What is Price Action in Gold Trading?

Gold xauusd price action is the analysis of price moves that are plotted on charts.

Gold Trading xauusd price action analysis uses lines or price patterns to try to figure out where the price chart may be heading.

Gold xauusd price action signals can be used along with systems that help decide which way to trade in the market.

Pin Bar Price Action Trade Strategy

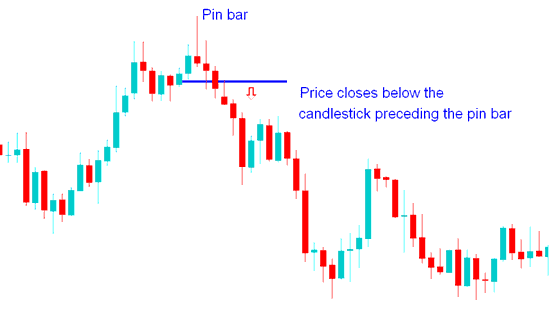

A pin bar acts as a reversal signal on a price chart. It highlights a clear switch in market mood during that trading session.

This particular price action formation, known as a pin bar, features an extended wick with the closing price for XAUUSD positioned very close to its opening price. The pattern resembles a pin, hence its name - Pin Bar - and it materializes after a significant move either up or down.

This indication of trend reversal is confirmed once the market closes below the candle that immediately preceded this specific price action formation. The reversal setup below is validated after prices settle beneath the blue candle that came before this pin bar candlestick.

Price Action 1 2 3 Strategy in Gold Trading

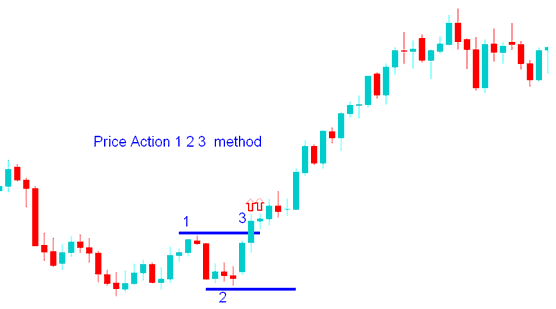

Gold Price action strategy is the use of only xauusd gold price charts to trade XAUUSD, without the use of trading chart trading indicators. When trading with this method, candlestick charts are used. This trading strategy uses lines and pre determined patterns like the 1 2 3 pattern which either develops and forms as one single price action pattern or series of price action setups.

Traders use this price action strategy because this market analysis is very impartial & allows the one to analyze the price market moves based on what they see and observe on the charts and market movement analysis alone.

Many traders rely on this strategy. Even those using technical indicators often add price action elements to their approach.

Price Action 1 2 3 Break-out Strategy

This price action plan uses 3 points on a chart to figure out which way xauusd will break out. The 1-2-3 method uses a high point and a low point, which become point 1 and point 2. If the market goes above the high point, the signal is to buy: if it goes below the low point, the signal is to sell. The breakout of point 1 or point 2 makes the third point.

Gold Price Action 1.2.3 Break-out Strategy Examples

Combining Together Price Action Method with other Indicators

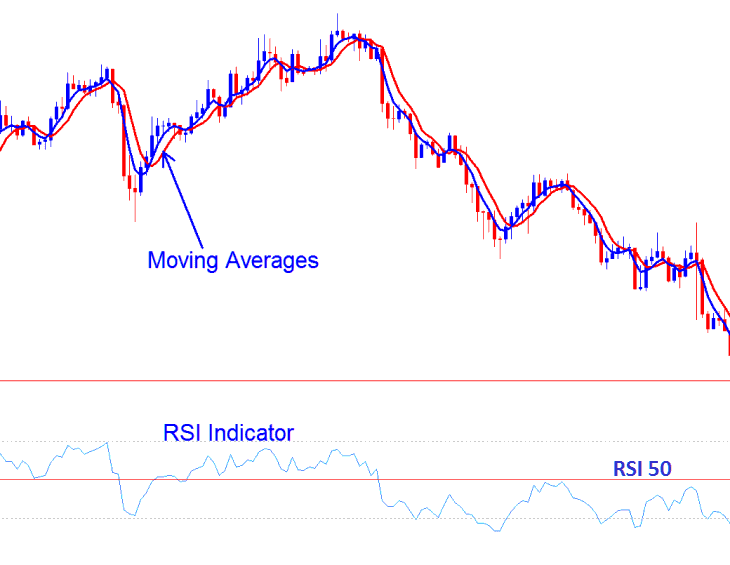

Good indicators to combine price action patterns with are:

- RSI

- MA Indicator

Traders should check these two indicators to make sure the price is moving in the same direction as the trend shown by these indicators. If the direction matches the direction of these technical indicators, traders can make a trade in the direction of the signal. If not, traders shouldn't trade because the signal is more likely to be a false one.

Like other tools in gold trading, the XAUUSD price action plan has false moves. Use it with other signals, not alone.

Integrating Price Action Strategies with other Indicators: A Strategy Combining RSI and MAs for Price Action Trading.

More Guides & Topics:

- How do you download gold indicators for MetaTrader 4 on iPhone? Any gold trading lessons?

- Different Types of XAU/USD Trading Platforms

- Consolidation Shapes and Symmetrical Triangles XAU/USD Shape

- How do you add stop loss orders for XAU/USD in MetaTrader 4 charts?

- Procedure for Adding the XAUUSD Symbol to the MT4 Application on an Android Device.

- What's XAU USD Demo Trading Account MT4 Trading Software?

- Gold Signal: Spotting XAUUSD Consolidation Patterns

- How Do You Activate a MT5 Automated Trading Robot in MetaTrader 5 Software Platform?

- How do you use the BOP indicator for buy signals in forex?

- How to understand Fibonacci retracement levels and Fibonacci expansion levels when trading XAUUSD.