BOP Analysis and Balance of Power Signals

Developed & Created by Igor Livshin

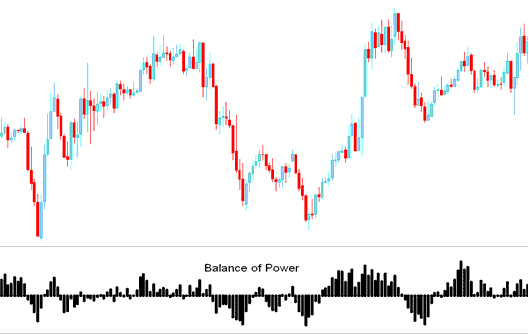

BOP tells us the strength of buyers versus sellers by checking each group's ability to move xauusd prices to very far areas.

Gold Analysis and Generating Signals

In utilizing this technical indicator, the zero line crossings are pivotal in generating trading signals.

The center point is designated as the zero line: levels fluctuating above or below this line are used to trigger trading signals.

Buy - The scale is marked & labeled from 0 to +100 for bullish market trend market movements

Sell - The scale is calibrated and labeled, running from Zero down to -100, charting declines in market value.

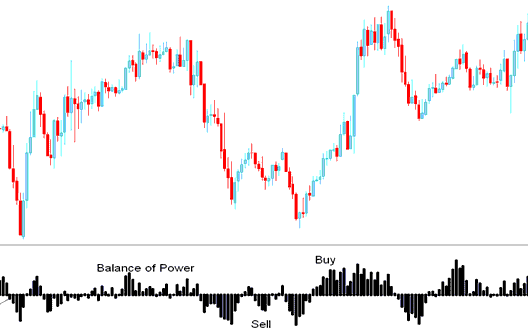

How to Generate Buy & Sell Signals

Buy Signal

When BOP crosses above zero a buy signal is given.

Furthermore, as the Balance of Power (BOP) ascends, indicating an upward market trajectory, some traders interpret this as an immediate buy signal: however, prudence dictates awaiting confirmation, specifically when an accompanying trading indicator crosses above the zero line. Receiving such a signal within bearish territory is prone to being a false signal, a 'whipsaw'.

Sell Trading Signal

When Balance of Power crosses below the zero a sell signal is generated.

Also when the BOP is declining, the market is in a downward trend, some traders use this as a sell signal but it's best to wait for a confirmation by moving below zero mark because this will be a sell signal in bullish territory and this type of market trading signal is more likely to be a gold whipsaw.

Sell & Buy Trading Signals

Divergence Trade

In gold trading, divergences between BOP and price trends can help identify reversal or continuation points in price movements. There are several types of divergences useful for technical analysis.

Classic Divergence Setup - Trend reversal setup

Hidden Divergence Trading Setup - Trend continuation

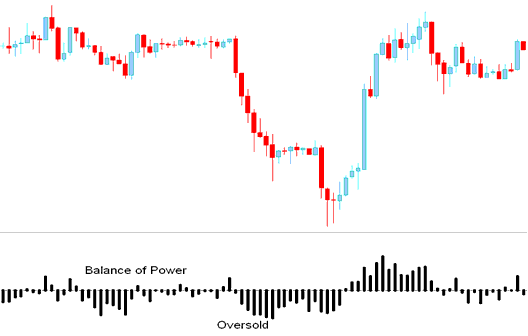

Gold Overbought-Oversold Conditions

Balance of Power helps spot possible overbought or oversold spots in price shifts.

- Overbought-Oversold areas can be used to provide an early signal for potential trend reversals.

- These levels are generated/derived when indicator clusters its tops and bottoms thus setting up the over-bought and oversold levels around those values.

However, the price might remain in these overbought or oversold regions and continue in that direction for a duration: consequently, it is always better practice to await a crossover signal from the BOP (Balance Of Power) indicator across the Zero line.

Based on the presented example, despite the Balance of Power indicator signaling oversold conditions, the price continued its descent until the indicator eventually crossed above the Zero line.

Technical Analysis in XAUUSD Trading

Learn More Courses & Guides:

- Learn Gold Analysis for Beginners

- Gold Strategy: Exploring XAU/USD Price Action Systems

- Gold Place a Downloaded MetaTrader 4 Expert Advisor on MetaTrader 4 Platform

- Gold MAs

- Identifying Buy Signals in Forex Trading using Momentum Indicators

- Drawing XAU/USD Channels in MetaTrader 4

- Securely Adding or Placing a XAUUSD Sell Order on MT5 Gold Charts

- Trading Gold Successfully with Key Indicators

- Spot Bullish and Bearish Hidden Divergence on Gold

- Identification of Classic Bullish Divergence on MACD and Bearish Divergence on Gold Indicators