Trading Market Hours and The 3 Major Gold Sessions

Tokyo Close Charts

To capitalize on trading opportunities during active Gold trading hours, it is essential to identify periods when the XAUUSD market is at its busiest, as this is when most trading activity occurs.

Despite the absence of rigidly scheduled official opening and closing times during the week, gold trading activity is segmented into three primary sessions: Tokyo, London, and New York.

It might not seem key at first, but picking trade times matters a lot for winning as an investor.

The most advantageous time for trading XAU/USD is when the market exhibits peak activity, resulting in the highest transaction volume. A more dynamic market presents a greater opportunity for generating profit, whereas a quiet, sluggish market is effectively a waste of time - in such conditions, switch off your desktop computer and refrain from gold trading altogether.

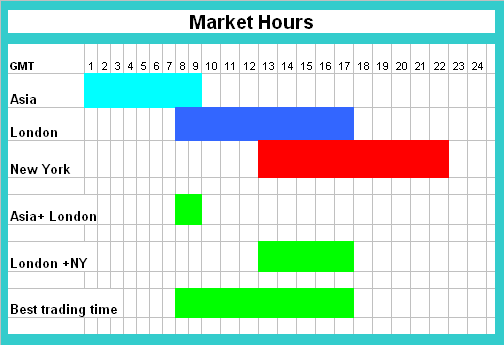

Trading conditions are not always optimal due to fluctuating volatility. Below is a guide that outlines the schedule for Gold Sessions, using GMT 0 as the standard reference time.

The 3 major sessions are:

- Asian Session Times( Tokyo ): 00:00 to 9:00 GMT

- European Market Session Hours( London ): 7:00 to 17:00 GMT

- U.S. Session Times( New York ): 13:00 - 22:00 GMT

Best Trade Times

Sometimes there are hours when two sessions overlap:

London + Tokyo overlap - 7:00 to 9:00 GMT

New York and London overlap from 13:00 to 17:00 GMT.

During these market hours that overlap, you'll see the most trading activity and therefore have better chances of winning at these times.

This means most trading happens when both the London and US markets are open. This is usually the best time to earn money.

Gold prices shift a lot during New York and London sessions. Big companies, funds, and banks trade then.

Multinationals will transact gold during this time to facilitate international business transactions and commerce, hedge funds and managed funds will trade gold for investment purposes, banks on the other hand will exchange lots of money on behalf of their clients, maybe tourists wanting to travel around the world or just anybody wanting to exchange their money so as to buy something in another country or make a transaction.

This keeps the XAUUSD market very active right now. High trade volume leads to big price moves. Charts often trend in one direction for a short time.

As a trader, join the crowd when orders flow in. Liquidity peaks then, creating solid chances to profit. With high liquidity, XAUUSD prices move in clear patterns. Low liquidity brings wild swings. Gold prices turn choppy and directionless in ranges.

Once you trade gold for a while you'll get to know that is easier to make money when the xauusd market is moving up or moving down, unlike when it is in a range.

Asia Session Characteristics:

- Least volatile of the 3 sessions

- Account for 15 % of daily trade transaction turnover

- Typical 20 -30 pip moves

European Session Characteristics:

- Most volatile of the 3 market sessions

- 35 % of daily trade transaction volume

- Typical 90 -150 pips moves

US Market Session Characteristics:

- 2nd most volatile of the 3 sessions

- Accounts for 25 % of daily trade turnover

- Focuses on USA economic news

US & Europe Session Overlaps Characteristics:

- Combines the 2 most volatile sessions

- Accounts for 60 % of the total daily trade transaction turnover

- Focuses on US & European economic/fundamental news

- Fast moving gold trading prices and gold trends in a particular direction

Acquire Additional Training and Themes:

- How Do I Open a Real XAUUSD Account from MT5 Platform?

- Inverted Hammer vs Shooting Star Candlestick Differences

- A List of XAU/USD Knowledge That a Trader Needs

- How to Develop a Plan for Gold by Writing it Down

- XAUUSD Platform/Software MT4 Sign In PC XAU/USD Real Account Sign In

- Trade XAUUSD With Support & Resistance Levels

- How Do I Trade the Difference between Sell Stop XAU/USD Order & Buy Stop XAU/USD Order?

- How to Draw Gold MT5 Trendlines in MetaTrader 5 Charts