Bears Power Analysis & Bears Power Trading Signals

Developed by Alexander Elder

Bears Power is used to measure power of the Bears (Sellers). Bears Power measures the balance of power between the bulls & bears.

This indicator aims at identifying if a bearish trend will continue or if the price has reached a point where it might reverse.

Calculation

A Stock Price bar has four parameters: the Opening, Closing, High & Low of the price bar.

Each Price bar either closes higher or lower than the previous price bar.

The highest price will show the maximum power of the Bulls within a price period.

The lowest price will show the maximum power of the Bears within a price period.

This indicator uses the Low of the price & a MA (Exponential MA)

The moving Average represents the middle ground between sellers & buyers for a certain price period.

Therefore:

Bears Power = Low Price - Exponential MA

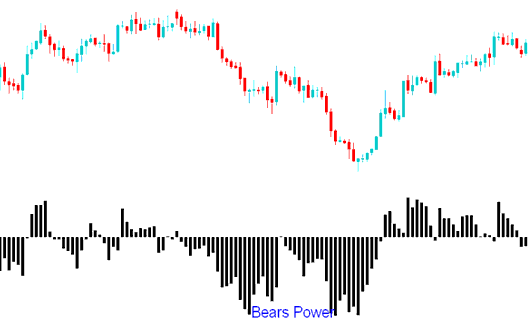

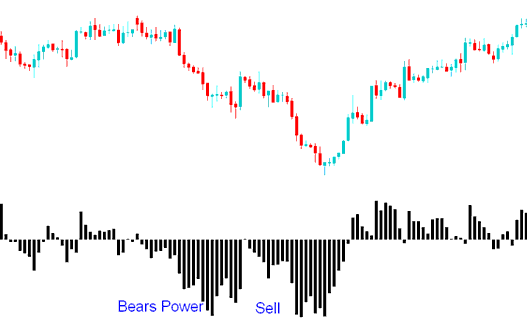

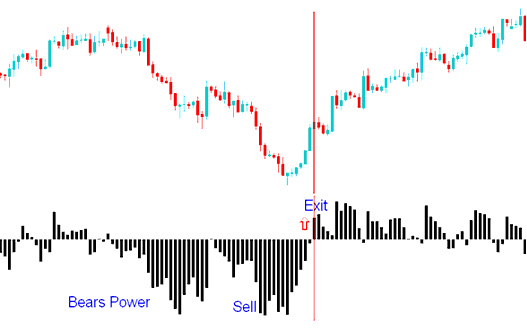

Stocks Analysis and How to Generate Signals

Sell Signal

A sell stock signal is generated when the oscillator moves below Zero.

In a down trend, the LOW is lower than Exponential Moving Average, so the indicator is below zero and Histogram is located below zero line.

Exit Signal

If the LOW moves above the Exponential Moving Average then it means that price are starting to rise, the histogram rises above the zero line.

The Triple Screen technique for this indicator suggests spotting the price trend on a higher chart interval (like daily time frame) and applying the bears power signals on a lower chart timeframe interval (like hourly chart time frame). Signals are traded according to the lower time frame but only in direction of the long term trend in the higher chart time-frame.