Trading Short-Term and Long-Term Price Period of Moving Average

A trader can choose to adjust the price periods used to calculate the moving average.

If a trader uses short price periods then the MA will react faster to the changes in price.

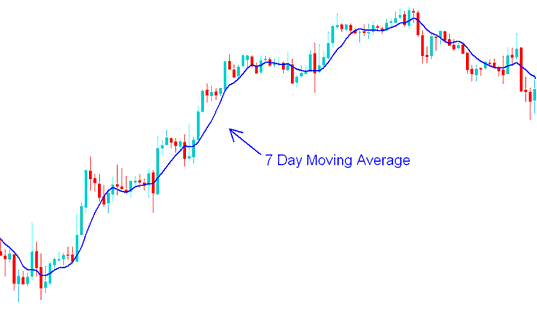

For example if a trader uses the 7 day moving average then, the moving average indicator will react to the price change much faster than a 14 day or 21 day Moving Average would. However, using short time price periods to calculate the MA might result in the indicator giving false signals (whipsaws).

7 Day Moving Average - Moving Average Oil Methods

If another trader uses longer time periods then the MA will react to price changes much slower.

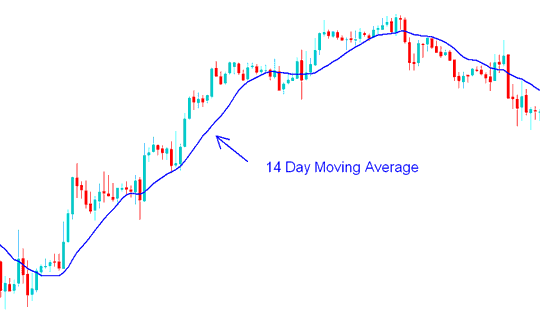

For example, if a trader uses the 14 day MA then the average will be less prone to whipsaws but it will react much slower.

14 Day Moving Average - Moving Average Strategy Example

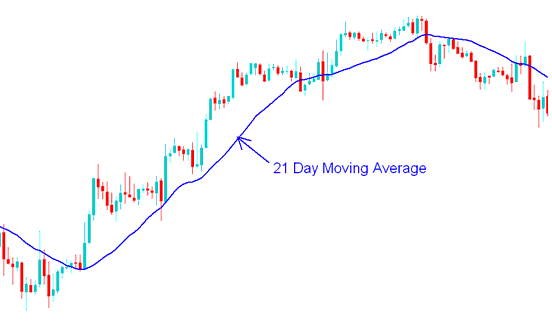

21 Day Moving Average - Moving Average Strategies Examples