Understanding and Setting Up Buy Entry Limit Orders and Sell Entry Limit Orders

Limit Order Definition - An entry limit is a way to buy or sell Gold at a specific price, one that is expected to be a point where the price goes back before moving in its first direction. People who trade use limit orders to purchase or sell at a better price.

Entry orders of this nature can be employed to initiate a buy position below the market price during a retracement in an upward trend or to open a sell position above the market price during a pullback in a downward trend.

Buy Limit - For buys, this pending order triggers when prices drop to your chosen level. Prices pull back down first. Sell Limit - For sells, it triggers when prices climb to your level. Prices pull back up in that case.

Entry limit orders are established by traders anticipating a price rebound after reaching the retracement level where they have placed their orders.

An Order Intended to Initiate a Long Position at a Market Level Situated Beneath the Current Going Rate.

Sell Limit Order to open sell at a level above the ruling price

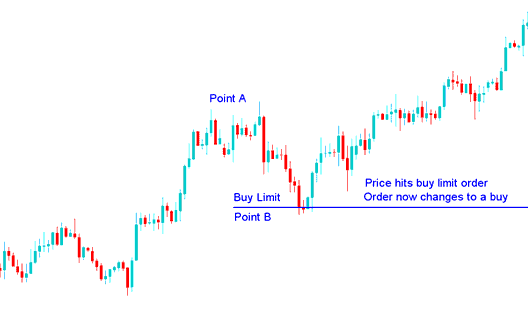

Buy Limit Example

In the example below, a buy limit order was set to buy at a price that was cheaper than the price in the market at the time: the buy limit order is at point B.

Buy LimitPlaced Below the Current Market Price

The price then experienced a pullback, reaching and triggering the pending buy entry limit order. Upon execution, this buy limit order instantly converted into an active buy trade. Subsequently, the price continued its upward progression, adhering to the trajectory of the original and established price trend, as demonstrated in the figure below.

Buy Limit Executed - Order Now Changes to a Buy Order

After the buy limit order was executed it then changed into a buy trade - the original upward trend then resumed and price continued heading upward. One using this type of trading order buys at better price after a retracement. One should also know where is the best place to set these entry buy limit orders so that they don't set this pending order too far such that the retracement doesn't get to their set order and they miss out on the trade transaction and they should also not set it very close, traders should use Fibonacci Retracement levels to know where is best place which to set their entry buy limit orders.

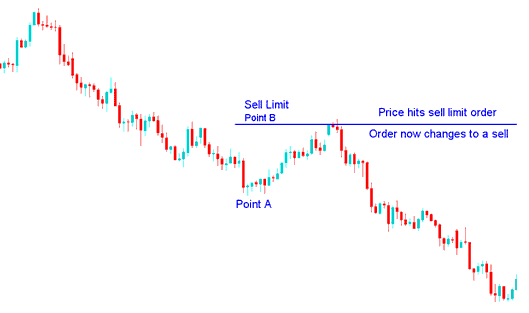

Sell Limit Example

In the example below, a sell limit order sits above the current price at point B.

Sell LimitPlaced Above the Current Market Price

The price then rallied and went up to hit the sell entry limit order. When sell limit order was executed it changed into a sell trade like shown - afterwards price continued to move downwards in the direction of the original and initial price trend as is illustrated below.

Following the trigger of the sell limit order, the order transitioned into an active sell trade, and the initial downward trajectory subsequently resumed, causing the price to continue its descent. An individual employing this order type sells at a superior price point subsequent to a price retracement. It is also vital to understand the optimal positioning for setting these entry sell limit orders: they should neither be set so far away that the retracement fails to reach the order, causing the trader to miss the transaction, nor should they be placed excessively close. Traders are advised to utilize Fibonacci Retracement levels to identify the most suitable price point for placing their pending entry sell limit orders.

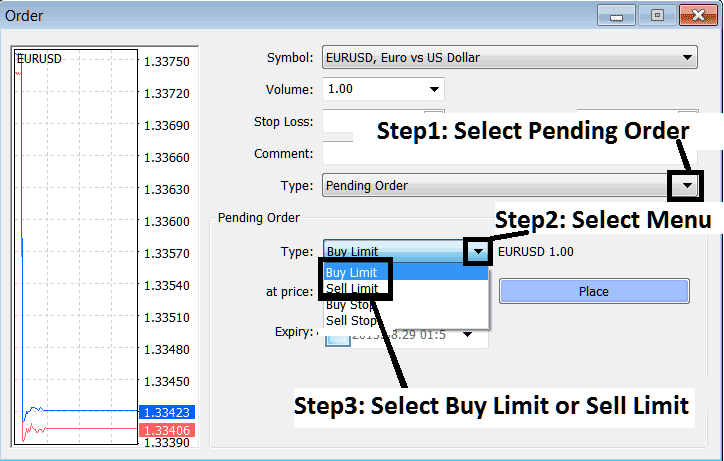

Setting Buy & Sell Limit Orders on MT4 Software Platform

To establish Gold orders on the MetaTrader 4 platform, right-click on the Forex chart, select "Trading," and then choose "New." In the pop-up panel that appears (as illustrated below), under the label "Type," select the "pending" option instead of "market execution." For the pending order options, choose the type of pending order: for this trade, select either "Buy Limit" or "Sell Limit," depending on whether you, as the trader, wish to place a pending sell or buy.

Placing Limit Orders on MT4 - Buy Limit & Sell Limit

Study Additional Tutorials, Lessons, and Subjects:

- XAUUSD Opening a Gold Order on Mobile MT5 XAU/USD

- McClellan Oscillator Gold Indicator Analysis

- Live Trade Charts for XAUUSD Analysis

- How to Trade the Parabolic SAR Indicator

- How to Trade XAUUSD MetaTrader 5 Charts Beginner Traders Gold Course Tutorial

- What's Free XAU/USD Margin in XAUUSD Trades?

- Examining the XAU USD MA Tool for Gold Trading Decisions

- Tutorial of How to Hide Symbols/Quotes on the MT4 Trade Software/Platform

- Managing MA Whipsaws in Range Markets for XAUUSD