Day Example Trading Strategy

Intra-day Trading Technical Indicators

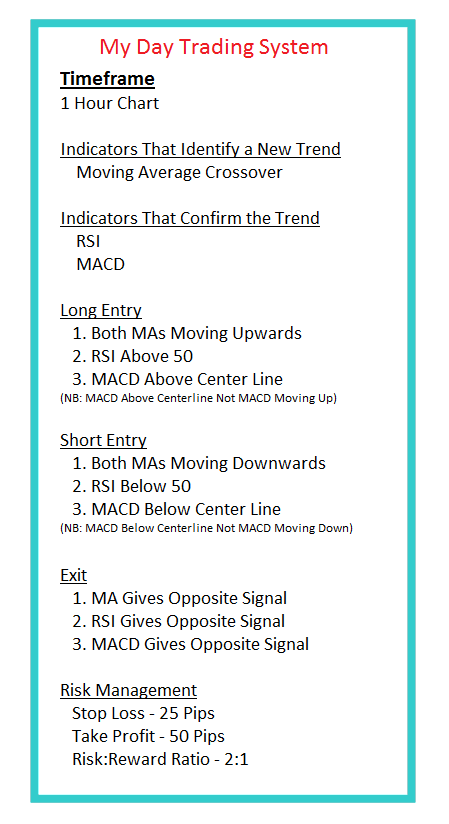

An example of Day Gold Simple System - that's a combination of:

- Moving Average Cross Over Strategy

- RSI Indicator

- MACD

Day Trading Example Strategy Rules are:

Day Chart Strategy - Daily Chart Strategies Methods - Day Example Strategy - Day Gold Time-Frame Strategy

Trading Rules: Day Gold Time Frame Trading Strategy - Day Indicators - Day Gold Simple System

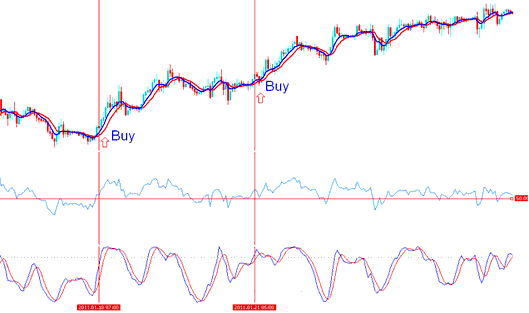

Buy Trade Signal is Generated when: - Day Gold Timeframe Trading Strategy - Day Indicators

- Both moving averages MAs heading up

- RSI is above 50

- MACD above center-line

Sell Trade Signal is Generated when: - Day Gold Time Frame Trading Strategy - Day Indicators

- Both moving averages MAs heading down

- RSI is below 50

- MACD below center line

Day Gold Timeframe Trading Strategy - Day Gold Timeframe Trading - Day Indicators - Day Gold Simple System

Exit Signal - Daily Chart Trading Method

Exit signal is generated when Moving Averages, RSI & MACD give a signal in the opposite price trend direction.

The chart timeframe to use is Day Trading chart timeframe.

For a beginner trader wanting to come up with a Daily Chart Strategy the above written rules will give a good example template of a Daily Chart Strategy that can be used to generate buy & sell signals - Daily Chart Strategies Methods - Day Example Strategy - Day Gold Timeframe Trading Strategy - Day Gold Timeframe Trading - Day Gold Simple System.

Daily Chart Strategy - Daily Chart Strategies Methods - Day Example Trading Strategy

Generating Signals with this Daytrade system is the best technique that a beginner trader can attempt to determine the xauusd market trend & with a little back testing on practice trade account so as to test this Day Gold Strategy

The best way to backtest a trading strategy is by following these two steps:

- Paper Trade your Day Gold Simple System

- Demo Trade your Day Gold Simple System

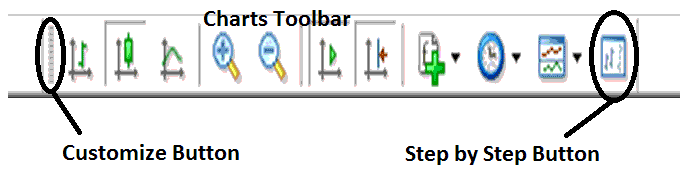

A good tool to use to back-test your Day Gold Simple System is known as the Meta Trader 4 XAUUSD Step-by-Step Tool. Found on the MT4 charts toolbar of MetaTrader 4 software, If you want to find the chart tool-bar in MetaTrader 4 platform it is at the top of MetaTrader 4 software. If it's not: Click View (next to file, left top corner of MetaTrader 4)>>> ToolBar >>> Charts. Then click the Customize button >>> Select Trade Step by Step >>> Click on Insert >>> Close.

MetaTrader 4 Daily Chart Tool-Bars - How to Trade Daily Chart for New Traders

MetaTrader 4 Gold Step by Step Button for Daily Chart Strategy - Daily Chart Strategy - Daily Chart Trading Strategies

Once you get this Meta Trader 4 tool you can move your Day Trade chart backwards, & use this Meta Trader 4 trading step by step button to move the Day chart trading step by step while at the same time testing when your Day Gold simple system would have generated either a buy or sell signals, & where you'd have exited the trade transactions, then write down the amount of profit or loss per trade transactions made using the Daily Chart Strategies & out of a sample number of trade transactions you would then calculate the overall profits and losses generated by the Daily Chart strategy - Daily Chart Trading Method.

If your Day gold strategy is profitable on paper trading then, it is time to demo trade and test if the Daily Chart Strategy is profitable on live market as it is on paper method. This is the process of back-testing the Daily Chart Trading Strategy.

Maintain a Journal to keep track of profitable trade transactions, and determine why these trades were profitable. And also maintain a record of all losing trades, determine why these trades made a loss and then avoid making the same mistakes the next time you trade using your Daily Chart Strategies.

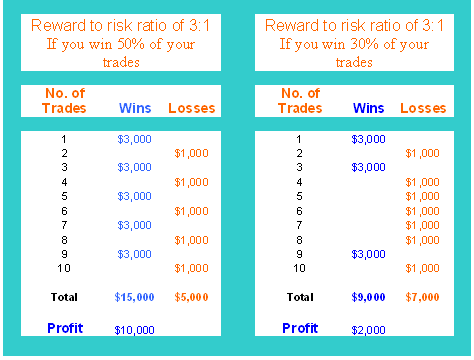

Tweak your trade system until you get a good risk reward ratio, with signals which you generate. Aim for a good risk: reward of 3:1 and use equity management guide-lines & read the topic about: Risk to Reward Ratio - Daily Chart Strategy - Daily Chart Strategies Methods - Day Example Trading Strategy.

Day Chart Strategy - Daily Chart Strategies Methods - Day Example Trading Method

Equity Management Strategies Methods Tutorial

Study More Topics and Courses:

- Trade XAUUSD With Support & Resistance Levels

- How to Analyze Rate of Change Trading Indicator

- XAUUSD Platform MetaTrader 5 Placing Fibonacci Lines in MetaTrader 5

- Technical Analysis Gann Swing Oscillator Buy Forex Trade Signal

- How Can I Trade a Gold Trend with a Gold Trend-line?

- Economic Reports Market Movers in Gold