable instruments available on their respective trading platforms.

Main online brokers offering xauusd as a financial instrument which can be transacted are forex brokers. FX brokers have been providing forex trading services to traders because the online currency exchange trading market is the largest financial market and the most liquid. This is why currency prices move in trends - because of this liquidity. The currency traders who trade fx use trading analysis to analyze the direction of these market trends and then place trades on the currency market so that to make profits from this price moves.

Now that gold has gained a lot of popularity, xauusd gold prices now also form trends which can be traded and analyzed. This liquidity in xauusd has led to the setup formation of these market trends. The liquidity also means that there are enough traders willing to buy or sell at any time when the gold market is open.

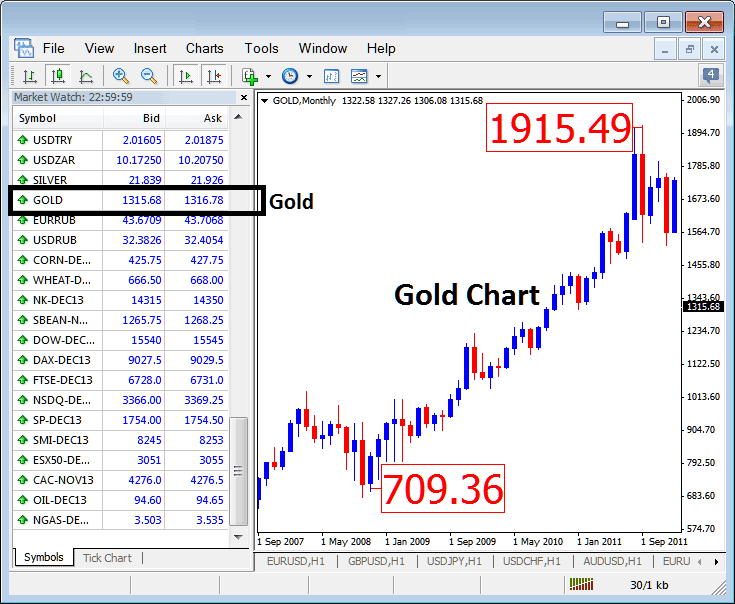

The chart presented below visualizes the market price for gold: traders will base their gold trades on this specific price chart.

XAUUSD Price Chart

About Gold Charts

By observing the preceding trading chart, one can swiftly ascertain the prevailing direction of gold prices based on observed price movements.

The first part prices are moving upwards in an upwards trend, then they start to move down in a downwards market trend & then finally the market prices move upwards in an upwards market trend.

As a beginner trader who wants to trade gold you'll have to learn how to analyze and interpret these market movements.

For instance, in the chart example above, we utilize the Moving Average crossover trading system: this system combines two moving averages to visually represent the direction of the price trend.

When both moving averages trend upwards, it indicates that XAUUSD prices are experiencing an upward movement. In such a scenario, a gold trader would typically purchase gold to profit as the market continues to rise.

Moving averages help identify trend direction changes. In the example provided, when two moving averages cross from moving upward, this indicates a trend reversal where traders should close active positions.

After the moving averages (MA) crossed each other, they shifted direction and started moving downwards. During a downward trend, a gold trader would sell XAUUSD and profit as long as prices continue to decline.

In the above example there also the RSI. This gold indicator has got a center line marked 50, when this indicator is above the 50 center-mark prices are bullish, when RSI is above 50 center line it means that the prices are in general closing higher than where they open meaning the price movement is bullish. When RSI moves below 50 center-mark it illustrates prices are in general closing lower than where they open meaning that the market prices are bearish.

Technical Analysis of Gold Trading

In gold trading, traders rely on analysis tools and indicators like those above to spot price direction. Once they identify the trend, they enter trades that align with it.

If the market trend is upward then a gold trader will open buy trades and if the trend is downward a gold trader will open a sell position.

Buying is known as going long and selling is referred to as going short.

Traders profit in up or down trends. In an up trend, buy gold to go long. In a down trend, sell XAUUSD to go short.

Trading Gold Contracts

In the online market, gold is traded as lots, and no real gold changes hands. When talking about contracts, one xauusd contract is worth 100 units.

If we measure gold in ounces, then one gold contract traded online is equal to 100 ounces of gold.

Gold Prices

The chart shows gold prices with two decimal places. That's the standard quote format for gold.

Gold Charts

Historical gold prices create the chart. Online traders use it to spot trend directions. They study price moves with technical analysis and indicators.

The gold chart is the main trading tool used to trade gold.

Learn More Guides:

- Top Trend and Momentum Indicators Combo for Gold Trading Leads

- Advantages of MQL5 Gold Signals to Gold Signal Sellers & to Gold Signal Providers

- XAUUSD Software Platform MT5 Line Studies Tool-bar Menu

- What's the Best XAU/USD Leverage for $20 in XAU/USD?

- How Do You Interpret a Sell Limit XAU/USD Order?

- How do you trade XAUUSD on the MT5 platform?

- Drawing XAUUSD Channels in MT4 XAU USD Charts

- XAUUSD: MT4 Software Toolbars Overview

- XAU/USD News System