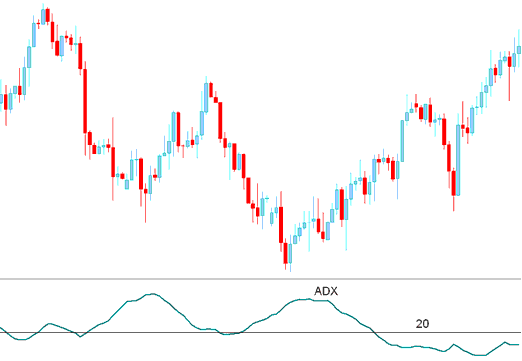

ADX Analysis & ADX Signals

Developed by J. Welles Wilder

This indicator shows how strong a trading price trend is: it comes from the DMI - Directional Movement Index, which has two lines.

+DI - Positive Direction Movement Index

–DI - Minus Direction Movement Index

ADX is calculated by subtracting these two values & applying a smoothing function.

The ADX indicator measures trend strength on a scale of 0 to 100 without indicating direction but offers insight into price momentum.

Higher the technical indicator reading the stronger price trend.

A value of below 20 shows that the market is not trending but moving in a range.

A reading over 20 confirms a buy or sell and shows a new trend starting.

Readings Above 30 Point to a Strong Trend.

When ADX turns down from above 30, it demonstrates that the ruling trend is losing force.

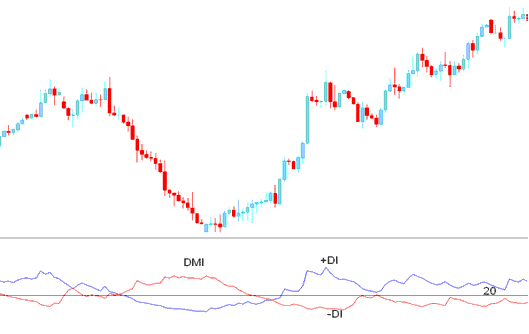

Directional Movement Index Trading Indicator

Combining ADX with DMI Index helps overcome ADX's directionless limitation and identifies gold market trends effectively.

DMI

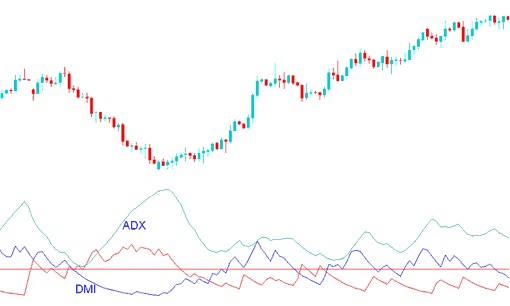

ADX & DMI Index

By combining the ADX with the DMI Index, one can identify trend directions and use this technical indicator to assess the strength of the current trend.

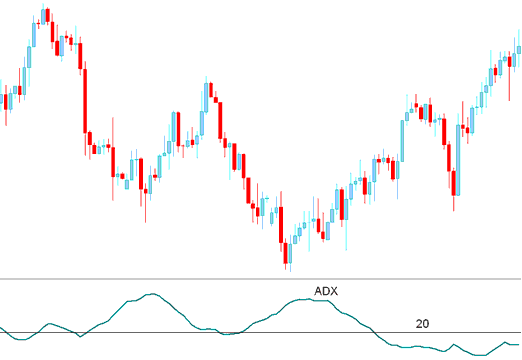

Trading Analysis & Generating Signals

Buy Signal

A buy signal is produced when the +DI exceeds the –DI, and the ADX indicator is above 20.

Exit signal gets generated when technical indicator turns down from above 30.

Buy Trade Signal

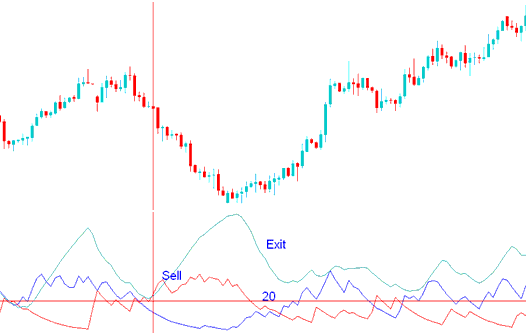

Sell Trading Signal

Short Sell Trigger: When –DI Tops +DI and ADX Exceeds 20

The exit signal is triggered when the technical indicator moves downwards from a level above 30.

Sell Trading Signal

Obtain Further Instructional Material & Instruction Sets:

- XAU/USD Chart Timeframes: Understanding Periodicity in Trading Software

- Chart Trade Pattern Defined with Examples

- XAU/USD Charts Analysis How to Analyze/Interpret XAU/USD Charts

- Counter Gold Trend Trading Strategies

- Technical XAUUSD Indicators for Day Trade XAU USD

- Save XAUUSD Profiles and Workspaces on MT4

- How to Trade Various & Different Types of XAUUSD Charts