Oil Trading Pivot Points

Pivot points is a set of indicators developed by floor traders in the commodities markets to determine potential turning points, also known as "pivots". These points are calculated to determine levels in which the sentiment of the trend could change from "bullish" to "bearish." traders use these points as markers of support and resistance.

These points are calculated as the average of the high, low and close from the previous session:

Oil Trading Pivot Point = (High + Low + Close) / 3

Day traders use the calculated pivot-points to determine levels of entry, stops & profit taking, by trying to determine where the majority of other oil traders may be doing the same.

A pivot-point is a price level of significance in technical analysis of a financial market that is used by oil traders as a predictive indicator of price movement. It's calculated as an average of significant prices (high, low and close) from the performance of a market in the prior trading period. If the prices in the following period trades above the central point it is usually evaluated as a bullish sentiment, whereas if price below central point is seen as bearish.

The central point is used to calculate additional levels of support & resistance, below and above central point, respectively, by either subtracting or adding price differentials calculated from previous trading ranges.

A pivot & the associated support & resistance levels are often turning points for the direction of price movement in a market.

- In an up oil trend, the pivot point and the resistance levels may represent a ceiling level for the price. If price goes above this level the up oil trend is no longer sustainable and a trend reversal may occur.

- In a down oil trend, a pivot point and the support levels may represent a low for price level or a resistance to further decline.

The central pivot-point can then be used to calculate the support and resistance areas as follows:

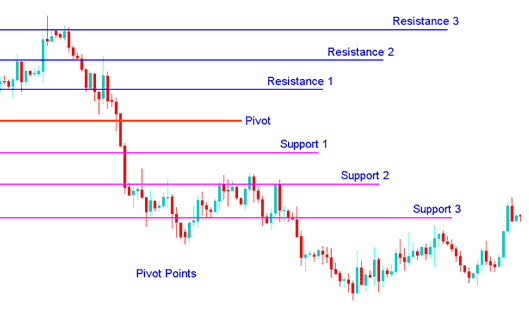

Pivot points consist of a central point level surrounded by three support levels below it and three resistance areas above it. These points were originally used by floor traders on equity and futures exchanges because they provided a quick way for those traders to get a general idea of how the market was moving during the course of the day using only a few simple calculations. However, over time they have also proved exceptionally useful in other markets as well.

One of the reasons they are now so popular is because they are considered a "leading" (or predictive) indicator rather than a lagging indicator. All that is required to calculate the pivot points for the upcoming (current) day is the previous day high, low, and close prices. The 24-hour cycle pivot points in this indicator are calculated according to the following formulas:

The central pivot can then be used to calculate the support and resistance areas as follows:

Resistance 3

Resistance 2

Resistance 1

Pivot Point

Support 1

Support 2

Support 3

Pivot Points Support and Resistance Levels

Pivot Points as a Oil tool

The pivot point itself represents a level of highest resistance or support, depending on the overall sentiment. If the market is direction-less ( range bound ) prices will often fluctuate greatly around this level until a price breakout develops. Prices above or below the central point indicates the overall sentiment as bullish or bearish respectively. This indicator is a leading indicator that provides signals of potentially new highs or lows within a given chart time frame.

The support and resistance levels calculated from the central pivot point and the previous market width may be used as exit points of the open trades, but are rarely used as entry signals. For examples, if the price is up-trending and breaks through the pivot point, the first or second resistance level is often a good target to close a position, as the probability of resistance and reversal increases greatly, with every resistance level.

In pivot point analysis 3 levels are commonly recognized above & below the central point. These are calculated from the range of price movement in previous trading period and then added to the central point for resistances & subtracted from it for support areas.

Pivot Points

Pivot levels can be utilized in many different ways. Here are a few of the most commonly techniques for utilizing them:

Trend Direction: Combined with other Oil Trading analysis techniquesmethods such as overbought oversold oscillators, volatility measurements, etc., the central point might be useful in determining the general trending direction of the market. Trades are only taken in direction of the trend. Buy trades occur only when the price is above the central point and sell crude trades occur only when the price is below the center pivot points.

Trading Price Break-outs: In price breakouts, a bullish buy oil signal occurs when the price breaks up through the central point or one of the resistance levels (typically Resistance Zone 1). A short sell oil signal occurs when price breaks down through the center point point or one of the support levels (typically Support Zone 1).

Trend Reversals: In oil trend reversals, a buy oil signal occurs when the price moves towards a support level, gets very near to this point, touches it, or moves only slightly through it, & then reverses and starts moving in the other direction.

To download this Pivot points technical Indicator:

https://c.mql5.com/21/9/pro4x_pivot_lines.mq4

Once you download the indicator. open it with the MQL4 Language Meta Editor, Then Compile the technical indicator by pressing the Compile Button Key and it will be added to your Meta Trader 4.

NB: Once you add it to your Meta Trader 4, the technical indicator has extra lines referred to as MidPoints, to remove the additional lines open MQL4 Meta Editor(shortcut key-board key - press F4), & change line 16 from:

Extern bool mid-pivots = true:

To

Extern bool mid-pivots = false:

Then Press Compile button again, & it will then appear as depicted on www.tradegoldtrading.com web site.