Upward Trendlines & Channels

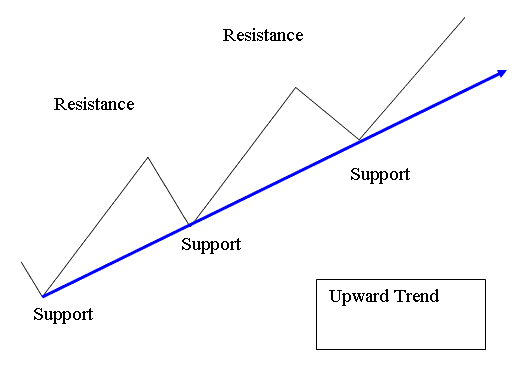

An upwards trend line is plotted below the trend pattern by connecting at least 2 lows. This upward trend line will draw a line that show the general direction of the market.

The diagram below shows how crude trading price moves when it is moving in a bullish market. The crude oil price will move upwards forming support regions.

Since the market moves in a zigzag manner traders normally draw a oil trend line which displays the general upward direction of the market.

A up trend occurs when the fore crude oil price will continue to make consecutive higher highs and higher lows. Each price high is going to be higher than the previous high - higher high, and each low is higher than the previous low - higher low.

Oil Trading Up trend lines gain more validity every time crude trading price touches this upward trend line but does not penetrate it. A up trend remains in place until this series of higher highs and higher lows is broken.

A downside penetration of an upward trendline is a technical sell oil signal, and usually the first indication that an up-ward trend may soon end.

Upward Trend Line MT4 Trend Line Indicator

When the market moves up it forms higher highs & higher lows forming a bullish market movement - Upward Trend. An upward trend line can then be drawn by connecting these higher lows.

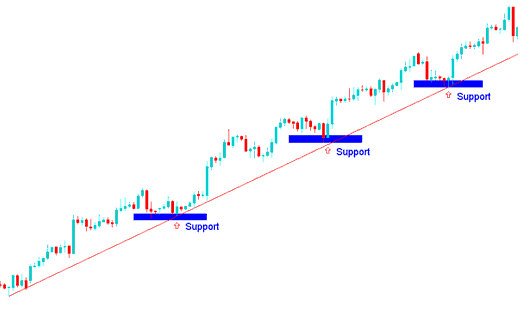

To draw this upwards trend line setup we use supports. To draw the upward trend line correctly two support zones are needed. When crude trading price touches the upward trend line we buy and place stop loss orders just a few pips below the upward trend line. The diagram below shows an example of an upward trend line.

The upward trendline setup will show the general direction of the market as bullish therefore traders will only open buy long crude trades as long as crude trading price is within this upward trend bullish market setup and within the support levels. These support levels are the levels where if the market retraces then these points will provide strong supports for the crude trading price. This is why many oil buyers will wait until crude trading price retraces downwards & hits these retracements levels market the upward trend line to open buy crude trades. trades opened at this support levels have a high Risk to Reward Ratio with minimum draw down.

In the above upwards trend line oil setup the trader would have opened buy/long crude trades from the signals generated at the support1, support2, support3 and these crude trades would have made a lot of trading profits with minimum amount of drawdown/retracement.

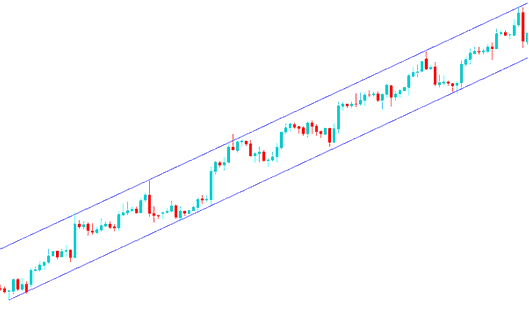

Upward Oil Channel

An upwards oil channel is drawn by drawing a line that's parallel to the upward trend line and then adjusted to touch the tops boundary of the crude price movement. This then forms an up-wards oil channel & as long as the crude oil price stays between these two trading channels the bullish market movement will continue heading upwards.

How to Trade Upward Oil Channel

This upwards oil channel is used by crude traders to show levels where it is best to take profits. traders will take some profit once the crude trading price touches upper channel and wait for another retracement before opening a long buy oil trade again.

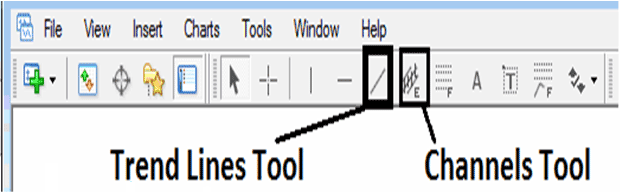

MT4 Tools For Drawing Trendlines & Channels

The Oil MT4 Trend Line Indicator drawing tools to draw these trend lines & oil channels setups on the MT4 are located on the MT4 drawing tool bar within the MT4 platform, To get this MT4 tool bar if it is not activated on your platform, Click in 'View' Next to 'File' menu at tops left corner of MetaTrader 4 platform and click View, Then Click on Tool Bars, Then Check 'Lines Tool-bar' by clicking on it.

Shown Below is the screenshot Image of the MT4 drawing tool bar. To draw a oil trendline on a oil chart click on this MT4 trendline plotting tool and select the point where you want to plot the trend line.

This is one of the learn oil analysis lesson among the many learn oil tutorials on this website located on the side navigation menu, where you will learn how to draw trend lines & analyze these trend lines setups.