Sell Limit

A sell limit order allows traders to sell gold at a higher price level after the market has retraced upward from its current range.

A sell limit order is an order to open sell after market retraces upward within a downward trend.

A sell limit pending order will only be triggered when prices increase and then retreat back to the specified sell limit pending level.

Limit Orders: Sell Limit

A Sell Limit order is an instruction to sell gold at a specified pullback price, where the price is expected to reverse briefly before continuing its original trend.

Traders use these sell limit orders to open sell at a better price.

A Sell Limit order of this configuration is appropriate for initiating a sell position at a price point situated *above* the current market rate (useful during price pullbacks in a downtrend).

Sell limit - When you sell, your sell limit order is carried out/begins when the price goes up to the price you set for your sell limit order. (goes back up)

Orders that are pending, like sell limit orders, are placed by those who trade when they think prices will go down after reaching a certain point.

- Sell Limit pending order to open sell at a level that is above the prevailing market price level.

Sell Limit

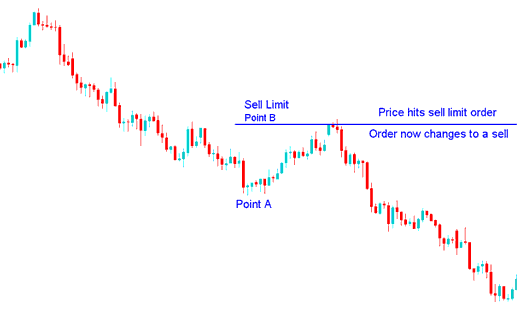

In the illustrations shown & described below a sell limit order was set to sell at a price above the prevailing gold market price. This is the level for price retracement.

Sell Limit Order Used to Sell above the Current Price

The price then went up quickly, going as high as the sell limit order that was waiting, and then the price kept going down like it was going to before.

Gold Price Hits Sell Limit Pending Order

The primary advantage of STP Live Accounts is that traders benefit from instant trade execution, owing to their direct connection to the interbank markets via their associated STP broker.

Sell Limit Order Meaning - Sell Limit

Study More Tutorials & Courses:

- Is the Hull Moving Average reliable for XAU/USD?

- Gold MA Indicator Analysis in Gold

- XAU USD System for 1H Candle Breakouts

- What Typically Follows the Appearance of a Bull Flag Chart Structure?

- Exploring Bullish XAUUSD Divergence Trading

- How Do You Predict XAU USD Candlesticks Patterns Trend Reversal?

- Studying How the Chandes Dynamic Momentum Index Indicator Shows When to Buy and Sell

- How to Trade Using the MT4 Platform User Course Tutorial

- Information on Regulated Online Brokers

- Leverage Ratios: How They Work in Markets