TIPS: MAXIMIZING PROFITS OF Gold SYSTEMS

1. Define Simple Rules and Follow the Trend

The less intricate a methodology is, the superior. If a trading approach becomes overly elaborate, adhering to its established regulations will prove exceedingly difficult. Moreover, complex trading frameworks can be quite baffling. A straightforward system facilitates effortless compliance with the strategy's mandates.

2. Eliminate Risk Quickly & Let Profits Run

Minimizing risk is far more important than earning money. Our first main aim in gold trading is to make the Gold trade less risky. We do and achieve this by entering only trade set-ups, setting stop loss orders, cutting losses quick & never average down, letting the profitable trade transactions run for sometime, just long enough, but not too long, in order to increase the profits. Profitable trade transactions are only kept and held open as long as the trade strategy shows the trend is in place, these positions should be closed immediately once your exit trade signal criteria is generated by the system.

3. Select and Choose the Right Trading Instruments

Once you have your system ready, start testing it on a demo account. Each gold will show different results, so keep an eye out for what works.

To maximize the return potential of your trading strategy, identify the periods of highest market activity for your selected gold asset and restrict your trading to those specific sessions only.

4. Use Gold Equity Management Rules

Risk no more than 2% of your account on each trade. Compounding will amaze you as your balance grows fast with a solid, winning strategy.

5. Keep a Gold Journal

Keeping a record of all your xauusd trades will help you improve as a trader and follow your system's trading rules. A gold journal will also track your profitable trades and losses, so you can understand why a setup was successful or not.

6. Place take Profit Targets

Set profit goals for each day, week, or month when you trade. Once you hit the goal, quit trading and rest. This keeps you from overtrading or losing back your gains. Aim for a strong risk-reward ratio, like 3:1. That way, you only enter gold trades where you could earn three times your risk.

Examples of signals derived & generated by our xauusd system

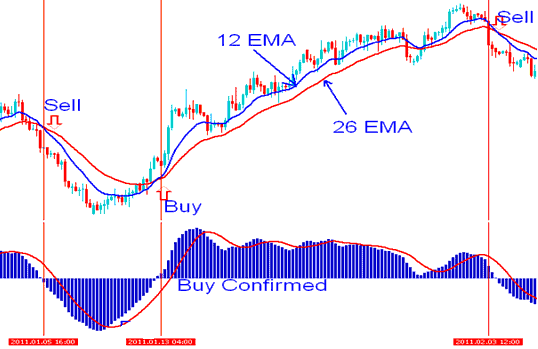

Example 1: Buy and Sell Signals from This Trading Strategy

A buy signal comes from the indicator-based system. An exit follows, then a sell signal appears on the XAUUSD chart.

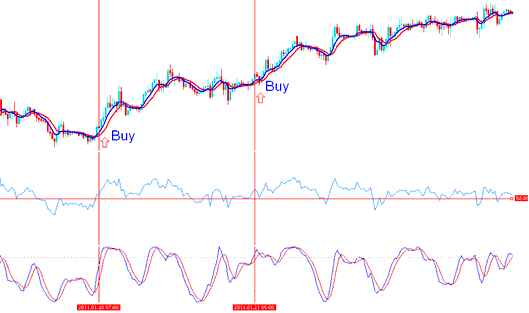

Example 2: 2 buy signals generated by Trading Strategy

Two buy signals are derived/generated during the upward trending market

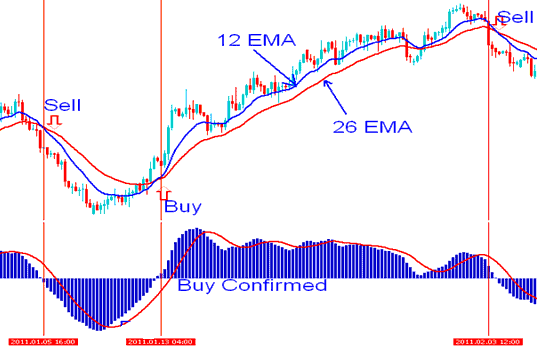

Example 3: Exit Trade Signal Generated by Strategy

Example of Signals Generated by a Strategy

Other Tips

Learn Education Lesson

The first tip is to learn about the Market (Learn Gold Lessons), those who don't learn the required knowledge from the various courses online will not improve their results no matter how many tips they have read. By not learning trading, these traders will keep making the obvious mistakes made by gold novice traders without even realizing what they are doing, XAU USD is a wide topic & in order to make profits a trader will be required to learn first.

Get a Strategy

A trading strategy is a must for every trader, a system is used to determine what decision to take. A trading strategy generates a trader an edge over others who don't have a plan. A good gold plan is one that is back-tested & proven to produce profitable trade transactions. After developing your system you should back test it on a Demo Trading Account.

Learn Money Management

Learn gold equity management basics. Do not trade without these rules. Key lessons include position sizing and stop-loss use.

Essential Methods for Gold Trading Capital Management

Learn about Trading Leverage & Margin

If you don't get how xauusd leverage works or how it impacts your margin, you're going to lose money in this market. There's no way around it.

Have a Written Trading Plan

A plan will take into account all the above tips and summarize them within one document that you can use to trade the online xauusd market.

In General

Your primary objective should be dedicating time to clearly define your financial aspirations and the specific profit target you aim to achieve. Once these goals are established, the subsequent three recommendations will assist you in commencing your trading journey. It's crucial to keep all three objectives in focus when executing any trade, though it must be noted that this is not an infallible guide to guaranteed trading success.

The first thing is to remember that you really need to work with short term xauusd trades until you become profitable and know how to properly monitor these trade positions. You should trade short-term because this way you can monitor your open trade positions and quickly close any position whose signal setup reverses. In order to truly to draw benefits from the system you've to be willing to take upon the effort to watch and monitor the market to see and determine precisely how long you can keep your money invested in the online market. Making short term trading investments will help you as a trader to monitor your xauusd trades and control all the risks, do not leave orders open when you are away from your Desktop computer PC or when you're going to sleep, close all gold trades and only open/execute orders when you can monitor them.

While enhancing the frequency of your trades is quite important, certain fundamental trading regulations must be respected. The standard money management guideline in trading typically involves never risking more than 2 percent of your total account equity on any single trade. This counsel is certainly logical when managing substantial capital in your trading account, but what if your holdings amount only to a few hundred units? Two percent of $10,000 equates to $200. Although adhering to this rule enhances security, it often lacks practical financial sense when dealing with smaller accounts. This is where trading leverage becomes instrumental, particularly when engaging in Gold trading, as it fundamentally alters the risk-reward dynamic. Generally speaking, possessing greater gold capital available for investment offers an advantage in terms of effective fund management.

Double-check all trade details before entering. Keep things simple on the market. It takes effort but builds profits and saves cash long-term.

Keeping your mind clear will help you study trading more effectively, but it's also important to know when to take breaks. Following the right steps will make it easier to succeed, and by understanding all the details and strategies, you'll be able to keep making profits. Learning about gold trading is not too hard, but many traders quickly lose money because they don't prepare or learn properly.

Learn More Courses:

- How Do You Trade a Reversal in a Downtrend?

- Gold Trading Platforms: Desktop, WebTrader, and Mobile XAU USD Reviews

- Comparison Between RSI Hidden Bullish Divergence and RSI Hidden Bearish Divergence for Gold

- Instructional Guide on Utilizing the MT4 Mobile Trading Application on iPhone Devices

- Downloading Gold for MT4 on PC

- How do you calculate different XAUUSD margin types?

- Day Trading Strategies Lesson