Characteristics of the 3 Major Trading Sessions: Asia, Europe & America Sessions

Asian Session

During the Asian market time, only 8% of all the daily trade deals go through the Tokyo offices. This is the least busy of the 3 main trading times. Most of this 8% only involves yen-based currency pairs, and very little trading happens with other things like GOLD. This is why it's not a good idea to trade XAUUSD metal during this time. If you don't trade then, you'll save time and money.

European Market Session

The London/European market period handles the biggest part of all money-related trades, and 34% of all money-related trades occur while the European market is open. London's time zone works out well for business hours in both eastern and western economies: this is when market times cross over, leading to a large amount of money-related trade during this time. This is when the market is most free-flowing and changes the most for all money pairings and also Gold.

The Europe timezone inherently encompasses nations within the Eurozone. This currency bloc features 17 member states, with major financial institutions actively operating, leading to substantial market liquidity as a high volume of financial transactions take place.

US Market Session

The US market session handles about 20% of all financial trades. The best time to trade is usually between 8 am and 12 pm GMT, when both London and New York are open. That's when volatility peaks, especially since most major US economic news drops during this window.

European and America Sessions Over-lap

Although the electronic exchange market operates continuously throughout the week, specific periods exhibit higher trading activity, thus presenting greater prospects for achieving gains.

For gold metal day trading, the most profitable period is the overlap between the London and US market sessions, which is the height of trading activity. During this confluence, there is a massive volume of transactions, and the market exhibits peak activity. Significant fundamental news often drops during this overlap, generating high volatility, leading to rapid Gold price movements and abundant trading chances. This overlapping window affords superior trading opportunities for those seeking maximized profits.

The best time to trade XAUUSD is during the overlap when gold prices move decisively. That's when you get the best shot at making profits.

This is also why Asian traders, such as those in Japan, tend to wait until the afternoon to begin placing their trades, as this timing coincides with the European and U.S. trading sessions.

Asian traders skip trades during Asian hours. So from anywhere, it's smart to wait too. Even big funds and pros from Asia hold off until afternoon. That's when US and UK sessions overlap for better flow.

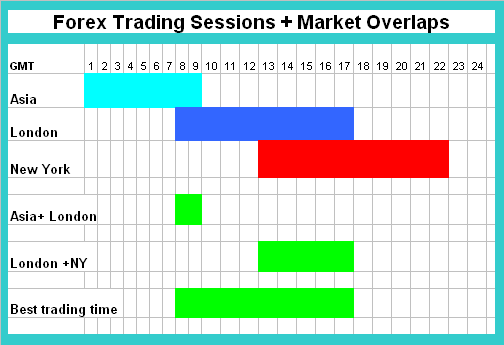

Therefore to create the best hours based on these 3 sessions is shown below:

Market Session Hours and Sessions Overlaps

The chart presented above details a schedule indicating the commencement and conclusion times for each market session. Additionally, the chart highlights periods of session overlap and illustrates the most advantageous trading times for Gold and other financial instruments based on these overlapping schedules.

Summary:

Determine Your Gold Trading Schedule

The type of XAU/USD trader that you're determines your trading schedule. If you do not have a lot of time then a longer-term Gold trading strategy would suit you best. If on the other hand you have got a lot of time then you may decide to set a intraday trading schedule where you open trade positions during the most active market trading hours. The above chart illustrates and shows the best GMT times to be trading in the market - from around 800 GMT and 1800 GMT.

Determine Your Chart Timeframe

To establish a trading schedule, you need to decide on the chart timeframe that aligns best with your trading activities. Experiment with various timeframes until you find one that suits your specific market schedule.

Test Your XAU/USD Strategy

Test your trading strategy on a demo practice account for a time period. Keep track of every trade & monitor the progress of your trading schedule. Try to analyze and interpret what times are most profitable for your trade strategy.

Your strategy should be specified on the XAUUSD plan which you use.

For further understanding of how to outline your trading strategy, refer to the tutorial on creating a Gold trading plan. This guide includes an example format to help structure your plan effectively.

Get More Lessons & Tutorials:

- See a list of all the open charts in MetaTrader 4 platform.

- Analysis of Candlestick Charts Illustrated by Patterns in MT4

- How to Create a Trading Plan?

- How Can I Tell a Double Bottom in XAU/USD?

- How to Place Awesome Oscillator XAU/USD Indicator on Chart in MT4 Platform

- Varieties of market brokers for XAUUSD

- How Do I Use Gold Sell Limit Order in MT5 Platform?