Kaufman Efficiency Ratio Analysis & Kaufman Efficiency Ratio Trading Signals

Developed by Perry Kaufman. Described in his book entitled "New Systems & Techniques".

The Kaufman Efficiency measures the ratio of the relative market speed in relation to volatility. The Kaufman efficiency is often used by traders as a filter to help avoid trading when the market is "choppy" or flat ranging markets. The indicator also helps to identify smoother market trends. This is an oscillator that oscillates between +100 and -100, where zero is the center point. +100 is upward trending market and -100 is downwards trending markets.

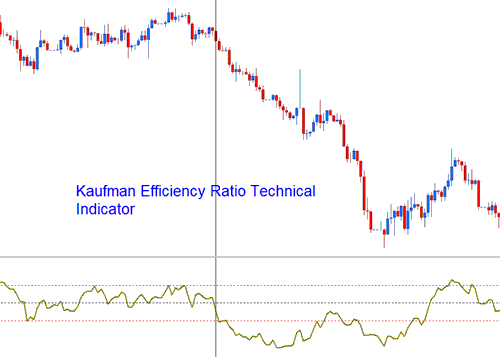

Kaufman Efficiency Ratio

Efficiency indicator is calculated by dividing net change in price movement over an n number of periods by sum of all the bar-to-bar price changes taken as the absolute values over these same n periods.

Stock Analysis & Generating Signals

The Kaufman is used to generate signals as follows:

The smoother the manner in which the market is trending then the greater the Efficiency Ratio shown by the indicator. Efficiency Ratio value readings of around zero indicate a lot of inefficiency or "choppiness" in the market trend movements (ranging markets).

- If the Efficiency Ratio shows a reading of +100 for stock, then stock is trending upward with perfect efficiency.

- If the Efficiency Ratio shows a reading of -100 for stock, then that price is trending downwards with perfect efficiency.

However, it is almost impossible for a market trend to have a perfect efficiency ratio since any retracement movement against the current trend direction during the time period being used to calculate the indicator would decrease the efficiency ratio.

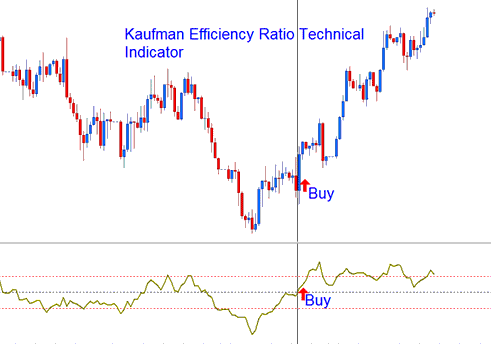

Bullish/Buy Trading Signal

Efficiency Ratio values above +30 indicate a smoother upward trend.

Buy signal is generated above center-line mark.

Buy Trading Signal

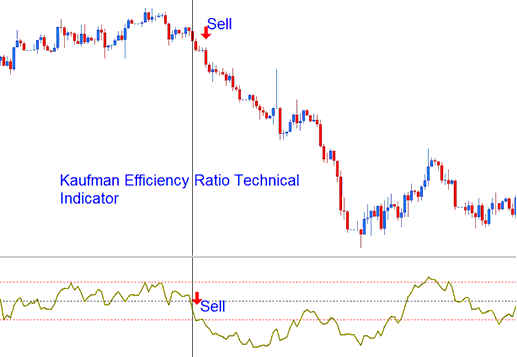

Bearish/Sell Signal

Efficiency Ratio values below -30 indicate a smoother downward trend.

Sell Stock Signal is generated below zero center-line mark.

Sell Trade Signal

However, it is good you experiment with other values to determine the most appropriate levels for stock being traded and the value that is the best for your stock methodology that you're using.