Divergence Trade Setups

Divergence is one of the trade set ups used by traders. It involves looking at a chart & one more indicator. For our examples we shall use the MACD indicator.

To spot this trading setup find two chart points at which price makes a new swing high or a new swing low but MACD indicator does not, indicating a divergence between price and momentum.

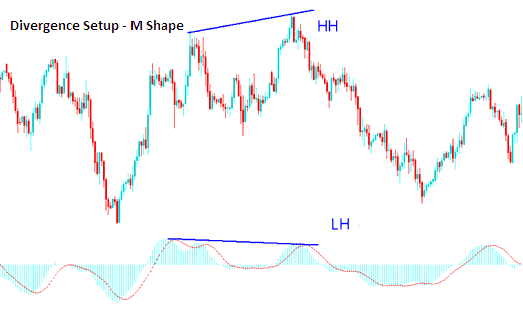

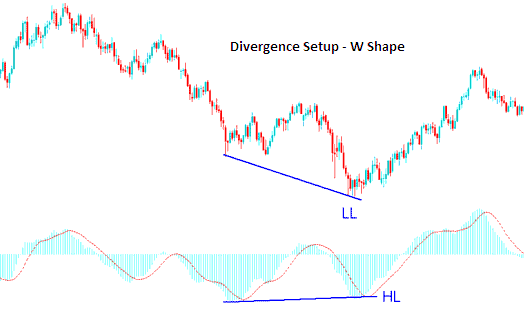

To look for divergence we look for two chart points, 2 highs that form an M shape on the Oil Trading chart or 2 lows that form a W-Shape on Oil Trading chart. Then look for the same M-shape or W-Shape on the indicator you use to trade.

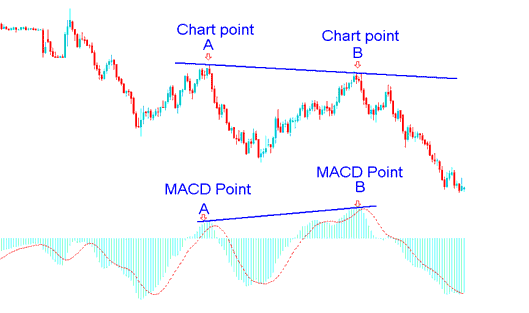

Example of a Divergence Setup Trade Setup:

In the chart below we spot 2 chart points, point A and point B (swing highs). These two points form an M-shape on the price chart.

Then using MACD indicator we check highs made by MACD, these are highs which are directly below Chart points A and B.

We then draw one line on the Oil Trading chart and another line on MACD trading indicator.

Drawing Divergence Oil Trading Lines

The chart above displays example of one of the four types of divergences, the one above is known as hidden bearish divergence, one of the best type to trade. Types of divergences are covered in the next tutorial.

How to spot divergence

In order to spot Oil Trading diverging trading signal we look for the following:

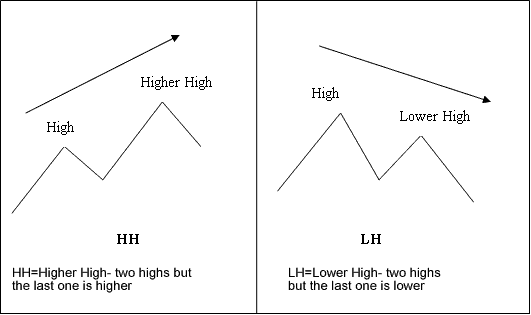

- HH=Higher High- two highs but the last one is higher

- LH= Lower High- 2 highs but the last one is lower

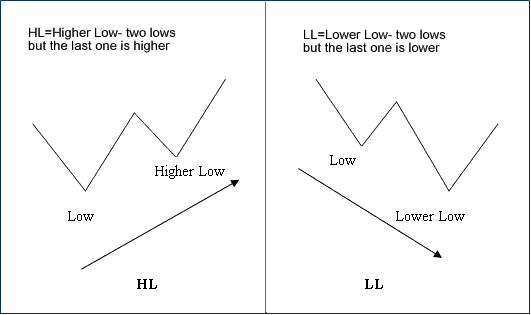

- HL=Higher Low- 2 lows but the last one is higher

- LL= Lower Low- 2 lows but the last one is lower

First let us look at the illustrations of these trading terms:

M-shapes dealing with price Highs

W Shapes dealing with price lows

Example of M Shapes

Examples of W Shapes

Now that you've learned the divergence trading terms that are used to explain set-up. Let us look at the two types of divergences & how to trade these chart setups.

There two types are:

- Classic Trade Divergence

- Hidden Trade Divergence

These two set ups are described on following guides below