What Happens in Gold Trading after a Bull Flag Pattern?

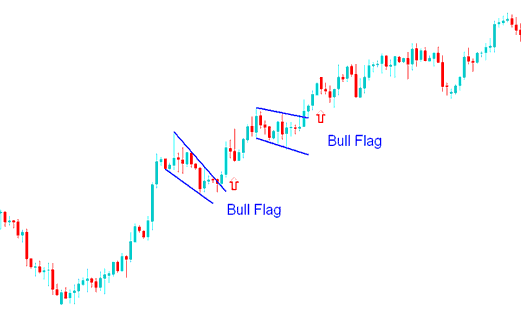

The bull flag setup is found within a Gold Trading up-ward trend.

The bull flag pattern setup formation occurs at halfway point of a bullish up-ward trend & after a break-out a similar move equal to the height of the flag pole is expected.

In the bull flag setup, we witness a continuation chart pattern where the market price experiences a slight retracement. This results in a narrow price action that displays a subtle downward tilt.

The precise moment to execute a buy entry occurs when the price pierces the upper boundary of the bull flag chart pattern. The flag segment itself features a series of peaks and troughs that can be connected by short, parallel lines, creating the visual appearance of a narrow channel.

What Happens in XAUUSD after a Bull Flag Setup?

The bull flag above was a pause. The market built strength to break out higher. The pattern confirmed when price broke the upper flag line.

More Topics:

- How to Read Fibonacci Expansion Levels XAU USD Indicator in MetaTrader 4 Software

- How to Mark a Trend-line on Charts in MT4 Program

- Free Examples of Gold Indicators Here

- Placing Buy Limit XAU/USD Orders Below Current Market Prices

- Calculated Methods for Determining Optimal Placement and Setting of Stop Losses specifically for XAU/USD Instruments

- How to Include the Alligator XAUUSD Indicator on a Chart in MetaTrader 4 Software

- Buy Stop Order versus Sell Stop Order

- Brokers for Standard Gold Accounts

- Gold Advice Top 5 XAUUSD Trading Methods to Improve Gold Trading

- Procedure for Placing a XAUUSD Take-Profit Order Utilizing the MT5 Interface