DIVERGENCE Gold TRADING SETUPS SUMMARY

XAUUSD Classic Bearish Divergence Trade Setup - HH price, LH indicator - Indicates underlying weakness of a trend - Warning of a possible shift in the trend from upward to downward.

Gold Classic Bullish Divergence Trading Setup - LL trading price, HL indicator - Indicates underlying weakness of a trend - Warning of a possible shift in the trend from downward to upwards.

Gold Hidden Bearish Divergence Pattern - LH price, HH indicator - Indicates underlying momentum of a market trend - Mainly found during the corrective rallies in a downward trend.

XAU USD Hidden Bullish Divergence Pattern - HL price, LL indicator - Indicates underlying power of a market trend - Occurs mainly during the corrective declines in an upwards trend.

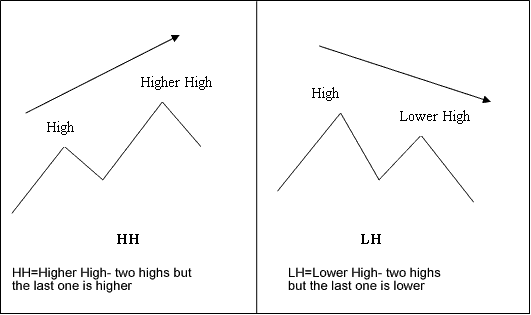

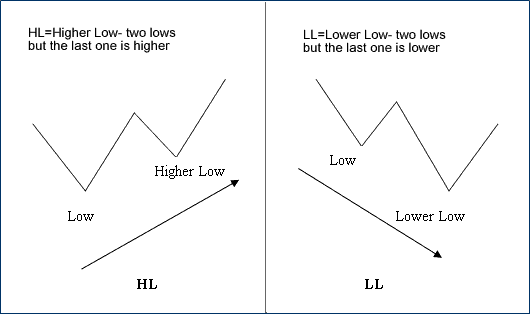

Divergence Forum - Illustrations of the divergence trading setup terms:

M-shapes dealing with XAUUSD price highs

M shapes - Divergence Forum

W-shapes dealing with price lows

W-shapes - Divergence Forum

These are divergence shapes to look for when using these trading setups.

One of the best indicator for this trading setup is the MACD - as a signal MACD divergence setup is a setup to open a trade position. But as with any signal there are certain precautions which have to be observed to make this gold trading signal a setup. Getting straight in to a trade position as soon as you see this trading setup is not the best strategy. This setup should be used in combination together with another indicator to confirm the direction of the market trend. A good system to combine together with is the Moving Average(MA) cross-over trading method.

Be aware this trading setup on a smaller time frame isn't so significant. When divergence is seen on a 15 minute chart it may or might not be very important as compared to the 4 H chart timeframe on MT4 platform.

If divergence setup seen on a 60 minute chart, 4 Hour chart, or day timeframe, then start looking for other factors & aspects to reflect when the price may react to the divergence.

This brings us to a crucial point when using the divergence setup signal to enter a trade position: on a higher time frame MACD divergence setup signal can be a fairly reliable technical indicator of a shift in the price direction. However, the big/large question is: WHEN? That is why getting straight in to a trade position as soon as you observe this setup is not always the best trading strategy.

Many traders get caught up by entering the market too soon when they spot MACD divergence. In many cases, trading price still has got some momentum to continue in the prevailing direction. The investor who has jumped in too soon can only stare at the screen in dismight as price shoots through his stop-loss taking him out.

If you simply look for this divergence trading setup without any other considerations you'll not be aligning yourself with the best odds, so to increase odds of making a successful trade you should also look at other factors, specifically other technical indicators.

What other factors & aspects should you consider when using this set-up?

1. Support level, Resistance levels & Gold Fib levels on higher Chart Timeframes

Another way to significantly increase the odds of a winning trade is to look at the higher chart timeframes before opening a trade order based on the lower time-frames.

If you look at the hourly, 4 hour or day chart has reached a major resistance, support or Fib level then the probability of a successful trade position based on the divergence on a lower chart timeframe at this point increases.

2. Risk Reward Ratio: Gold Trade Money Management Rules

And finally, when looking for divergence, it's very crucial that you enter the Gold trade correctly, so that as you have a good risk/reward ratio and only open positions which have more profit potential than what you are risking. If you understand how to open a trade position properly, you as a xauusd gold trader can gauge your risk reward before you open a trade position. That way, you as a trader can only choose to open orders which offer a favorable ratio.

Finally, when used correctly and combined with other indicators to confirm this gold signal, divergence trade setup can offer huge profit potential.

Study More Courses:

- XAUUSD Box Pattern Trading Analysis

- Bullish XAU USD Candlesticks vs Bearish XAU USD Candlesticks

- What Are Different & Various Types of Gold Traders?

- How to Draw Downward XAUUSD Channel in the MetaTrader 5 Platform

- How Do I Read Ehler MESA Adaptive Moving Average(MA) Indicator Buy & Sell Forex Signal?

- XAU/USD Set Stop Loss XAUUSD Orders in MetaTrader 4 XAUUSD Charts

- RSI XAU/USD Indicator Trading Strategy

- Where Can You Get a Guide?