Leverage and Margin Explanation and Examples

Margin required : It's the amount of money your online broker requires from you to open/execute a trade position. It's denoted in %s.

Equity refers to the total amount of capital available in your trading account.

Used margin : sum of money on your account which has already been used when opening a trading contract, this contract is the one that is displayed and shown on open positions. You can't use this amount of money after opening a trade transaction because you've already used it & it's not available to you.

To put it another way, because your online broker has made a trade for you using money you have borrowed, you need to keep enough money in your account to cover the trade, so you can keep using the leverage your broker gave you.

Free margin: the amount in your account you can use to start new trades. This is the money in your trading account that hasn't been used yet because you haven't started a trade with it. This amount is very important because it lets you keep your open trades going, as will be shown below.

But, if you use too much gold leverage, the extra money you have will drop below a certain level. Then, your broker will automatically close all your trades, causing you to lose a lot of money. At this point, the broker will close your trades because if they stay open, the broker could lose the money they lent you.

For this very reason, traders of XAUUSD gold must consistently ensure they maintain ample free margin. A prudent risk management approach advises never allocating more than 5% of your trading account to any single trade, with 2% being the generally recommended ceiling.

The Difference Between Leverage Stipulated by the Broker and Leverage Actively Utilized in Gold Trading

If the leverage is set at 100:1, it means you're allowed to borrow as much as $100 for each $1 you have in your account, but you don't have to borrow the full $100 for every $1: instead, you can pick and choose to borrow at 50:1 or 20:1. In this case, even though the highest possible leverage is 100:1, the leverage you actually use will be the 50:1 or 20:1 that you chose to borrow for your trade.

Example:

You have $1000 (Equity)

Set 100:1

Leverage Used = Amount utilized / Equity

If you buy lots equal to $100,000 you'll have used

= 100,000/1000

= 100:1

If you buy xauusd gold trading lots equal to $50,000 that as a trader you'll have used

= 50,000/1000

= 50:1

If you engage in XAUUSD gold trading with positions valued at $20,000, that represents the capital you as a trader have utilized.

= 20,000/1000

= 20:1

In these 3 cases you can see that although the set is 100:1

The leverage ratio used is 100:1, 50:1, or 20:1, depending on the size of the lots or contracts traded.

Why simply restrict the Maximum Gold Leverage to a 10:1 ratio? Prudent risk management principles actually advise traders to operate with significantly lower leverage settings than this, even when it is an option.

Although this question seems simple, it is not because trading involves using borrowed funds, which is known as leverage. When borrowing money from someone or a bank, a trader needs to provide something of value as security to get the loan, even if the security involves regular deductions from their paycheck: gold trading works the same way.

When engaging in xauusd trading activities, the collateral required is termed 'margin,' which essentially is the capital you allocate to your chosen online broker.

As you trade, this is computed in real time. As a trader, you must maintain what is known and referred to as required capital (your deposit) in order to keep the funds you have borrowed.

Now if Your XAUUSD Leverage is 100:1

If you trade with $1,000 and 100:1 leverage on one lot worth $100,000, your margin is that $1,000. It's the cash at risk if the trade turns bad. The rest, $99,000, comes from the broker. They'll close your gold trade once your funds run out.

But this is if your online broker has set 0% Margin Requirements before closing out your xauusd trade positions automatically.

If you need a 20 percent requirement before your gold positions are automatically stopped, your trades will close when your account balance drops to $200.

If you want to mechanically close your xauusd positions at 50% of the required amount for this level, then your trades will be closed when your account drops to $500.

If they set 100% requirement of this level before liquidating your open positions mechanically/automatically, then your trade position will be stopped out once your trading account balance reaches $1,000 dollars: Explanation the trade position will closeout as soon as you execute it because even if you pay 1 pip spread your account balance will drop to $990 and the needed percentage is 100 percent i.e. $1,000, thence your trade orders will immediately get stopped out.

Most brokers do not set 100 percent prerequisite, but there are those that set 100% aren't appropriate for you at all, choose those set 50 percentage or 20 percent margin requirements, in fact, those xauusd brokers that set their margin pre-requisite at 20% are among some of the best because the likelihood they close out your trade is reduced and minimized such as displayed and shown in the above example.

This level, which is determined by your software automatically, can be viewed on the MetaTrader 4 Platform as "XAUUSD Margin Requirement. " It is represented as a percentage, and a higher percentage indicates a lower likelihood of your active trades being stopped out.

For Example if

Using 100:1

If the leverage is 100:1 & you trade amounts equal to $10,000 worth of goods or assets

$10,000 dollars divided by 100:1, your used capital is $100

Calculation:

= Capital Used * Percent(100)

= $1,000/$100 * Percent

XAU/USD Margin Requirements = 1000 %

Investor has 980 percent above required amount

Using 10:1

If you operate with a 10:1 leverage ratio and execute trades equivalent to $10,000 in notional value.

Ten thousand dollars ($10,000) divided by a 10:1 ratio means your utilized equity amounts to $1000.

Calculation:

= Capital Used * Percent(100)

= $1,000/$1000 * Percent

XAU/USD Margin Requirement stands at 100%.

Investor has 80% above the requirement amount

Because when one has a higher leverage means they have more percentage above what's required (Also Known As More "Free Gold Margin") their open gold transactions are less likely to get stopped out. This is the main reason why traders will select the option 100:1 for their trading account but according to their risk management guidelines, they won't trade above 5:1 leverage ratio.

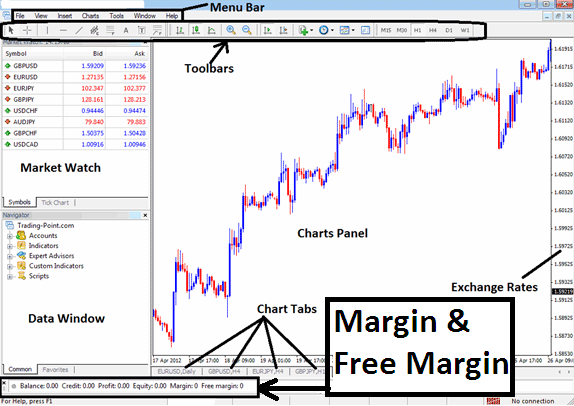

These Levels are Shown on the Platform Screenshot Below as an Example:

MetaTrader 4 Platform

<<

Explore Further Subject Areas:

- XAU/USD Introduction

- What Happens after a Falling Wedge Pattern in Gold?

- Darvas Box Gold Indicator Analysis on Trading Charts

- How to Figure Out/Read the SMA Indicator to Buy Forex Signal

- How Do I Place Gold Indicators on Gold Charts in MT4 Platform?

- How Do I Read XAU USD Fib Pullback Levels Settings in MT5?

- Determining the Most Effective RSI Setting for 5-Minute XAUUSD Charts

- How Can I Draw Fibonacci Pullback Indicator on Gold Charts?

- Lesson tutorial for XAUUSD on the MT4 platform

- How to Add XAU/USD Sell Orders in MetaTrader 5 XAU/USD Charts