MT4 Template System

A Trading Strategy refers to a set of trade rules which you follow & adhere to to manage your trades. These written rules will determine when you open/execute a trade and when you'll exit. A trade system is developed by combining 2 or more technical indicators.

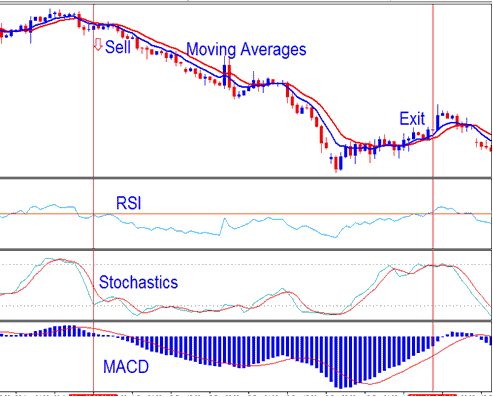

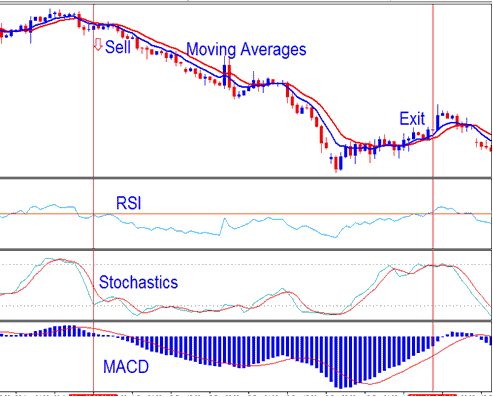

For example illustration, the Stochastics Indicator can be combined with other indicators to form a system strategy. For this exemplification - stochastic oscillator can be combined with the technical indicators below to come up with the following system.

- RSI indicator

- MACD

- MAs trading indicators

Examples - MetaTrader 4 Template Trading Strategy Example

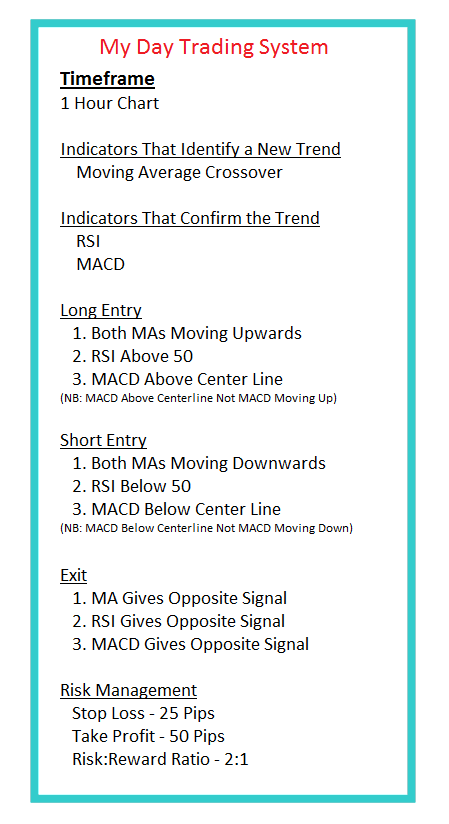

Making a Trading Strategy - System Example

Hence, the fundamental question remains: how can a trader devise trading systems paralleling the provided example, and what is the process for documenting its rules? To formally document the trading system's rules, adhere to the subsequent steps.

Seven steps to creating a technical indicator based system

To create these set of trade rules we shall use the following seven steps.

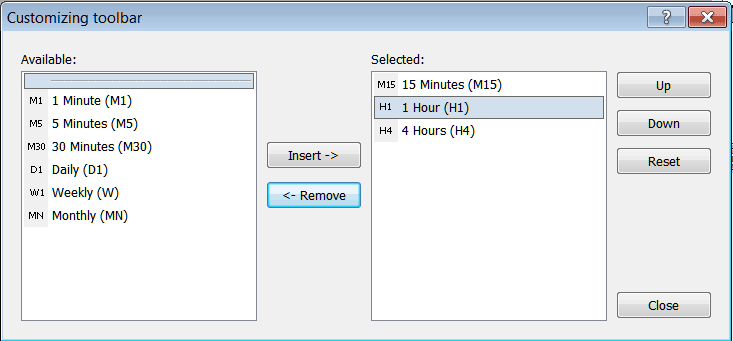

1. Select your Timeframe

This first step depends on the number of hours you want to set a side to trading. Whether you prefer to sit in front of the Desktop computer throughout for several hours analyzing the short timeframe OR you prefer setting up your trading charts using bigger time frame once or twice in a day. Choosing/Selecting a chart timeframe will mainly depend on what type of trader you're.

TimeFrames on MT4 Software

Test your new strategy on various chart timeframes. Check how it performs. Pick the one that proves most accurate and profitable for you.

2. Choose and Select indicators to identify a new trend

The goal of a trader is to get into the trade as early as possible and take maximum advantage of price moves.

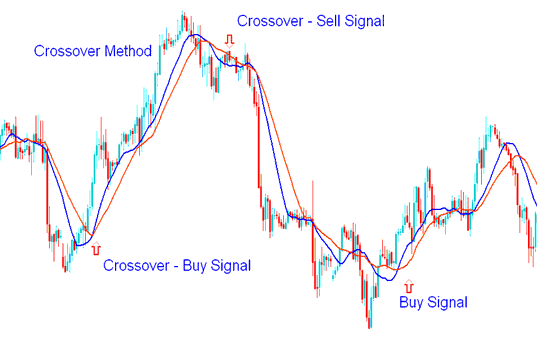

One prevalent method for rapidly identifying emerging trends involves employing MAs Trading Indicators. A straightforward approach is utilizing an MA cross-over system, designed to flag a new trading opportunity at its earliest inception.

Moving Average Cross over Technique

Sales and Purchase Trading Signals Derived from the Moving Average (MA) Crossover Methodology

3. Select additional technical indicators to confirm the trend

Once we find a new market trend we need to use additional technical indicators that will confirm the entry signals & give either a green light for action or save a trader from fake outs.

To confirm the trading signals we use RSI and Stochastic Oscillator.

RSI Indicator and Stochastic Oscillator Indicator System

4. Finding xauusd entry and xauusd exit points

Once you've picked your indicators - one to give the signal and another to confirm - it's time to enter your trade.

Enter a trade right after a signal forms and confirms on a closed candlestick.

Aggressive traders enter a trade immediately without waiting for the current price bar to close.

Some traders prefer to wait for the current candlestick to close before entering a trade position, especially if the Gold trading setup remains unchanged and the signal is still valid. This approach helps to minimize the likelihood of false entries and trading whipsaws.

Generating Signals - how to Generate Signals.

Generating Signals

Set a target profit amount for each trade. Or apply tools like Fibonacci expansion for profit targets. Place a stop loss order based on price swings at the time. You can also close out when indicators signal a shift to the other trend.

When initiating any new trade, it is crucial to pre-calculate the maximum amount you are prepared to forfeit should the Gold trade move adversely. While the aspiration is to develop the world's best system, incurring losses remains unavoidable: consequently, establishing your exit point and cutting your losses *before* commencing a trade is exceptionally important.

5. Calculate risks in each trading setup

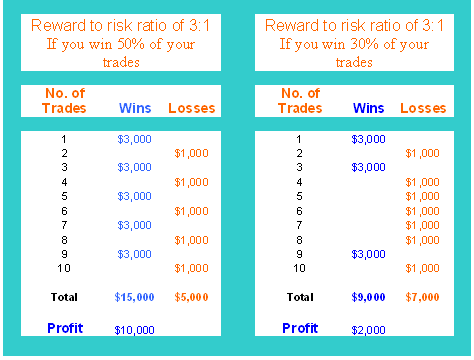

In XAUUSD trading, you need to calculate your risk for every trade. Serious traders only enter a trade if the risk-to-reward ratio is at least 2:1.

If you use a high risk : reward like 2:1, you significantly increase your chances of becoming profitable in the long run.

The Risk-Reward Chart below portrays you how:

Gold Trade Money Management Chart Showing Risk-to-Reward Ratios - A Template for Trading Strategies

In the first examples of Risk-:-Reward Ratio, you can observe that even if your system only won 50% of your trade positions, you'd still earn profit of $10,000. Interpret more on this money management trading topic: Here Gold Trade Money Management Rules - MetaTrader 4 Template System and Gold Equity Management Methods - Template Trading Strategy Example.

Before starting a new trade, a gold trader should pick the exit point if the trade loses money. Some use Fibonacci tools and support or resistance areas. Others set a stop loss order right after opening the trade.

6. Write down the systems rules and follow them

Trading Strategy Means Rules You Use to Run Your Positions.

The key is to adhere to A SET OF TRADING RULES. In the first place, you don't have a trading strategy if you don't adhere to the trading guidelines.

This system guide provides an instructional example for creating your customized online trading strategy.

Subsequent Topic: Defining the Rules for Writing Trading Systems

7. Practice on a Practice Trade Account

Few trades hide your system's true profit level.

Once you have your trading system rules written, it is time to test and improve your trading system by using it on a practice trade account.

Open free practice account & trade your strategy to see how well it will respond.

Start with a demo account. Practice for at least one or two months. This builds experience on how the market moves.

Once you start making steady profits on your demo account, try opening a live account and trade with real money.

Learn More Guides and Topics:

- Guidance on Integrating a Custom Trading Indicator into the MetaTrader 4 System

- How to Use Trading Signals from Indicators to Trade Gold

- How to Use the Chaikin Money Flow Indicator for Buy Signals

- Example of a Written Down Gold Schedule

- How do you read the Bulls Power indicator?

- The Dark Cloud Cover Bearish Candlestick Pattern

- Get price information for MT4 charts using the MT4 data history center in MetaTrader 4's tools.

- Setting Stop Loss and Take-Profit Orders for Gold in MT5 Software