MACD Trading Hidden Bullish & Bearish Divergence

MACD Trading Hidden divergence is used by traders as a possible sign for a trend continuation.

This MACD Trading Hidden divergence setup occurs when crude price retraces to retest a previous high or low. The two MACD Trading Hidden divergence setups are:

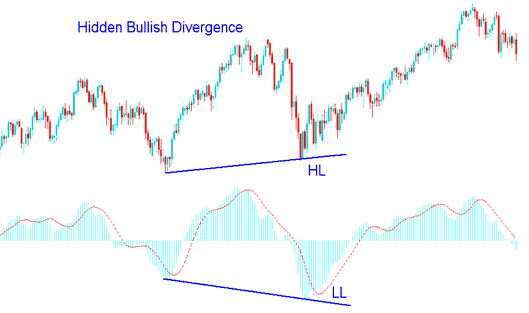

1. Hidden Bullish Divergence

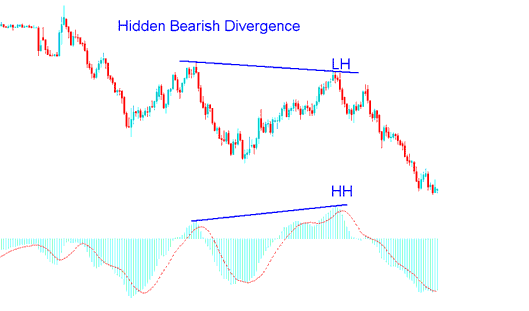

2. Hidden Bearish Divergence

Oil Hidden Bullish Divergence in Oil

MACD Trading Hidden bullish divergence setup occurs when crude price is forming a higher low (HL), but the MACD oscillator is showing a lower low (LL).

Hidden bullish divergence occurs when there's a retracement in an upwards crude trend.

MACD Bullish Divergence Strategy - MACD Bullish Divergence Trading Setup

This MACD bullish trade divergence setup confirms that a price retracement move is complete. This divergence shows underlying strength of an up-ward trend.

Oil Hidden Bearish Divergence in Oil

MACD Hidden Bearish Divergence trade setup forms when crude price is forming a lower high ( LH ), but the MACD oscillator is showing a higher high ( HH ).

Hidden bearish divergence set up occurs when there's a retracement in a downwards crude trend.

MACD Bearish Divergence Strategy - MACD Bearish Divergence Trading Setup

This MACD hidden bearish divergence setup confirms that a retracement move is exhausted. This diverging indicates momentum of a downwards crude trend.

NB: Hidden divergence is the best divergence setup to trade because it gives a signal that is in the same direction with the crude trend. It provides for the best possible entry and is more accurate than the classic type of divergence signal.