How Can You Analyze Morning star candlestick pattern Technical Analysis?

Interpret Morning Star Gold Candle Bullish or Bearish

Morning Star Pattern Gold Candlestick Pattern

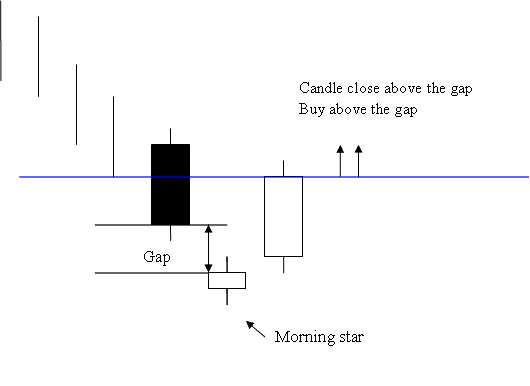

Morning star candles setup is a 3 day bullish price reversal trade pattern.

The initial day features a long black candlestick.

The second day's candle leaves a gap from the big dark candle from the day before it.

Day Three: Long White Candle Fills the Gap.

The successful filling of the trading gap, accompanied by the closing of the white candle above the gap area, constitutes a strong bullish signal for Gold.

Traders and investors should enter a buy position after the market price closes above the gap in the morning star candlestick pattern. This acts as confirmation for the buy signal from the XAUUSD morning star setup.

More Topics & Tutorials:

- How to Improve XAU USD Psychology with These Techniques/Methods & Tips

- Stochastic Indiicator Gold Indicator

- XAUUSD Platform/Software Workspace

- How Can I Use Zigzag Gold Indicator in Trading Chart?

- Can You Start XAU/USD with $1000 for Standard XAUUSD Trading Account?

- How Do I Draw Downward XAUUSD Channel in MetaTrader 4 Chart?

- MACD Hidden Bullish and Bearish Setups for XAUUSD

- Choosing the Right Analysis XAU/USD Strategy for Beginners