Combining MACD RSI Stochastics Strategies

Combining RSI & MACD & Stochastic Trading Method.

Stochastic indicator can be combined with RSI & MACD indicators to form a strategy.

- Moving Averages Trading Indicator

- RSI

- MACD

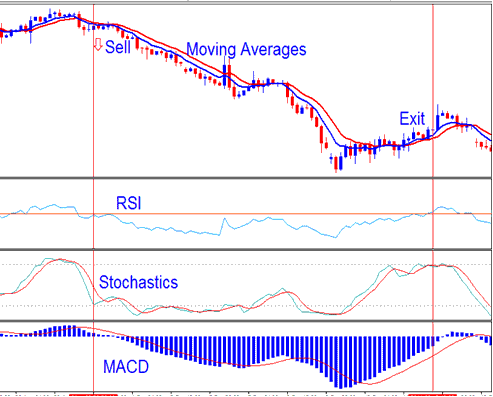

Examples RSI & MACD & Stochastic Trading Method

MACD RSI Stochastics Strategy - Combining MACD RSI Stochastics Strategies

From our Moving Averages, RSI, MACD & Stochastic Strategy - sell stock signal gets generated when:

- Both Moving Averages are moving down

- Stochastic moving downward

- RSI is below 50

- MACD heading downwards below center-line

The sell stock signal was generated when all these rules were met. The exit signal is generated when a signal in opposite direction is generated - when the technical indicators reverse.

A buy stock signal would be generated using Moving Averages, RSI, MACD and Stochastic Strategy - buy stock signal gets generated when:

- Both Moving Averages are moving up

- Stochastic moving upward

- RSI is above 50

- MACD heading upwards above center-line

The buy stock signal would be generated when all these rules are met. The exit signal is generated when a signal in opposite direction is generated - when the technical indicators reverse.

Good thing about using such a strategy - Moving averages, MACD, RSI and Stochastics Strategy - is that a trader will be using different types of indicators to confirm the signals and avoid as many whipsaws as possible in the process.

- Stochastic Indicator - is a momentum oscillator indicator

- Moving Averages TradingTechnical Indicator - is a trend following indicator

- RSI - is a momentum oscillator indicator

- MACD - is a trend following indicator

It's very important to combine more than one indicator when coming up with a strategy, as a combination of signals is better than relying on just a single indicator. The indicator combinations reinforce each other's trading signals, and cancel out false whipsaws signals.

A trend following indicator helps a trader to interpret the overall market trend, while at the same time using more than one momentum indicator gives better and more reliable entry and exit signals for trading stock.

Stochastics and MACD and RSI Day Strategy - Stochastic vs MACD vs RSI Strategy PDF

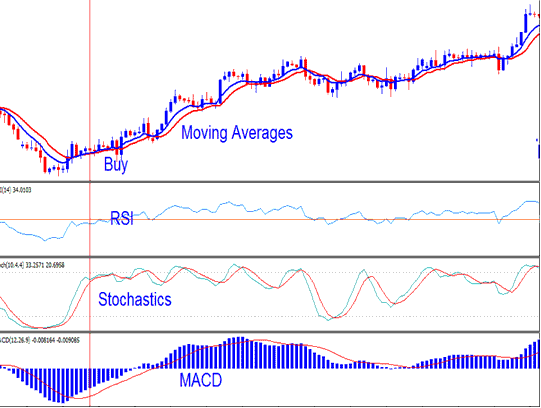

Examples 2 - Stochastic MACD RSI Strategy - RSI & MACD & Stochastic Method

Stochastic MACD RSI Strategy - RSI & MACD & Stochastic Method

For this example the trend direction is upwards, but at some point there were a few whipsaw signals generated by the stochastic oscillator - & the question is how can a trader avoid these whipsaws?

To avoid whipsaws combine two or more indicators - such as MACD, RSI and Moving Average indicator to help avoid these whipsaws, for example the MACD technical indicator had not given a cross-over stock signal although MACD indicator was very close to the zero center-line level.

One tip is that as long as MACD indicator is above zero center line even if the MACD indicator lines are heading downwards then the trend is still upwards. As shown on the example above MACD indicator did not go below the zero center line and after this the upward trend continued & MACD indicator was above the zero line mark & the trend continued to move upward.