Indicators for Setting Stop losses in Gold Trading

Some technical indicators are used for setting stoploss orders taking away the need for traders to perform complicated calculations on where to place these stop loss xauusd gold orders.

Someone trading gold systems can also put in a stoploss order based on these technical technical indicators. Some indicators use math to figure out where the order stop loss should be to best get out of the trade. These technical indicators can be used to decide where to put stop losses. These indicators watch how a instrument's price moves closely & show the range where prices should be moving. If the price goes outside this range it's then best to end the open trades because the price is no longer going in that direction.

Some of the Trading indicators that can be used to set stop losses are:

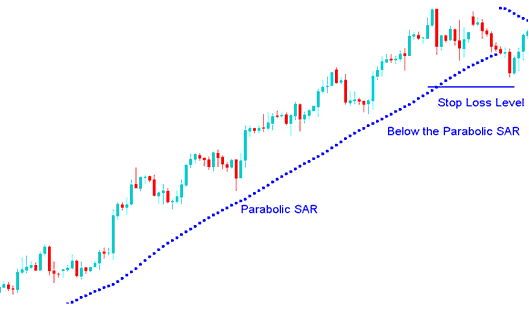

Parabolic SAR Indicator

The Parabolic SAR functions akin to an automated indicator for Stop Loss and Take-Profit Orders, useful for setting variable trailing stop losses.

Parabolic SAR provides excellent exit points.

In an upward trend, you should exit any long trade positions if the price decreases below the signaling level of the Parabolic SAR indicator.

In a downward trend, you should close short trade positions when the price rises above the Parabolic SAR.

In a long position, price sits above the SAR. The Parabolic SAR then rises each day, no matter the price direction. Its upward shift matches the price's movement.

Parabolic SAR - Indicator - It functions as an Automatic Stop Loss Order and Take Profit Order Indicator.

Picture of parabolic SAR and how it's used

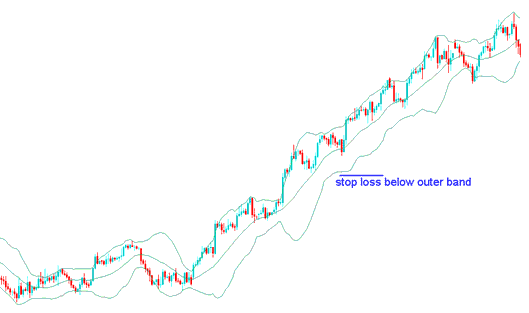

Bollinger Band

The Bollinger Band indicator uses standard deviation to measure market volatility. As a volatility indicator, the Bollinger Bands adjust automatically, expanding during times of greater volatility and narrowing when price fluctuations are less pronounced.

The Bollinger Band indicator comprises three lines engineered and intended to enclose the majority of a financial instrument's price movements. The central band functions as a gauge for the intermediate-term trend, generally being a 20-period simple Moving Average (MA), which also forms the basis for calculating the positioning of both the upper and lower bands. The extent of separation between the upper and lower bands relative to the middle band is typically dictated by market volatility.

Since these Bollinger Bands are there to include how the price changes, those who trade can use these bands to decide where to put stop losses just outside where the bands are.

Bollinger Bands Setting Stop Loss Order Level - Bollinger Band Technical indicator

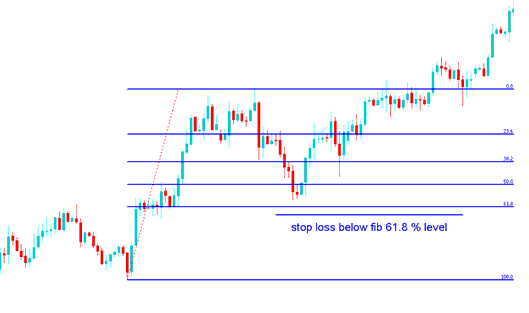

Fibonacci Retracement Levels Trading Indicator

Fibonacci retracement levels provide crucial support and resistance areas that traders can leverage when setting stop loss levels.

The most typical Fibonacci Retracement level for placing stop loss orders is 61. 80%. A stop loss order should be placed at the Fibonacci retracement level, which is slightly below 61. 80%.

The 61.8% Fibonacci retracement level is frequently used for setting these orders because it is infrequently touched by the price.

Fibonacci Indicator Stop Loss Setting at 61.80 % Retracement Level

Fibonacci retracement level 61.8% - Fib Indicator

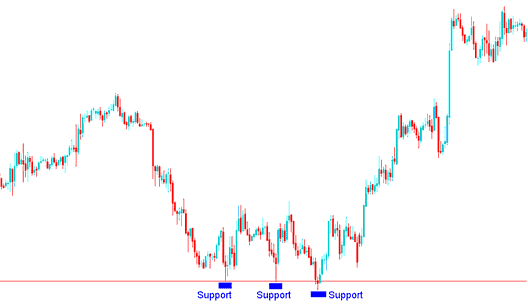

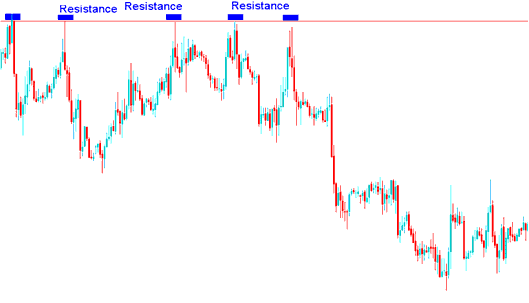

Support & Resistance Areas Lines

Support and resistance areas can be used to decide where to put stop loss levels, where the stop loss orders are placed just above or below support/resistance.

- Buy Trade - Stop Loss set just a couple of pips below the support

Buy Trade - Stop Loss Order set few pips below the support

- Sell Trade - Stop Loss Order set few pips above the resistance

Sell Trade - Stop Loss Order set a few pips above the resistance

Get More Tutorials & Courses:

- Saving the Configuration Profile for MetaTrader 4 Gold Charts within the Software

- How Do You Trade MT4 Fibonacci Expansion Gold?

- Saving the Configuration Profile for MetaTrader 4 Gold Charts within the Software

- Hammer Candlestick Reading Techniques

- Creating a Bull Power indicator system on XAUUSD for trading.

- Optimal Leverage for a $50 Forex Account

- Opening a Gold (XAU/USD) Order on the MT5 Mobile App

- Key Gold Support and Resistance Levels

- Instructions for Reading and Interpreting a Downward Channel Displayed on MetaTrader 4 Charts.