How Do I Read Hammer Candles?

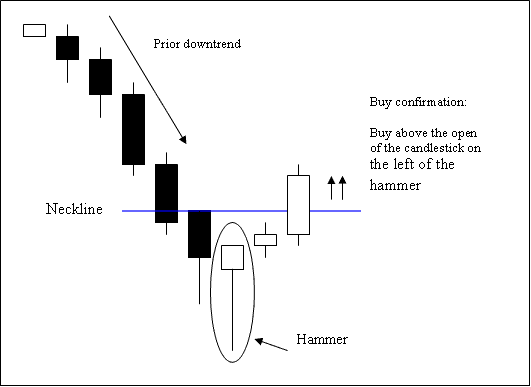

The hammer candlestick pattern is a potential bullish signal that forms during a downtrend. It is named so because it indicates that the market is "hammering" out a bottom.

A hammer candlestick visually presents:

- A small body

- The body is at the top

- Lower shadow is 2 or 3 times length of real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body isn't important

How Can I Analyze Hammer Candle-sticks Pattern Bullish or Bearish?

Analysis of the Hammer Candlesticks Pattern

You get a bullish reversal buy signal when a candlestick closes above the opening price of the candle just to the left of the hammer pattern.

Stop-loss orders should be placed a few pips just under the lowest point of the hammer candle after starting a trade using this candlesticks pattern.

Get More Topics:

- Technical Analysis Bears Power Technical Indicator Buy Forex Signal

- Steps for a Beginner to Start Trading XAUUSD Gold

- What is Free XAUUSD Demo Account for Beginners?

- Inverted Hammer Bearish XAUUSD Candlesticks Pattern

- Day Trading XAU USD Utilizing the Chaos Fractals Indicator

- The Most Active XAUUSD Market Overlaps

- How to Set MetaTrader 5 Volumes Indicator on Gold Chart