Kaufman Efficiency Ratio Trading Analysis and Kaufman Efficiency Ratio Trading Signals

Developed by Perry Kaufman, as detailed in his publication titled "New Systems and Methods."

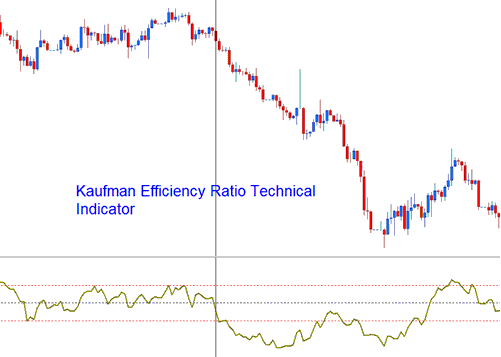

Kaufman's Efficiency Ratio gauges market speed against volatility. Gold traders use it to skip choppy or flat markets. It spots smooth trends too. This oscillator runs from +100 to -100, with zero in the middle. +100 signals an uptrend. -100 points to a downtrend.

Kaufman Efficiency Ratio

The Efficiency indicator is calculated by dividing the net change in price movement over a specific number of periods by the sum of all absolute price changes between consecutive bars over those same periods.

Analysis and How to Generate Signals

The Kaufman is used to generate trading signals as follows:

The more consistently smooth the market trend formation, the higher the Efficiency Ratio indicated by the indicator. Efficiency Ratio figures near zero suggest considerable market inefficiency or significant price "choppiness" in the trend movements (i.e., ranging markets).

- If the Efficiency Ratio shows a reading of +100 for gold, then gold is trending upwards with perfect efficiency.

- If the Efficiency Ratio shows a reading of -100 for gold, then that price is trending downwards with perfect efficiency.

Nevertheless, since any retracementpullback movement against the current market trend direction during the trading time period being used to calculate the technical indicator would lower this efficiency ratio, it is almost impossible for a trend movement to have perfect efficiency ratio.

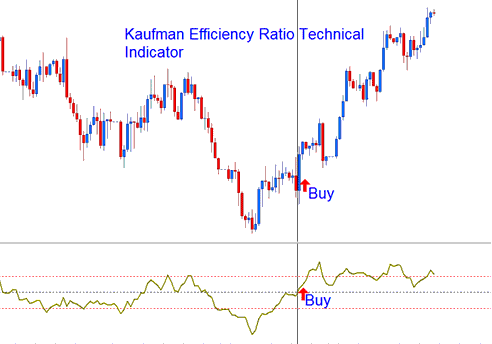

Bullish/Buy Trading Signal

Efficiency Ratio values above +30 show a smoother upwards trend.

Buy trading signal is generated above center-line mark.

Buy Signal

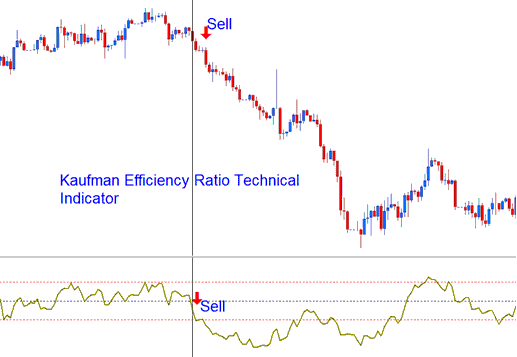

Bearish/Sell Trading Signal

Efficiency Ratio values below -30 show a smoother downwards trend.

Sell Trading Signal is derived & generated below zero center line mark.

Sell Trading Signal

Nevertheless, it is beneficial to test various parameter settings to ascertain the most suitable levels specifically for trading gold and the optimal value for the particular gold trading method you are employing.

Study More Guides & Tutorials:

- Exploring Different XAU USD Trading Methodologies Across Various Chart Time Frames for Gold.

- Trying Out XAU USD Demo Accounts on MetaTrader 4

- System for 5-Minute XAU/USD Charts

- A Description of Technical Analysis for Gold Trend Reversals in Trading

- Chande Momentum Oscillator: Analyzing Gold with This Indicator

- Clarification of XAUUSD Gold Margin and Available Gold Free Margin on the MT4 Platform

- Executing Pending XAUUSD Trades Using MetaTrader 5 Software

- Adding More Trade Charts in MetaTrader 4: A Step-by-Step Guide