Moving Average Strategy

- Price Period of MA

- SMA, EMA, LWMA and SMMA

- Moving Average Trend Identification

- MA Whipsaws in Range Market

- Moving Average Crossover Strategy Method

- Moving Average Support and Resistance

- How to Select a MA

- Short-Term and Long-Term Setups

- 20 Oil Pips Price Range Strategy

About the Moving Average Strategy

Oil Moving average is one of the most widely used Indicator because it's simple and easy to use.

This Indicator is a trend following indicator that is used by traders for three things:

- Identify the beginning of a new market trend

- Measure the sustainability of the new trend

- Identify the end of a trend and signal a reversal crude trade signal

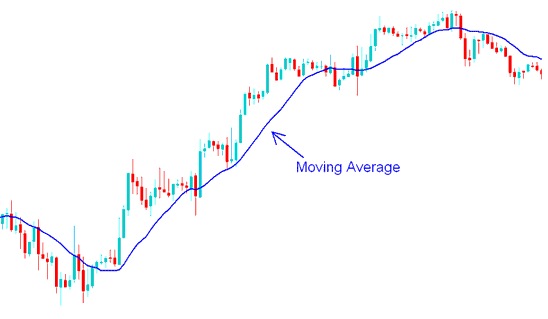

The Trading Moving Average or MA is used to smooth out the volatility of crude price action. The MA is an overlay indicator & it is placed on top or superimposed on the crude price chart.

On the example chart below the blue line represents a 15 period MA, which acts to smooth out the volatility of the crude price action.

Oil Moving Average Technical Crude Indicator - MetaTrader 4 Chart Indicators

Calculation of the Moving Average

The Trading Moving Average is also known as MA - is calculated as an average of crude trading price using the most recent crude trading price data.

If the MA uses the 10 period to calculate the average of the crude trading price then it is known as to as a 10 period moving average, because most traders use the day as the standard crude trading price period we shall just refer to it as the 10 day MA.

To calculate the ten day MA the crude price of the last 10 days is averaged, the moving average indicator is then updated constantly after every new crude price period. So after every new crude trading price period is formed the moving average is then calculated afresh using the most recent 10 crude trading price periods, that is why it is called a moving average because the average is constantly moving when crude trading price data is updated.