Islamic Swap Free Account

When trading gold contracts online, you pay swap fees each day. The swap is a fee from the broker to hold a position overnight. If you keep a trade open past the day, you pay this rollover fee, or swap. It acts like interest. You pay it or receive it for holding an XAUUSD position.

Gold trades against the USD, which carries a 0.75% interest rate. A XAUUSD trader pays or earns interest based on the position held.

Buy Trade - When purchasing Gold, a trader will acquire XAUUSD and sell USD. Selling USD incurs an interest rate of 0.75%. However, this interest is annual, meaning the Gold trader will pay a small daily portion of this 0.75% interest.

Sell Trade - Selling XAUUSD means a gold trader will sell gold and buy USD. Buying USD means you will either get or have to pay interest of 0.75%. Since this interest is for a year, the gold trader will get a small part of this 0.75% interest each day.

Conversely, the magnitude of this interest paid or received by the trader is generally small: however, the concept of paying or receiving interest presents an issue within the Islamic faith.

This issue of paying and getting paid interest which is an Issue in Islamic Religion brings us to the Swap Free Islamic Accounts. Islamic Religion doesn't allow paying and getting paid interest, for Islamic XAUUSD Gold metal traders there is a trading account designed in compliance with their Values: Known as Swap Free Trade Account.

In a swap-free account, XAUUSD traders skip overnight fees on gold. They earn no interest either. This fits Shariah rules by avoiding RIBA. People call these Islamic accounts.

For a xauusd/gold trader to get a swap free account, a xauusd/gold trader has to navigate to a broker and choose & select option of 'Islamic Account", this option is provided under the Trade Accounts Section of the online Gold broker specifying the steps of opening and registering one of these swap free trading accounts.

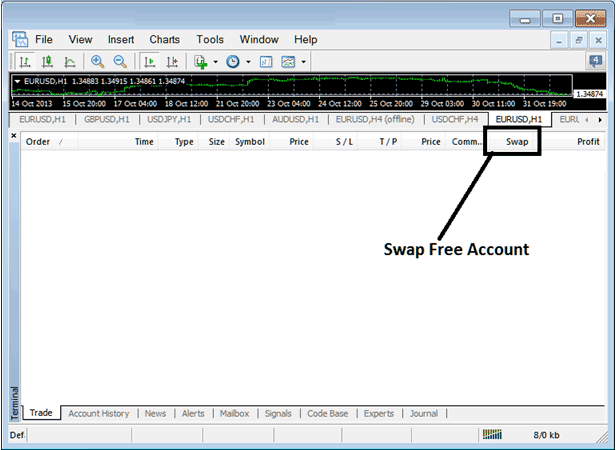

Once a trader opens this Islamic XAUUSD Account, then the XAUUSD roll over fee is removed. Once this no paying of interests set, if a trader is using the Gold trading platform - the MT4 then the roll over fee record will be reset to zero.

Islamic Forex Account

The rollover fee is taken each day at the end of the day for those who have an open XAUUSD trade that has a swap roll-over fee. If you don't want to pay this roll over swap interest as a trader, you must close your trades before the day ends. That way, you won't pay the roll over interest because you won't have any open gold trades left. Since the online financial market is closed on Saturday and Sunday, the swap interest for these two days is charged on Wednesdays. This means that on Wednesday, a trader pays the roll-over fee for Wednesday, Saturday, and Sunday. Because of this, traders pay this swap interest 3 Times on Wednesdays.

These open positions that pay a roll-over interest are commonly referred to by traders as Overnight Positions. Day Traders rarely leave their trade transactions opened overnight and close them all before the close of the day. Swing Traders on the other hand might leave their trades opened for a couple of a few days and leave these trade transactions overnight so that to capture more movement in the price trend.

Once a trader successfully locates a swap-free online XAUUSD broker and establishes an Islamic Gold Trade Account, the online trader will operate under identical conditions as other account holders, with the sole exception being the non-application of rollover interest. This means that the gold trader will utilize the MT4 Software Platform just like everyone else, and this gold trader retains the ability to trade Gold alongside all available currencies, stock indices, CFDs, metals, and all other trading instruments offered by the broker, including XAUUSD.

However, be careful in selecting a swap free online broker, some brokers will add a commission or add some pips to the spread you trade with to cover the swap(This are Swap Fee Online Brokers). This isn't supposed to happen as the online trader will still be charged for the interest even though it's disguised as a different type of payment, good brokers do not add any commission nor do they add any charge on to the spreads.

Another thing is that some brokers will charge roll over fee if the open position held by a xauusd/gold trader is opened for more than 5 days or more than seven days, this shouldn't be the case and the broker shouldn't charge any carry-over interest even if the open positions are held open for more than five or seven days. For traders who want to open this swap free Trade Account it's good to check for any additional terms of trading for the Islamic Account that you're going to be opening to ensure that the broker you choose is really a - no swap broker.

As the number of traders in the Islamic XAU USD and forex markets who trade online grew, brokers began to offer free swap accounts. In what is known as roll over interest, the conventional trading account involved the payment of rollover interests. Because of this, Interest Free Trading Accounts were established, allowing Islamic traders to trade financial instruments like XAUUSD and other currencies while adhering to their prohibition against earning and paying interest.

Study More Topics and Courses:

- XAU USD Tutorial Guides List of Gold Indicators

- Utilizing the Kurtosis Trading Indicator on Charts

- Resources for Finding a Gold Trading Course

- Learn How to Trade and Learn Online XAUUSD Tutorials

- Bollinger Bandwidth XAU USD Indicator Analysis

- Creating a Simple System for Gold Trading

- Proficient Stop Loss System for XAU/USD

- Applications for Gold Trading Platforms

- How Many Types of Gold Candles Are There?