How Do I Trade Head and Shoulders Pattern?

How Do I Trade the Head and Shoulders Setup

Head & Shoulders Pattern

Head & Shoulders Pattern is a reversal pattern which forms after an extended Gold Trading up-ward trend.

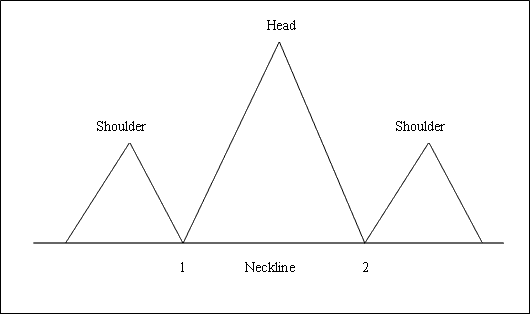

Head and Shoulders Pattern is made up of 3 consecutive peaks, the left shoulder, the head and the right shoulder with two moderate troughs between the two shoulders.

This Head & Shoulders Pattern is considered complete once price penetrates and moves below the neck line, which's drawn by joining and connecting the two troughs between the shoulders setup.

To open a sell trade position after the reversal setup, traders place their sell stop gold orders just below neck line.

Summary:

- This Head & Shoulders Pattern forms after an extended move upward - gold upwards trend

- This Head & Shoulders Pattern setup reflects that there'll be a reversal in the market

- This Head and Shoulders Pattern looks like a head with shoulders thus its title.

- To draw the neck line we use chart point 1 & point 2 like as illustrated and shown on the illustrations illustrated and shown and described below. We also extend the line in both directions.

- We sell when the price breaks-out below neck-line: as elaborated on the example illustration revealed and explained below.

Trade Head & Shoulders Setup?

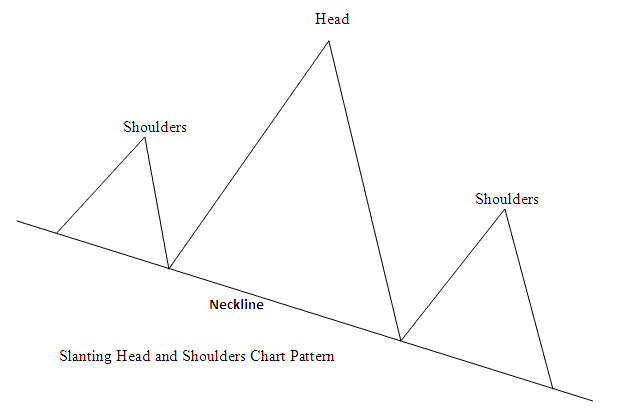

Or the head & shoulders chart pattern setup formation also can form on a sloping neck line, such as the illustration shown & described below:

Trade Head and Shoulders Setup?

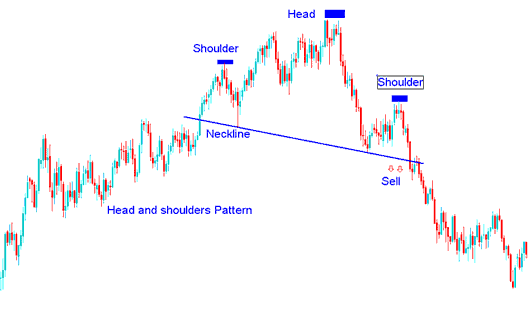

Example of Head & Shoulders Pattern on Chart

How Do I Trade the Head and Shoulders Chart Setup

This Head & Shoulders Pattern also can be formed on a sloping neck line, like the head and shoulders setup illustrations above, the neck line does not have to be necessarily horizontal.

More Tutorials & Topics:

- Gold News Trading System

- Classic Divergence Gold Setup

- Where Can You Find the List of Best Scalping Indicator for Gold?

- Gann HiLo Activator Gold Indicator Technical Analysis

- What Broker is the Best XAU USD Broker for Beginners?

- MT4 Gold Software Guide Tutorial

- Multiple Gold Timeframes on Chart

- How Do I Start XAU USD on MT5 Android App?

- Gold RSI Indicator Patterns

- How Do You Trade XAUUSD Price Consolidation in Gold Trading?