How Do I Trade Retracement on Downward Trend

How Do You Draw Fibonacci Retracement for Downtrend?

The Fib retracement tool is put on a chart during a market downtrend, and then this Fibonacci Retracement tool calculates where the prices might pull back to within that downtrend on the charts. A lot of traders use Fib retracement levels as an indicator for trading pullbacks.

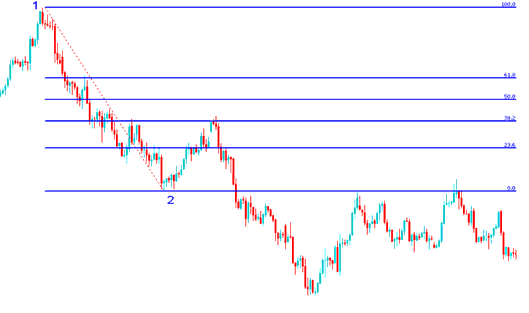

In the Retracement Method example shown and explained below the market is moving down-wards between chart point 1 & chart point 2, then after chart point 2 the price then retraces upto 38.2 % retracement area & then-it continues heading and going downwards in original downwards trend. Note that this Fibonacci retracement indicator is drawn and plotted from point 1 to point 2 in the direction of the trend (Downwards Direction).

Because we recognize this is just a pull-back depending on the chart trend we put a sell order at 38.2% Fib retracement level and a stop loss just above 61.8% Fib retracement level.

If you had put a sell order at the 38.2% Fib retracement level just as displayed on the Gold trade below you would have made a lot of pips afterwards after the price reached the 38.2% Fib retracement level and then resumed the downwards trend.

In this trade, the price retracement reached the 38.2% Fibonacci retracement area but did not make it to the 50.00% Fibonacci retracement level. Using the 38.2% Fibonacci retracement area is often good because most of the time the price retracement does not reach the 50.00% mark.

How to Execute Trades on Price Retracement During a Downtrend - Fibonacci Retracement Levels in Chart Analysis.

Gold Fibonacci Retracement Method Example Explained

The examples above of the Fibo Retracement Method show a setup where the market retraces right after hitting the 38.20% Chart Fibonacci Retracement Level.

This Fib Retracement area was a strong barrier for the price to come back up, making it the ideal spot for a trader to place a sell order, as the market quickly went down after reaching this 38.2% Fib level.

Get More Guides:

- Gold Patterns Candlestick Definition Explained

- List of Online Gold Brokers in Australia

- How Do You Trade Using the Triple Exponential Moving Average Tool?

- Gold Price Moves: Using the 1-2-3 Strategy for Price Breakouts in XAUUSD Charts

- Fibonacci Technique Practice on Gold Charts

- How do I read the Chande DMI indicator?

- Engaging with XAUUSD Patterns for Effective Analysis