RSI Indicator Divergence Setups

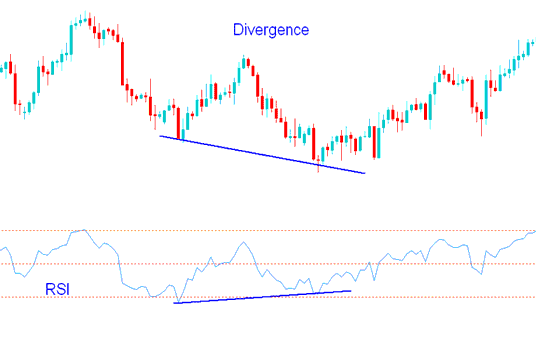

Oil Divergence is one of the trade setups used by Oil traders. It involves looking at a chart and one more indicator. For our example we shall use the RSI indicator.

To spot this divergence setup find two chart points at which crude price makes a new swing high or a new swing low but the RSI indicator does not, indicating a divergence between crude price and momentum.

RSI Divergence Example:

In the crude chart below we spot two chart points, point A and point B (swing highs)

Then using RSI indicator we check the highs made by the RSI indicator, these are highs that are directly below the Chart points A and B.

We then draw one line on the crude chart & another line on the RSI indicator.

RSI Divergence Oil Setup - Divergence Oil using RSI Technical Indicator

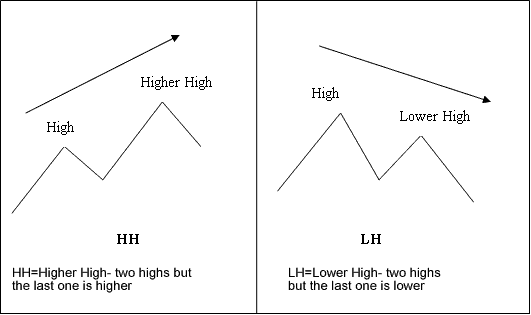

How to spot divergence

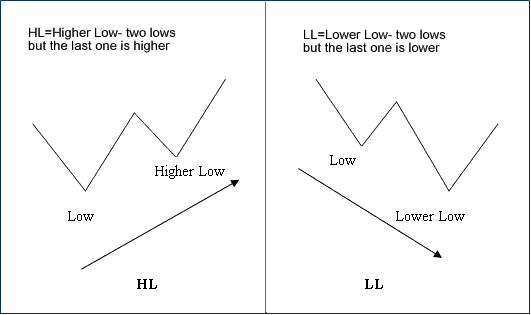

In order to identify this divergence setup we look for the following:

HH=Higher High- two highs but the last one is higher

LH= Lower High- 2 highs but the last one is lower

HL=Higher Low- two lows but the last one is higher

LL= Lower Low- 2 lows but the last one is lower

First let us look at the illustrations of these oil terms

Divergence Oil Terms Definition

Oil Divergence Oil Terms Definition Examples

There are 2 types of divergence setups:

- Classic Oil Divergence

- Hidden Oil Divergence