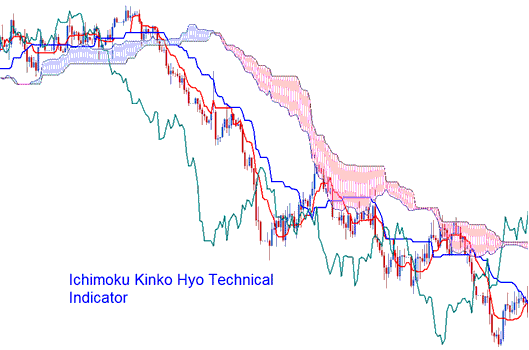

Ichimoku Technical Indicator

Ichimoku is a Japanese charting technique that was developed before by a Japanese newspaper writer, with the pen name of Ichimoku Sanjin.

- Ichimoku means 'a glance' or 'one look'

- Kinko means 'equilibrium' or 'balance'

- Hyo is the Japanese word for "chart"

Thus, Ichimoku means, 'a glance at an equilibrium chart'. Ichimoku attempts to identify the likely direction of price & help the trader to determine the most suitable time to enter or exit the market.

Calculation

This indicator consists of five lines drawn using the midpoints of previous highs & lows. The five lines are calculated as follows:

1) Tenkan Sen: Conversion Line: Red Line (Highest High + Lowest Low) / 2, for the last 9 price periods

2) Kijun-Sen: Base Line: Blue Line (Highest High + the Lowest Low) / 2, for last 26 price periods

3) Chikou Span: Lagging Span: Green Line Today's closing price drawn 26 price periods behind

4) Senkou Span A: Leading Span A = (Tenkan Sen + Kijun Sen) / 2, drawn 26 price periods ahead

5) The Senkou Span B: Leading Span B: (Highest High + Lowest Low) / 2, for the past 52 price periods, drawn 26 price periods ahead

Kumo: Cloud: area between Senkou Span A and B

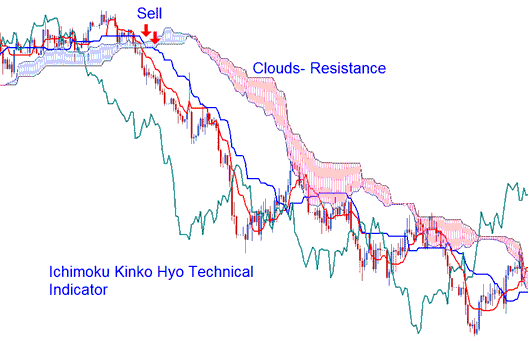

Trading Analysis & Generating Signals

Bullish signal - Tenkan Sen crosses the Kijun-Sen from below.

Bearish signal - Tenkan-Sen crosses Kijun-Sen from above.

However, there are different areas of strength for the buy and sell trade signals generated.

Analysis in Stocks Trading

Bullish crossover signal forms above the Kumo (clouds),

Very strong buy trade signal.

Bearish cross-over signal occurs below the Kumo (clouds),

Very strong sell trade signal.

If a bullish/ bearish crossover signal takes place within the Kumo (clouds) it's considered a medium strength buy or sell trade signal.

A bullish crossover that occurs below the clouds is considered a weak buy signal while a bearish crossover that occurs above the clouds is considered a weak sell trade signal.

Support and Resistance Levels

Support & resistance levels can be predicted by the presence of Kumo (clouds). Kumo can also be used to identify the current trend of the market.

- If price is above the Kumo, the prevailing market trend is said to be upwards.

- If price is below the Kumo, the prevailing market trend is said to be downwards.

The Chikou Span or Lagging Span is also used to determine the strength of the buy or sell trade signal.

- If the Chikou Span is below the closing price of the last 26 periods ago and a sell short signal is given, then the strength of the trend is downward, otherwise the signal is considered to be a weak sell trade signal.

- If there is a bullish signal and the Chikou Span is above the price of the last 26 periods ago, then the strength of the trend is to the upside, otherwise it's considered to be a weak buy trade signal.