DeMarks Analysis & Range Expansion Index Trading Signals

Created by Tom DeMark.

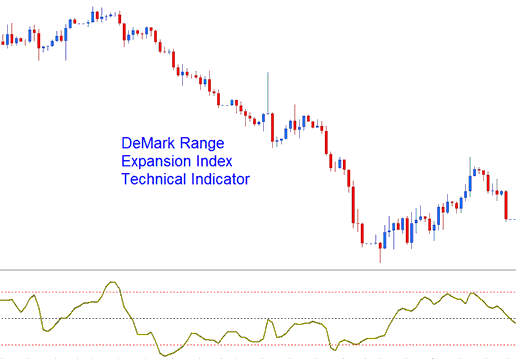

DeMark used the Range Expansion Index trading indicator to trade options, in his trading strategy. This indicator is an oscillator.

DeMark Range Expansion Index

This Oscillator is used as a market-timing oscillator which attempts to overcome problems with exponentially calculated oscillators, which are calculated arithmetically and these indicators tend to lag the market.

Stock Analysis and How to Generate Signals

This Oscillator typically oscillates between values of -100 to +100.

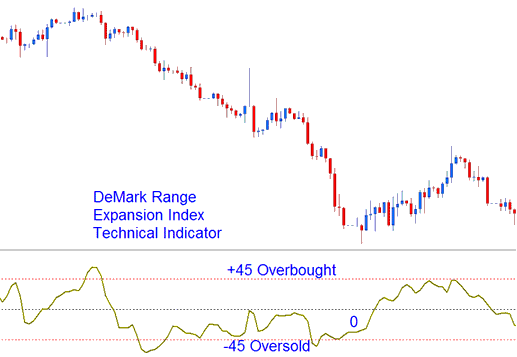

Overbought Levels - Readings of +45 or higher indicates overbought conditions.

Oversold Levels - Readings of -45 or lower indicates oversold conditions.

Overbought and Oversold Levels on Indicator

Exit Signals - DeMark advises against trading in extreme overbought conditions indicated by six bars above +45, exit for buy signals is generated six bars after price hits +45.

Exit Signals - extreme oversold conditions indicated by six or more bars below the -45 thresholds will generate exit signal for short trades.