What's Falling Wedge Pattern?

Identify a Falling Wedge Pattern in XAU USD Trading

A Beginner's Primer on Identifying and Trading Optimal Chart Formations - Focus on Recognizing and Trading the Falling Wedge Pattern.

Patterns for Day Trading - Patterns Tutorial

This guide on falling wedge patterns describes how to spot XAUUSD patterns on charts. Identifying chart patterns marks the start of trading falling wedges in gold.

The falling wedge pattern is a common formation in gold price charts. This tutorial outlines how traders can analyze and trade based on falling wedge patterns effectively.

Falling Wedge Pattern

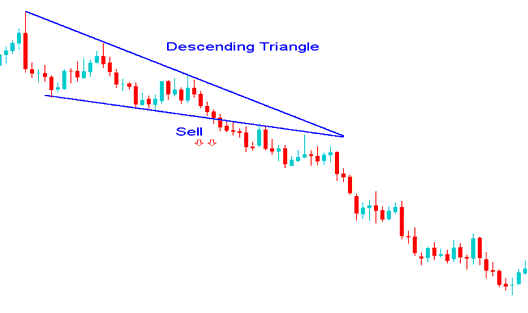

In gold trading, the falling wedge pattern develops during a downtrend and suggests ongoing downward price movement.

The Falling Wedge pattern suggests sellers continuously push prices lower toward a support level. Once this support breaks, it indicates that the market may continue moving further downward.

The support level acts as a temporary floor preventing price decline, while the downward-sloping line above indicates the persistence of selling pressure (bears). A confirmed break below the bottom line serves as a sell signal for a descent from a descending triangle pattern, forecasting subsequent selling activity.

Falling Wedge chart setup is found within a downwards trend, the Falling Wedge develops/forms as a consolidation phase within the down trend and reflects down-side market trend continuation will follow.

Falling Wedge Chart pattern What's Falling Wedge Pattern?

Market formed a descending triangle pattern during its down trend which led to further selling & continuation of the downwards trend. The technical sell signal is when price breaks-out lower horizontal sloping line as selling resumes to push the market lower.

Explore Further Training & Subject Areas:

- XAU/USD Brokers Type

- How Do I Trade a New Gold Order on XAUUSD MT4 iPhone Trade App?

- How Can I Use MetaTrader 4 XAUUSD Platform/Software on My Android Phone?

- Strategies for Trading on a 15 Minute Chart

- How to Analyze/Interpret a New Gold Order on MT5 iPhone Trade App

- How to Analyze/Interpret Different Types of Gold Candlestick Patterns Analysis

- Setting up and placing buy limit pending orders in the MT5 platform.