How Do I Interpret Difference between Sell Limit Order & Sell Stop Order?

How to Interpret Difference between Sell Limit Order & Sell Stop Order

A sell limit order is an order used to sell xauusd at a better price after the price has retraced upward from its current area.

A sell limit order is an order to open sell after market retraces up-ward within a downwards trend.

A sell limit pending order is only executed when prices moves upwards and retraces to the set sell limit pending level.

Entry Limit Orders: Sell Limit

Sell Limit Order definition - Entry sell limit order is an order to sell a xauusd at a certain price which is a pull-back area where the price is predicted to pull-back to before resuming the initial trend.

Traders use these sell limit pending orders to open sell at a better price. These types of sell limitpending orders are provided in most of the online trade platforms, for our examples we will use MetaTrader 4.

An entry sell limit pending order of this type can be used to sell above market level (retracement pull-back in a down-wards trend market).

Sell limit - When selling, your entry sell limit pending order is executed/opened when market rises to your set price. ( retraces upward )

Entry orders are placed by traders when they expect price to pull-back downward after reaching this region.

- Entry Sell Limitsell at a level above ruling market level.

What's a Sell Limit Order Example?

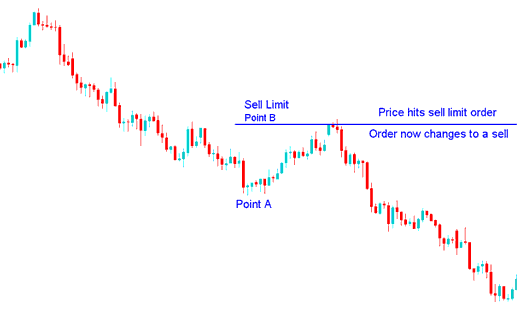

In the illustrations illustrated and shown & described below a sell limit order was set to sell at a level above the ruling market price. This is the level for the price retracement.

Sell LimitPlaced to Sell above Current Market Price

The gold then rallied, headed upward to hit sell entry limit order, & afterward price continued to move down-ward in the direction of the initial downward trend.

Order now Changes to a Sell order

When price got to the set sell limit order level sell limit pending changed in to a sell order, this is thenceforth a good technique to sell at a better price after a pull-back.

What is Sell Stop ?

What Does Sell Stop Order Mean?

A Sell Stop Order is an order to sell a gold after the price rises to the set sell stop price region.

The sell stop order is always set to sell below the current market prices.

What's Sell Stop Order Example?

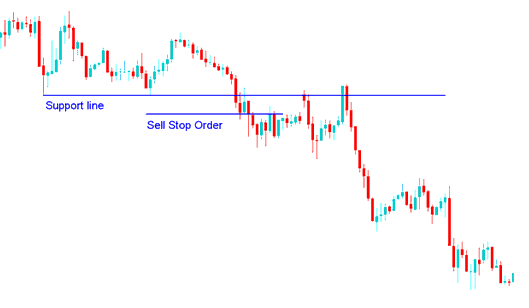

In the illustrations explained and shown below a sell stop order was set to sell at a level below current market price.

The price of the gold then moved downwards to hit sell stop, and afterward price continued to move in a downwards direction.

Placing Sell Stop Order below Resistance Level - What's Sell Stop?

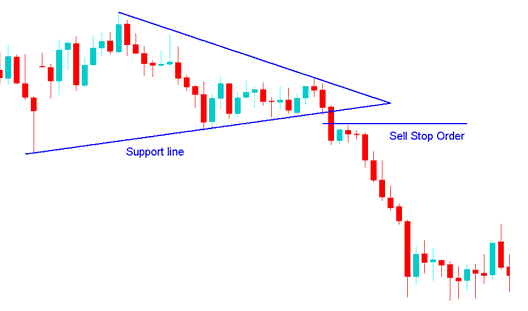

Sell stop order is also used to set a pending trade order when there is a consolidation pattern on a trading chart. The Sell stop is used to set a sell order just below consolidation pattern as shown below so that if there is a price break out down-wards after the consolidation pattern then a new sell order is opened - by sell stop once sell stop price that's set is reached and attained.

Placing Sell Stop Order in a Break Out - Sell Stop Order Definition & Trade Example

A Sell trade signal was derived and generated from the above sell stop pending order when the price broke a support area in the first examples & when there was a downwards price break-out after a market consolidation pattern on the second sell stop pending order illustrations.

How Do I Read the Difference between Sell Limit Order and Sell Stop

Get More Tutorials & Topics: