ADX Breakout Signals - DX Momentum Trade Analysis

ADX is a momentum indicator used to trade gold - ADX Momentum Breakout Indicator.

The ADX Momentum Breakout Indicator checks trend strength on a 0-100 scale. Higher numbers mean a stronger trend. Price direction matters for its math, but the tool does not point the way. Readings over 30 signal a strong trend. Below 20 points to a flat or sideway market.

Traders pair the ADX indicator with others as a filter for an ADX momentum plan.

Traders see ADX below 20 rising as a sign of a fresh trend start. ADX above 30 falling points to the trend ending.

The ADX Momentum Indicator should be a part of a system that also uses the +DI and -DI lines. Most trading platforms integrate the original ADX Indicator with these lines, referring to the entire setup collectively as the ADX Momentum Indicator.

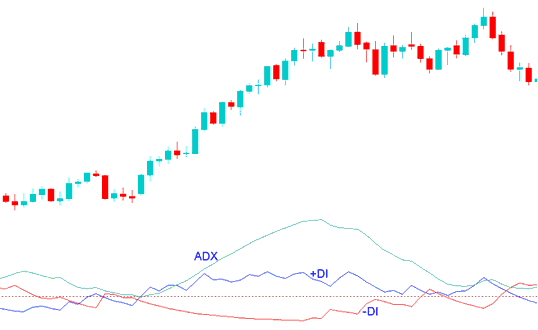

In the ADX indicator illustration depicted & explained:

ADX Momentum Technical Indicator is the light green line

+DI is the blue line - bullish line

- DI is the red line - bearish line

ADX Gold Strategy That Works - ADX False Breakout Indicator MT4

Bullish Trend - when +DI, blue-line is above the -DI, red-line

Bearish Trend - when -DI, red line is above the +DI, blue line

ADX Momentum Strategies Methods Lesson

A bullish signal gets derived & generated when +DI line is above -DI line, when blue line is moving above the red line.

To spot a very good ADX Momentum Break out signal, we wait for the ADX Momentum indicator numbers to go over 20, and the blue line has to be above the red one. This is seen as a great ADX Momentum Breakout signal because the DMI system says it is good to buy, and ADX Momentum indicator numbers over 20 show a strong trend going up.

ADX Momentum Strategies Methods PDF

A bearish signal occurs when the red line sits above the blue line. That means the -DI line is over the +DI line. If the ADX momentum tops 20 with this signal, it points to a solid short sell opportunity.

To spot a strong bearish ADX Momentum Breakout signal, check when the indicator climbs over 20. The red line needs to sit above the blue one. This setup counts as a bearish breakout. The DMI views it as a sell, and levels past 20 signal firm downward momentum.

Study More Guides & Guides:

- How to Set a Buy Limit Order for XAUUSD in MetaTrader 4

- How Economic Reports Move the Gold Market

- Analyzing the Acceleration/Deceleration (AC) indicator for XAU/USD

- Gold Trading Method Used for Trading XAUUSD is Explained Here

- How to trade when gold charts show typical signs of prices going up or down.

- How to Use MetaTrader 4 Software Tutorial Lesson

- How to Download MT4 Software for iOS

- How do you analyze the William %R indicator on XAU/USD in MetaTrader 4?

- Techniques for Drawing Trendlines in Swing Gold Trading

- Executing a New XAU USD Order via the MT5 Mobile Gold Trading Application