MACD Whipsaws and Fake Out Signals on Bearish & Bullish Territory

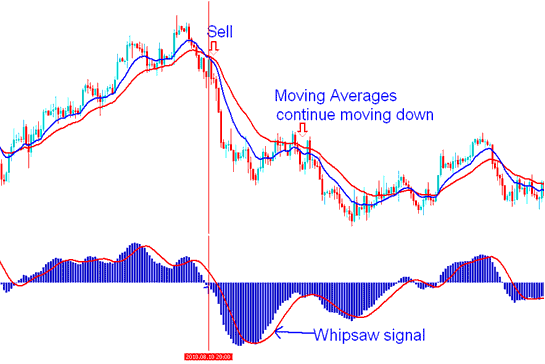

Since the MACD indicator is a leading indicator which sometimes gives whipsaws, we shall look at an example of a oil whipsaw generated by this MACD indicator, so as to illustrate why it's always good to wait for a confirmation signal.

MACD Indicator Whipsaw - Oil Whipsaws

The MACD indicator gave a buy oil signal, when this buy oil signal was generated and the MACD indicator line was still below the zero center line mark. At this point the buy oil signal had not been confirmed and it resulted into a oil whipsaw as illustrated by the moving averages which continued to move downwards.

A whipsaw signal is as a result of dramatic rise and fall in the crude price in a short time and in such a manner that skews the data used in calculating the moving averages that draw the MACD indicator data. These types of whipsaw moves are usually brought about because of some news event that can produce market noise.

Traders should have the ability to gauge a oil whipsaw and withstand the whipsaw; a oil whipsaw might result into an upswing session and then a downswing session. To minimize the risk of trading oil whipsaws, it's good to wait for confirmation of signals by waiting for MACD to cross above or below the zero center-line mark.

Combining MACD Crossover with Center-Line Crossover to Prevent Oil Whipsaws

Buy crude trading signal - When there is a crossover, followed by a steep rise in crude price and then a center-line crossover the buy oil signal is confirmed.

Sell crude trading signal - When there is a crossover, followed by a steep decline in crude price and then a center-line crossover the sell signal is confirmed.

1. Buy Oil Signal in Bearish Territory Whipsaw

When a buy oil signal is generated in a bearish territory, it might result into a oil whip saw especially if it is not followed soon by a MACD center line crossover.

In the example shown below, MACD indicator gives a buy oil signal even though it is in bearish territory, the MACD indicator then turns downwards and starts moving down again resulting into a oil whipsaw. By waiting for center line crossover it is possible to avoid the whipsaw.

However, in this case there was a brief center line crossing: this oil whipsaw would have been hard to trade using this MACD indicator alone, that is why it is good to combine the use of MACD indicator with another oil indicator. In the example shown below MACD is combined with the moving average indicators analysis.

MACD Whipsaw - Buy Oil Signal in Bearish Territory

2. Sell Oil Signal in Bullish Territory Whipsaw

When a sell signal is generated in a bullish territory, it might result into a oil whip saw especially if it is not followed soon by a MACD center-line crossover.

In the example shown below, the MACD indicator gives a sell signal even though it is in bullish territory, the MACD indicator then turns up and starts moving upwards again resulting into a oil whipsaw. By waiting for center-line crossover it is possible to avoid the whipsaw. In the example shown below by combining this MACD indicator with the MA Crossover Oil Strategy you would have avoided this whipsaw.

MACD Whipsaw - Sell Oil Signal in Bullish Territory

To avoid oil whipsaws completely when trading the market with this MACD Indicator it is best to use the Center-line Crossover Signal as the Official Buy or Sell Oil Signal of The MACD Indicator.