Setting A Gold Schedule and a Written Example

Gold operates within a market characterized by its global reach. Because the market is accessible continuously throughout the week due to its worldwide nature, gold traders possess substantial adaptability regarding the specific times they elect to trade. Nevertheless, not every trading period is suitable for initiating a transaction.

Set a trading schedule around the busiest gold hours. Those times help boost your profits the most.

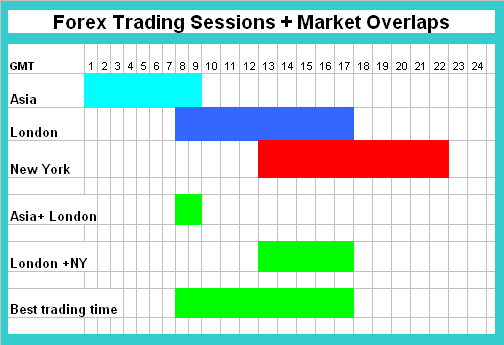

The USA and London sessions represent the peak activity periods. These three sessions account for the largest global trading volumes daily, although generally speaking, the Asian session is the least favorable of the three for active trading.

Overlap periods exist where two trading sessions are simultaneously open: these are generally the most dynamic trading times. Such overlaps present excellent opportunities for engaging in multiple markets concurrently, thereby maximizing potential returns.

The intersection between the US and London markets is the most significant. The trading possibilities are at their peak at this time, and there are more options available.

The Asian session is the least busy of the three main market times. All financial items move slowly or stay around the same price during this time. It is not a good time to trade then, so it is best to take a break.

Considering that the trading day operates continuously, around the clock, making constant vigilance impossible, investors ought to establish a manageable timetable. By comprehending these specified market trading hours, a trader can set suitable trading periods to heighten the probability of optimizing trading returns.

When organizing a schedule, it should fulfill the following objectives:

1. Learn about the different times when markets are open, like when the New York, London, and Tokyo markets are open.

London Trading Session Hours - 3 A.M. through 12 P.M. EST (Equivalent to 8:00 GMT to 17:00 GMT.)

New York Trading Session Hours - Covering 8 A.M. to 5 P.M. EST (Equivalent to 1300 GMT through 2200 GMT.)

Tokyo Session - 7 P.M. - 4 A.M. EST (00:00 GMT to 9:00 GMT.)

2. Trade during this time when the prices are most active.

3. Plan a workable schedule. So as to keep a balance between your trading time & time to get adequate rest. Best time is between 3 a.m. To 5 p.m. EST

When both the USA and UK trading sessions overlap, prices typically move decisively in one direction, covering a significant number of pips. During this time, technical indicators often yield high-quality, advantageous signals that accurately capture the prevailing price trend.

In Strong Gold Trends, Traders Find It Simple to Earn Profits.

On the flip side, at other times like during the Asia trading period, prices tend to stay within a limited range. Traders who depend on indicators may find it tough to earn profits because technical indicators are usually more prone to giving false signals. It will be tough and hard to gain profits when the price is stuck within a range.

Generating revenue when the market is clearly trending either up or down is substantially simpler than attempting to profit within a confined, ranging market environment.

During the best times to open/execute orders, i.e. 800 GMT & 1800 GMT the prices will trend in one direction, during other times like Asia Session, the prices likely to be Range-Bound.

- London session 08:00 GMT -16:00 GMT.

- US session 13:00 GMT - 22:00 GMT.

- Asian session is a relatively slow for all instruments & not suitable at all.

Essentially, your trading plan should target the time frames of 800 GMT and 1800 GMT as the optimal periods for trading gold.

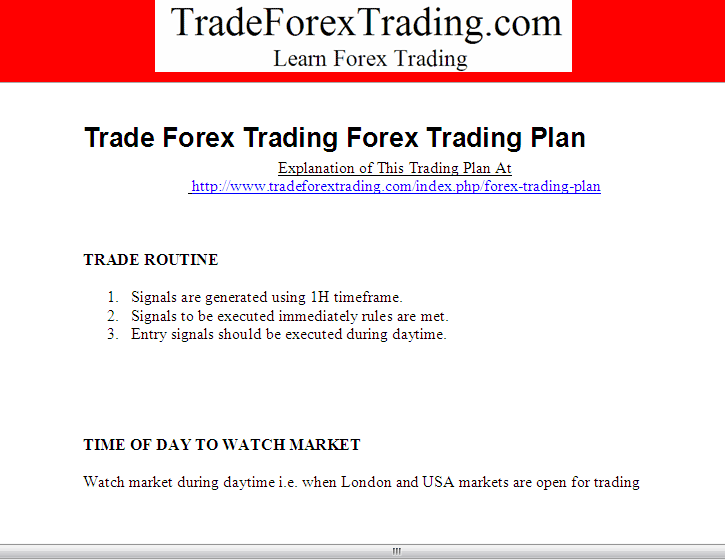

Example of a Schedule on a Trading Plan

The example illustrated below shows how to specify your routine and time of day to watch the market. This will form the essence of your trading schedule. The time frame that you use will also be specified and mostly it'll depend on what type of trader you are. The time set for this trading example is during the day when the UK and US sessions are open such as shown in the example illustration displayed and explained below.

Written Schedule - Gold Plan Sections

More Courses & Lessons:

- CCI XAU/USD Indicator Divergence: Analyzing XAU/USD Setups

- How Do I Trade More XAU USD Charts in MT4 Platform Software?

- How to Use Zigzag Gold Indicator in Gold Chart on Gold Platform Software

- Meaning of Fib Extension Levels in MetaTrader 4 XAUUSD Trade Software Platform

- Understanding What a Chart Is & Interpreting Gold with a Chart

- Learning to Use MetaTrader 4 with an XAUUSD Demo Account: Where to Start