What's a Inverted Hammer Candle in XAU USD Trading?

What the Inverted Hammer Candle Shows in Candlestick Patterns.

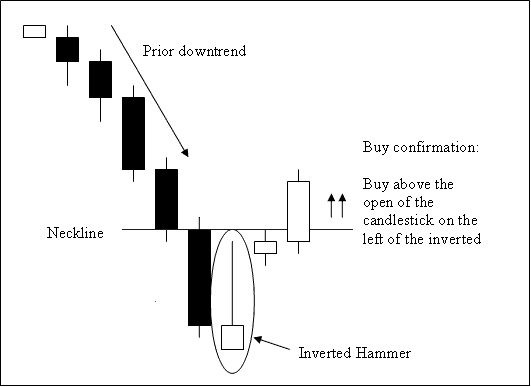

The Inverted Hammer candlestick pattern signals a bullish price reversal. It typically appears at the bottom of a downtrend.

Inverted Hammer candle-sticks form at the bottom of a downtrend, showing a possible market price reversal of the downward trend.

What is an Inverted Hammer Candle in Gold Trading? - Inverted Hammer Candlestick Pattern - Candle Setup Explained

Candle Sticks Setup

A buy is confirmed when a candle closes above the neckline, which is when the candlestick opens on the left side of the pattern. The neckline here is the resistance zone.

For buy trades, set stop orders just below the recent low in XAUUSD prices.

The pattern known as an inverted hammer is designated this way because it suggests that sellers are actively trying to push the market to find a floor.

Get More Tutorials:

- Procedure for Placing a Pending Gold Order via the MetaTrader 5 Android Application

- Technical Analysis Rainbow Charts Indicator Buy Forex Signal

- MACD Analysis Buy & Sell XAU USD Signals

- How to Read Fibonacci Pullback and Extension Levels in Gold Trades

- How Can I Learn How to Add Oscillator Technical Indicator MT5 Course Guide?

- How Do I Setup MT4 XAUUSD Platform/Software Lesson Guide Guide Guide?

- What's Bear Pennant Pattern in XAUUSD Trading?

- One of the Best Broker for Gold for All Trade Method/Techniques