Reversal Price Action Patterns

The Listing of all Candle Patterns Course - Types of Candlestick Patterns Example

List of candlestick price action patterns for gold trading. Here are the top 10 common xauusd candlestick patterns for the online xauusd market.

Reversal Setups Based on Price Action: Trading Configurations for Hammer and Hanging Man Candles

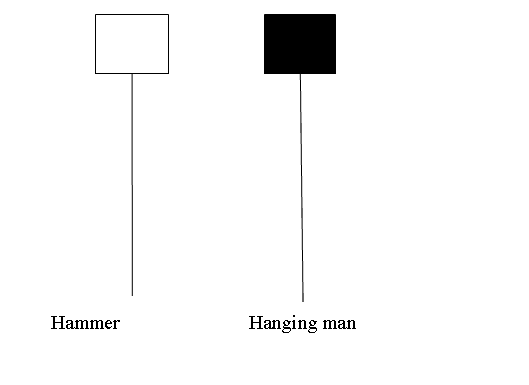

The Hammer Candle Pattern and the Hanging Man Candle Pattern may appear similar but have contrasting meanings. The hammer signals a bullish reversal, while the hanging man represents a bearish reversal in price action patterns.

Hammer Candle Pattern & Hanging Man Candlestick Pattern - Setups Signifying Potential Reversals in Price Action.

Hammer Candlestick Price Action Reversal Setups

The Hammer xauusd/gold Candlestick Price Action Pattern is a formation that suggests a potential bullish reversal, materializing during a prevailing downtrend for xauusd gold. It earns its name because it visually resembles the gold market "hammering out" a market bottom.

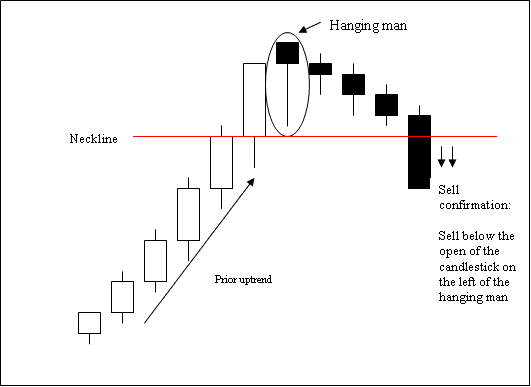

Hanging Man Candle Price Action Reversal Setups

The hanging man candlestick in gold signals a possible bearish turn. It forms in an uptrend for XAUUSD gold. The name fits its look - like a man suspended from a rope high up.

Hanging Man Candle Pattern

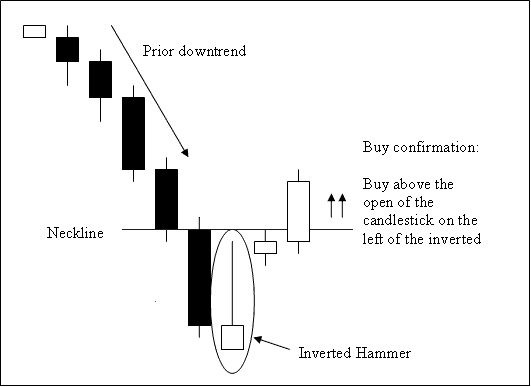

Inverted Hammer Candle Price Action Reversal Setups

This is a bullish reversal pattern known as the gold Candle Price Action Pattern Setup, which appears at the bottom of a market trend.

An inverted hammer xauusd Candle Price Action Pattern shows up at the bottom when a price is falling, and it could mean the xauusd gold trend might go back up.

Inverted Hammer Candle Pattern - Price Action Reversal Setups

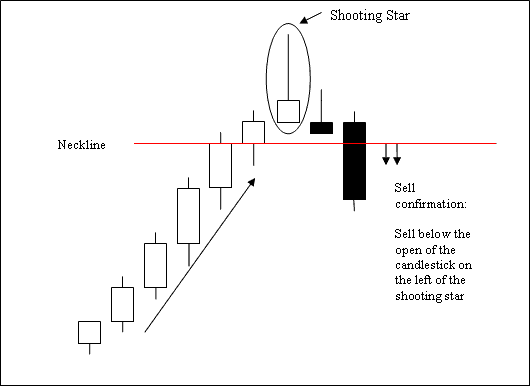

Shooting Star Candle Price Action Reversal Setups

The Shooting Star is a bearish reversal pattern in gold candle price action. It shows up at the peak of a gold uptrend.

The Shooting Star XAUUSD Candlestick Price Action Pattern manifests at the peak of an uptrend in the gold market: the initial XAUUSD gold price matches the low, and while the XAUUSD gold price subsequently pushes higher, it is ultimately forced back down to conclude near the opening price.

Shooting Star Candle - Price Action Reversal Setups

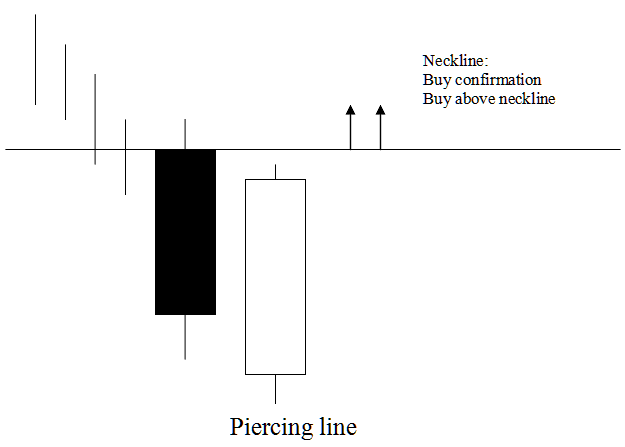

Piercing Line Candle Price Action Reversal Setups

The Piercing Line candlestick pattern in gold price action is characterized by a long black candle followed immediately by a long white candle.

The white body pierces the mid-point of the previous black body.

This Piercing Line XAUUSD Candlestick Price Action Pattern Setup constitutes a bullish reversal pattern for gold, which materializes and forms at the lower boundary of a declining XAUUSD gold trend. It is characterized by the market opening at a lower point and subsequently closing above the center point of the preceding dark candle body.

This Piercing Line pattern in gold candlesticks shows the downtrend losing steam. The XAU/USD price may soon reverse and climb.

This specific candlestick formation, known as the Piercing Line in XAUUSD price action analysis, suggests that the market is testing a potential floor, signaling an end to the prevailing downward trend for gold prices.

Piercing Line Candle Setup - Price Action Reversal Setups

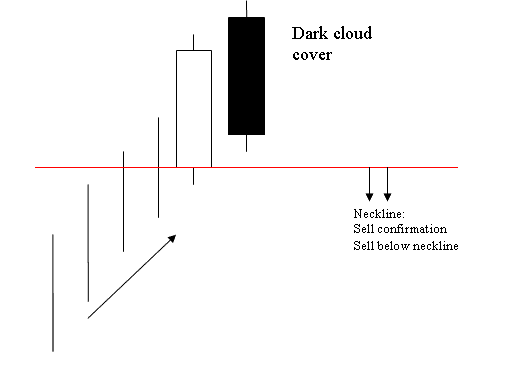

Dark Cloud Cover Candle Price Action Reversal Setups

Opposite of piercing candlestick gold candle.

This candlestick is a long white body followed by a long black body.

Black body pierces the mid-point of the prior white body.

This is a bearish reversal gold gold price action pattern that forms at the top of an upwards xauusd gold trend.

Dark Cloud Cover xauusd Candlestick Price Action Pattern Setup means that the xauusd market starts higher but ends below the middle of the white part.

Dark Cloud Cover xauusd Candle Price Action Pattern Setup shows the force of the up trend is reducing/decreasing and the gold trend is likely to reverse & move in a downwards trade direction.

The dark cloud cover pattern for XAUUSD shows a bearish candle. It caps the gold price rise like a ceiling.

Dark Cloud Cover Candle Pattern

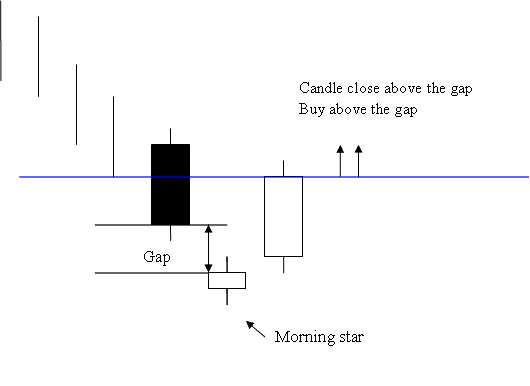

Morning Star Candle Price Action Reversal Setups

Morning Star Candle Setup - Price Action Reversal Setups

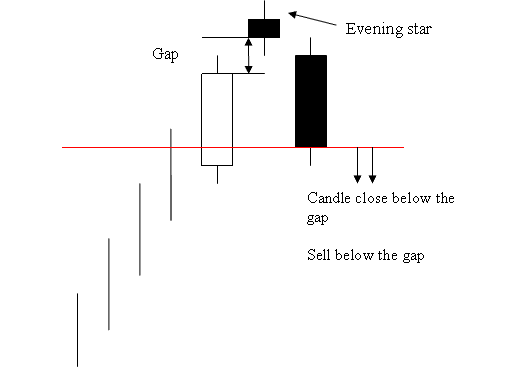

Evening Star Candlestick Price Action Reversal Setups

Opposite of morning star candles setup

Evening Star Candlestick Pattern - Price Action Reversal Setups

XAU/USD Price Action Reversal Setups

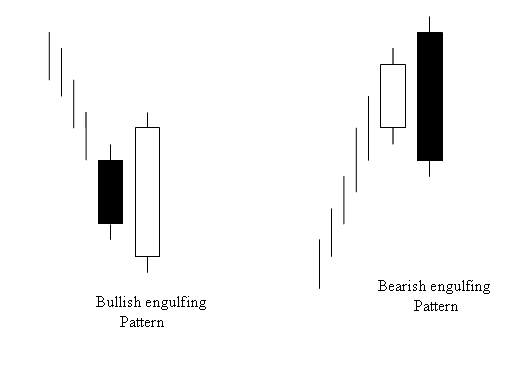

Engulfing is a reversal gold Candlestick Price Action Pattern Setup which can be bearish or bullish depending upon whether if it appears at the end of a market down trend or at the end of a xauusd market upwards trend.

Bullish and Bearish Engulfing Candlestick Patterns - Reversal Setups Identified Through Price Action.

XAUUSD Candle Patterns Lesson Tutorial - Candle Patterns Tutorial Course

The Listing of all Reversal Candle Patterns - Types of Price Action Reversal Setups Candlestick Setups Lesson Guide

Get More Tutorials & Courses: