Stochastic Trading Strategies

- Overview of three types of stochastic oscillators as technical trading indicators

- Understanding the Stochastic Indicator

- Recognizing Oscillator Levels: Overbought and Oversold Zones

- Technical Analysis of the Stochastics Indicator

- Stochastic Indicator Cross-over Signals Explained

- Signals for Stochastic Divergence Trading

- Stochastic Trading Systems

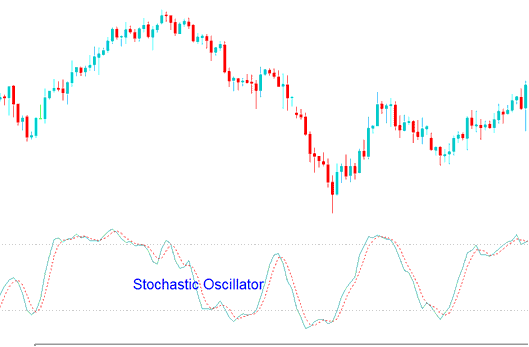

Stochastic Oscillator Indicator Trading Strategy

The Stochastic Oscillator, being an oscillation indicator, gauges the momentum characteristic of gold.

The Stochastic Oscillator Indicator works on the idea that when prices are generally rising, they tend to finish near the highest price of the period, and when prices are generally falling, they tend to finish near the lowest price.

The Stochastic Oscillator shows how strong the current trend is, and points out when a market is overbought or oversold.

The Stochastic Oscillator is a popular tool. Traders follow its signals, making them reliable on their own.

The Stochastic Oscillator is employed to recognize specific chart patterns, including divergences.

Stochastic Oscillator Indicator can give very early predictions of price activity, thus Stochastic Oscillator Indicator is a Leading technical indicator.

The Stochastic Oscillator gives more signals than other momentum tools. Pair it with additional indicators for best results.

The Stochastic Oscillator Indicator has two lines - a fast line and a slow line. Both lines follow the trend's direction.

Stochastic Technical Indicator - Stochastics Indicator Technical Method

Get More Lessons and Courses:

- Gold Chart on MetaTrader 5

- Forex Trading Signals Identified by the Fractals Indicator for Buying Opportunities

- How Buy Entry and Sell Entry Limit Orders Work

- How Do You Use Ehler Relative Strength Index Trading System?

- Bear Pennant Patterns – Spotting Them in XAUUSD Trading

- Procedure for Charting Fibonacci Expansion Levels Corresponding to Upward and Downward Market Trajectories