Trading Analysis and Signals for the Kase Peak Oscillator and Kase DevStop 2 Indicators

Developed by Cynthia Kase

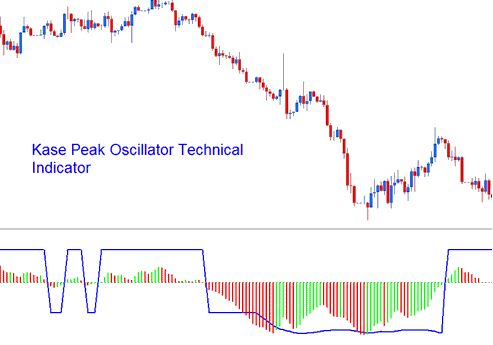

The Kase Peak Oscillator works like other standard oscillators. But it comes from a stats-based check of market trends. This check looks at over 50 trend spans. That helps it fit market ups and downs better. The tool shifts on its own. It matches cycle lengths and volatility shifts in trends.

Kase Peak Oscillator Metric

When the histogram dips below the center-line, that's bearish. Readings above the center-line are bullish. Traders use crossovers both to enter and exit trades.

Kase DevStop 2 Indicator

Conceived and Constructed by Cynthia Kase

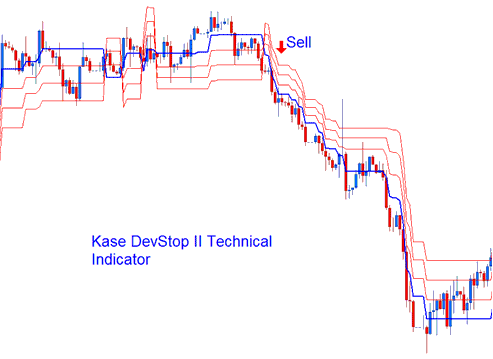

Kase DevStop II Finds Average Range Plus Three Deviations.

Gold Analysis of the Kase DevStop II Indicator

This Indicator is employed to pinpoint realistic exit points for trades, taking into account overall volatility, variations in that volatility, and volatility skew. This specific gold indicator generates a plot of four lines: one designated as a Warning Line, along with three Standard Deviation Lines corresponding to levels 1, 2, and 3. These lines assist traders in securing profits or cutting losses at levels where the likelihood of a trade position remaining profitable is exceedingly low, all while preventing premature profit-taking or incurring excessive losses.

Kase DevStop 2

Gold traders use the three red lines to determine when to exit trades or where to set stop loss orders. The DevStop II is a tool that follows market trends.

Additional tutorials and topics available:

- Instructions for Setting the Fractals Indicator on a Gold Chart within the MT4 Platform

- How to Improve XAU USD Psychology with These Techniques/Methods & Tips

- How Do I Read Rising Wedge Chart Trade Pattern?

- XAU/USD Average Directional Index Indicator

- Why Do XAU USD Brokers Give XAUUSD Leverage?

- Standard Tool Bar Menu and Customizing Standard Tool Bar Menu in MT4 Software Platform

- Trading an Upward Channel Formation utilizing the MetaTrader 5 Platform Capabilities

- MT5 XAUUSD Indicators List on Charts Menu on the MetaTrader 5