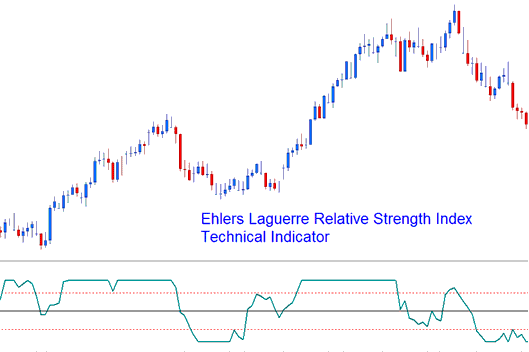

Ehler Laguerre RSI Analysis and Ehlers RSI Signals

Created by John Ehler.

Originally used to trade shares and commodities.

The Ehler RSI technique employs a four-component Laguerre filter to achieve a "time warp" effect, causing lower-frequency elements, such as significant XAUUSD price spikes, to be delayed far more than the higher-frequency components. This specialized indicator facilitates the creation of smoother filters using less extensive datasets.

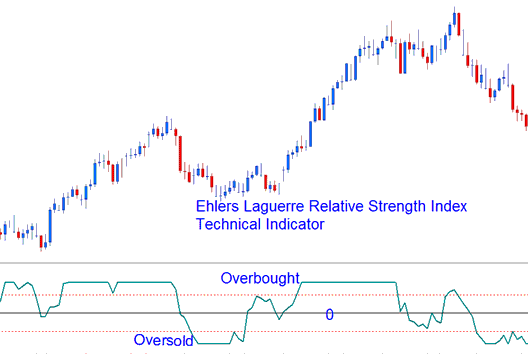

The Ehlers RSI uses numbers from 0 to 100, the middle line makes signals, and the 80/20 areas show when something is bought or sold too much.

Optimize only the damping gamma for this indicator, set between 0.5 and 0.85 to match your style.

Ehler Laguerre RSI

Analysis and How to Generate Signals

This implementation of the Laguerre RSI uses a scale of 0-100.

XAUUSD Cross-over Signals

Gold Buy Signal: An Ehlers RSI crossing above the 50 level threshold generates a buy signal.

Sell Trading Signal Confirmation – A sell signal is generated once the Ehlers RSI crosses beneath the 50 level mark.

Overbought/Over-sold Levels in Indicator

Overbought/Over-sold Levels in Indicator

A typical use of the Laguerre RSI is to buy after it crosses back above the 20 % level & sell after it crosses back below the 80% level.

Get More Topics and Guides:

- How Do You Draw Downwards Channel in MT4 Chart?

- Entry Order Comparisons: Buy Stop XAUUSD versus Sell Stop Gold Orders

- Technical Analysis: Using Fractals Indicators for Forex Buy Signals

- Gold System Tutorial for New Traders

- Gold Market Opening Schedule

- Illustrative Example of Generating Trading Signals Using a Specific XAU/USD Strategy